This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive

compensation for actions taken through them.

compensation for actions taken through them.

We’d all like to be rich.

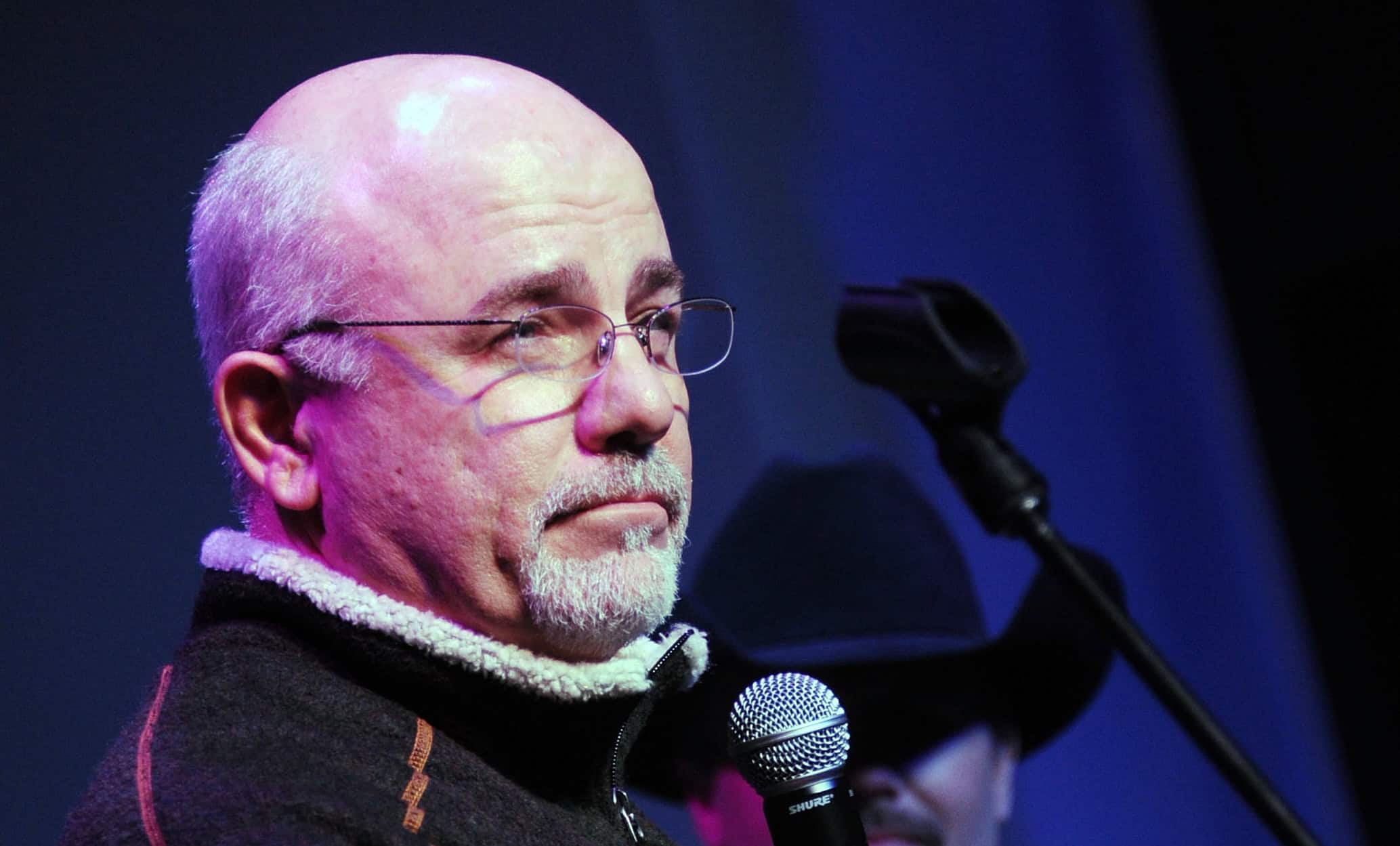

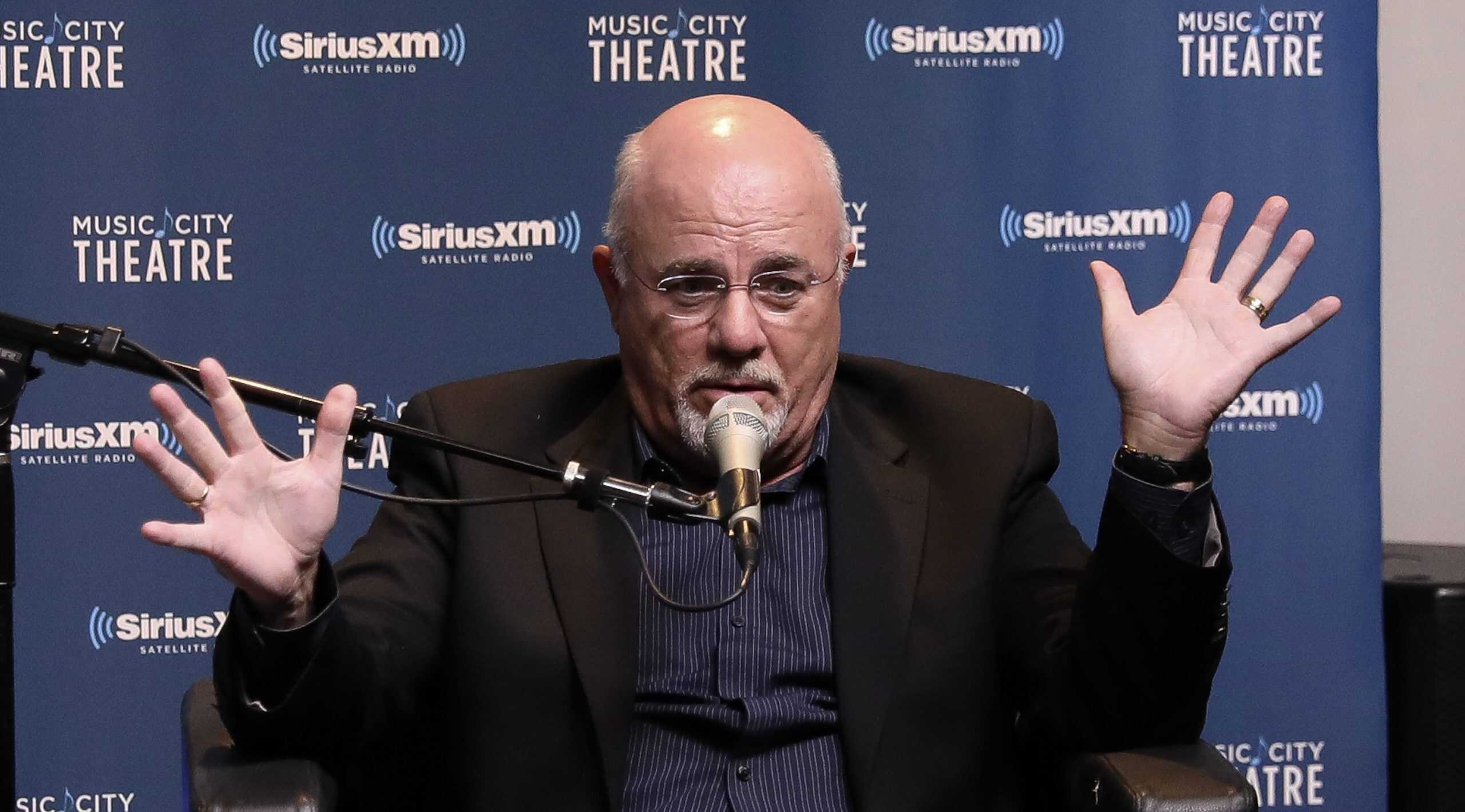

Unfortunately, as finance coach Dave Ramsey will tell you, “the rich get richer and the poor get poorer”.

