Investing

Billionaire Sold Palantir and Is Buying This Stock That Could Soar 237%, According to a Wall Street Expert

Published:

Palantir Technologies (NASDAQ:PLTR) has been described as the best pure-play stock in artificial intelligence. The market agrees, sending shares of PLTR stock some 342% higher over the past year, far better than Nvidia (NASDAQ:NVDA), which typically grabs all the AI headlines. It only returned 143%.

The data analytics stock, though, has pulled back 15% from the all-time high it hit in December. A lot of its gains, though, were the result of the election of Donald Trump as president as several people in the new administration have ties to the AI shop, including founder Peter Thiel and David Sachs, an early investor in Palantir.

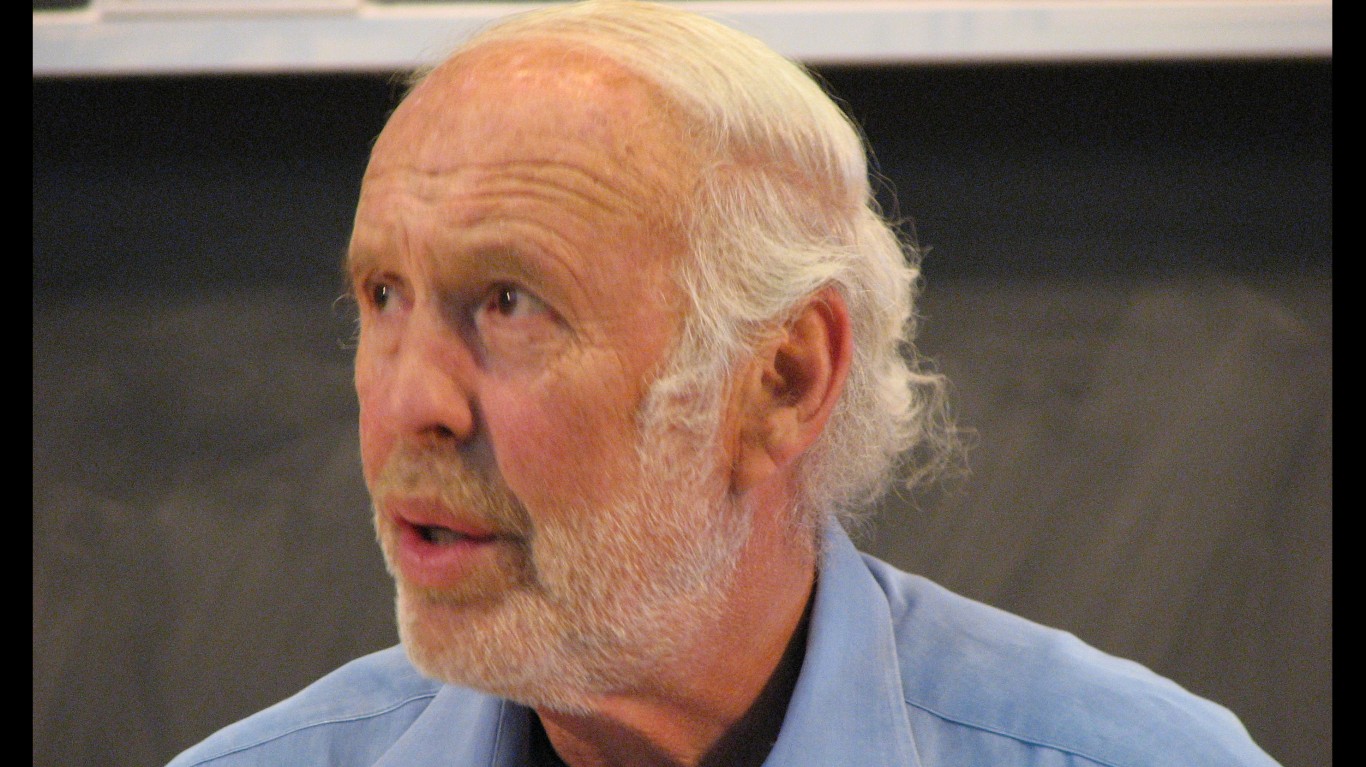

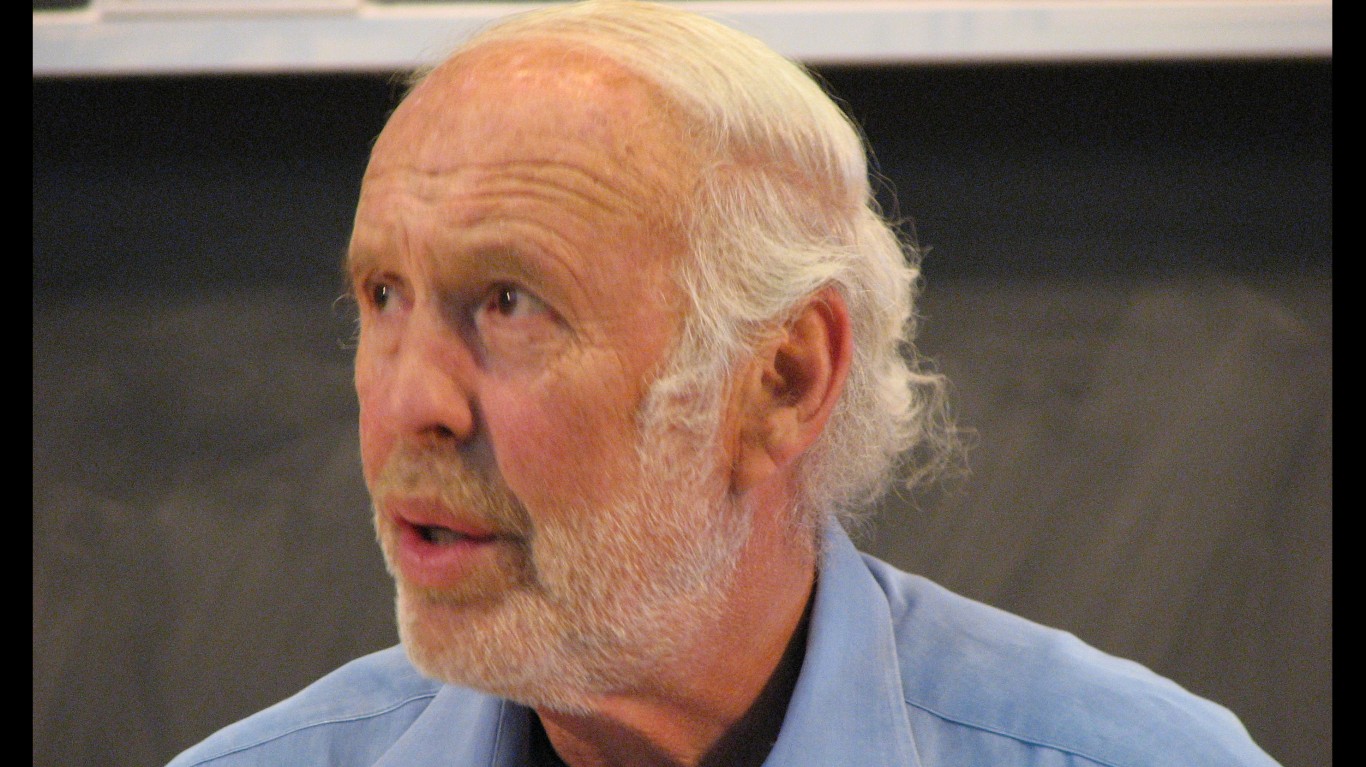

Yet there are concerns about revenue growth at the company, and that’s caused some billionaires on Wall Street to start hedging their bets. Jim Simons’ Renaissance Technologies was among them as the hedge fund sold 1.1 million shares of PLTR. It still owns a substantial stake in the Big Data company, some 38 million shares worth $1.4 billion, but it was deploying its capital to other promising growth investments.

Palantir Technologies (PLTR) has been called the best pure-play AI stock and its performance reflects that assessment.

