Investing

Can Quantum Computing Stocks Recover From Mark Zuckerberg's Second Gut Punch?

Published:

A day after quantum computing stocks took it on the chin again after Meta Platforms (NASDAQ:META) CEO Mark Zuckerberg cast doubts on the sector’s viability in the near term, they are rising sharply once more.

Zuckerberg’s comments on the Joe Rogan Podcast saying that the technology was “still quite a ways off from being a very useful paradigm” come less than a week after Nvidia (NASDAQ:NVDA) CEO Jensen Huang told CES 2025 the technology was still 15 years to 30 years away from practical usage.

Quantum computing stocks plunged hard once more. D-Wave Quantum (NASDAQ:QBTS) lost 33% on Monday, Rigetti Computing (NASDAQ:RGTI) plummeted 32%, Quantum Computing (NASDAQ:QUBT) tumbled 27%, and IonQ (NASDAQ:IONQ) fell 14%.

But the next day they were rising sharply. Rigetti was up 25% in morning trading, Quantum was 20% higher, D-Wave was up 15%, while IonQ was rising 4%. Still, all of these stocks are still down 50% to 60% in just the last week.

Quantum computing is still a nascent technology, one that proponents argue is the next stage of computer evolution, especially in the age of artificial intelligence. Yet it is a technology that has yet to find its footing.

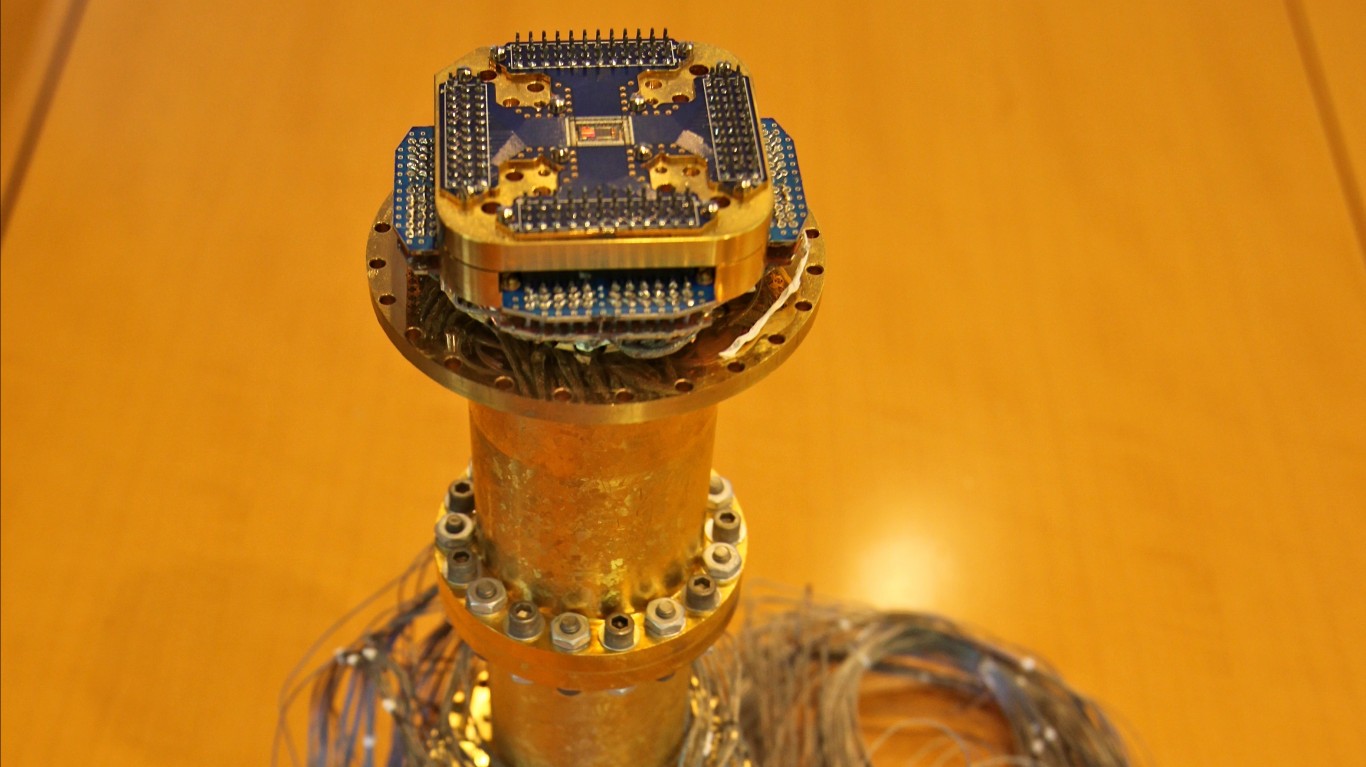

Due to the extremely sensitive nature quantum states have to external disturbances, they generate high error rates and make it very difficult to build large, stable quantum computers with enough quantum bits, or qubits, to reliably perform complex calculations.

Where traditional computers break data into two-dimensional 1s and 0s, quantum computers use qubits that can be either a 1 or a 0 — or both at the same time. There are also an infinite number of possibilities in between, called superposition.

Think of binary data as a light switch where it is either on or off. Qubits, on the other hand, are more akin to a dimmer switch, where you can dial them in. That’s why a traditional PC has billions of transistors to handle all of the complex processing its needs to perform, while International Business Machine’s (NYSE:IBM) first Condor quantum chip had just 1,121 superconducting qubit quantum processors. Heron is IBM’s 133-qubit chip, System Two combined three Heron chips, and Egret is a 33-qubit processor.

But traditional computers are essentially flawless in operation. Yes, software quirks can make mistakes, but largely it always performs as expected all the time. The same can’t be said for quantum computers because of their inherent fragility.

While quantum computers are heralded as being prime candidates for use in various research disciplines, to assist in new drug discovery processes, or, more darkly, breaking encrypted data, these are operations that are well into the future. It’s why Huang and Zuckerberg say they are nowhere near ready for deployment, and certainly not on a day-to-day basis.

Regular computers can already do most of these tasks, and do so relatively quickly, without the limitations imposed by the instability of qubits and quantum computers. Even small temperature changes can disrupt qubits and cause calculations to fail.

Quantum computing stocks soared throughout 2024, many rising 1,000% or more, as they got caught up in the fervor of AI spending. Yet these companies are money-losing operations with few to no actual products to show the market. At the first sign of trouble, they cratered.

It’s clear quantum computing is not ready for the big leagues yet and the valuations the market was assigning were unwarranted. That they continue to drop by double-digit percentages, even though they might be bouncing back a bit now, indicates there is no reason investors should wade into the waters just yet.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.