Key Points from 24/7:

- As Dave Ramsey will tell you, “the rich get richer and the poor get poorer.”

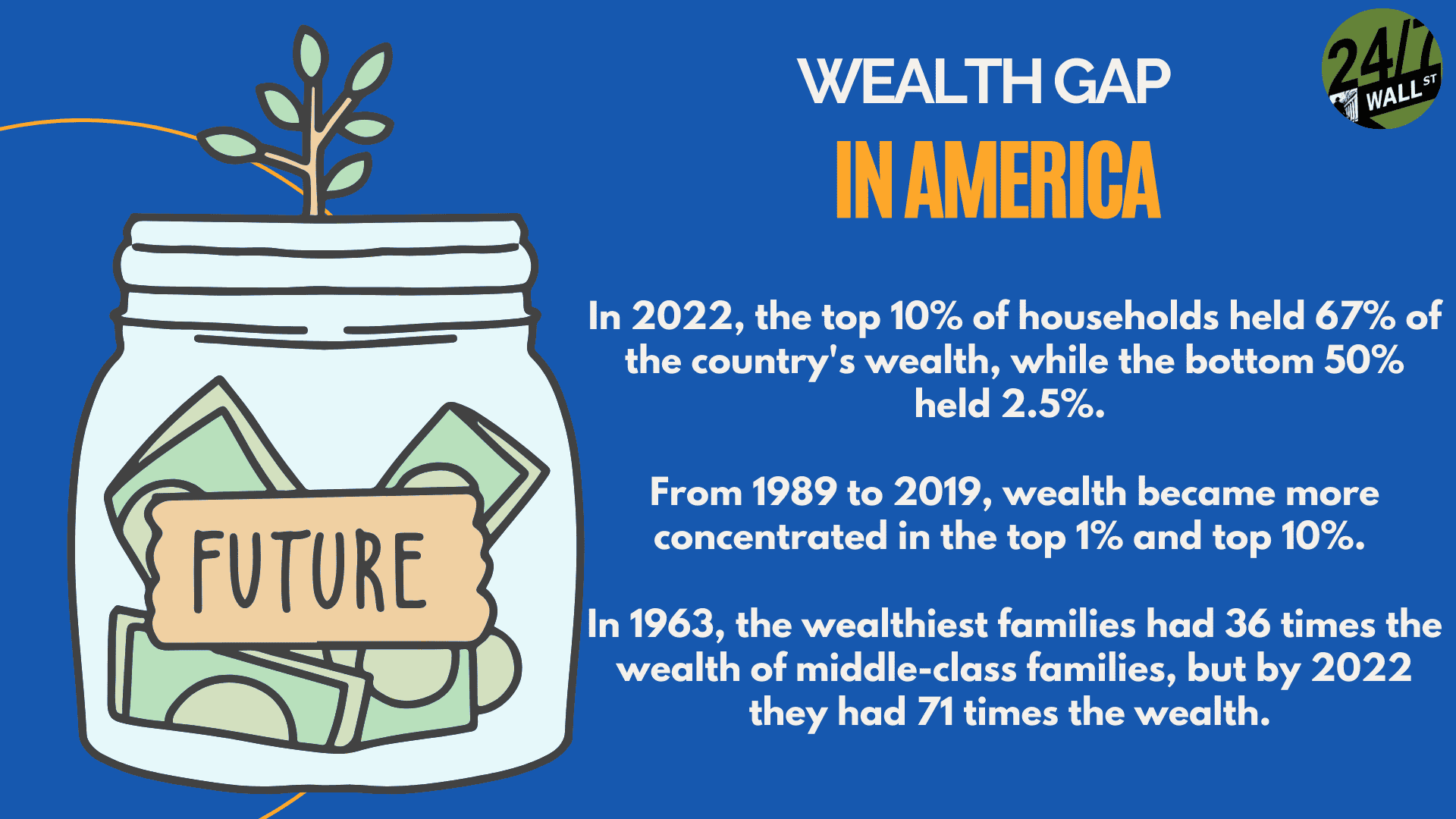

- According to the St. Louis Fed, the top 10% of U.S. households by wealth had about $6.9 million on average. The bottom 50% of households had $51,000 on average.

- Meanwhile, the middle class will make payments, such as monthly car payments. They think they can make a fortune on airline miles from their credit card payments.

- Also: Take this quiz to see if you’re on track to retire (Sponsored)

Consider this. According to the St. Louis Federal Reserve, the top 10% of U.S. households by wealth had about $6.9 million on average. As a group, they held 67% of household wealth. The bottom 50% of households had $51,000 on average. As a group, they held about 2.5% of the total household wealth in the country.

So, why is the wealth gap so big?

According to Dave Ramsey, it has a lot to do with financial moves, which will keep you in the middle, poor, or upper class.

The rich don’t ask questions such as: How much per month?

Instead, they simply ask: How much? They’ll pay for things upfront to avoid interest payments, which can chew a big hole in your wallet. Doing so keeps them rich, added Ramsey.

Meanwhile, the middle class will make payments, such as monthly car payments. They think they can make a fortune on airline miles from their credit card payments. They may even take out loans to pay for home improvements.

In addition, Ramsey says that poor people use payday lenders and pawn shops, take out title loans and use rent-to-own services to “buy” furniture and appliances. People who stay poor focus on playing the lottery with the belief that it will “make them rich.” In fact, he said that 78% of lottery tickets are sold in poor zip codes.

However, none of this is set in stone. You can change how you spend and save.

If you want to build wealth, there are some big steps you can take

One, try to increase your income with dividend stocks, for example. You can even take on a part-time job if time allows for it.

Two, create a budget. This is crucial. Without a budget, many of us lose account of what’s coming in financially and what’s going out. When others have asked me for financial advice, my top question is, what are you spending on? Unfortunately, I’m often met with the deer in the headlights stare and a response of “I don’t know.” Unfortunately, not knowing will destroy you financially.

Three, if you don’t already have an emergency fund, create one.

Start small with an emergency savings goal of at least $1,000.

Sure, it’s small but it’s a safety net, and it’s a start. If you can put away about $85 a month, you’ll reach that goal and have some wiggle room. However, be sure to store this in a separate “don’t touch” account, automatically depositing money every time you’re paid. Plus, if you ever receive another source of income, such as a bonus or a gift, put it directly into that “don’t touch” account instead of spending it immediately.

Fourth, pay off your debt if you can. That includes credit card debt, mortgage debt, and student loan debt. If you want to get better control of that debt, according to Dave Ramsey, use the debt snowball method – where you pay off your debts in order of smallest to largest. In doing so, list out all of your debt, including student loans, car payments, mortgages, credit cards, etc.

Five, live below your means. As Suze Orman has said, live below your means to achieve financial freedom. Identify your needs and your wants, eliminating part of the expenses tied to wants. Automate your savings. Figure out your savings goal.

Six, invest in your retirement plans.

An Individual Retirement Account (IRA) allows you to save for retirement with tax-free growth or on a tax-deferred basis.

You can invest in a traditional IRA, for example. While it’s best to check with your financial advisor, many times you can deduct contributions on your tax return. There’s also the Roth IRA, where you make contributions with money you’ve already paid taxes on. With a Roth IRA, your money can grow tax-free with tax-free withdrawals. But again, check in with your financial advisor before doing anything.

Or, if you’re self-employed, look into the Solo 401(k), a variation of the 401(k) plan but specifically set up for those who work for themselves.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.