Yet there are concerns about revenue growth rates, leading some billionaire investors to pare their holdings.

They are turning their attention to the second-biggest investing theme of the past year, weight-loss.

If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Next to AI, weight-loss has been one of the biggest investment themes over the past year or so. After Novo Nordisk (NYSE:NVO) hit the market with Ozempic, its glucagon-like peptide-1 (GLP-1) therapy for diabetes, it sparked a revolution as it was found to be effective in helping people lose a lot of weight.

Although the Dutch pharma giant is still the leader as it introduced Wegovy to specifically target the weight-loss market, rival Eli Lilly (NYSE:LLY) is quickly closing the gap with its own GLP-1 treatments, Mounjaro and Zepbound.

All of these treatments, however, are delivered via injection. The real Holy Grail is a weight-loss-in-a-pill formulation, which has investors very interested in Viking Therapeutics‘ (NASDAQ:VKTX) VK2735, which is showing better efficacy than Novo Nordisk’s semaglutide in clinical trials.

Renaissance Technologies added to its holdings of VKTX, buying 24,700 shares at an average price of around $58 a share. Wall Street is incredibly upbeat on Viking’s prospects, too, as analysts have set a $106.75 per share one-year price target on the stock. That implies a 237% upside in the stock. At the high-end, some analysts foresee the stock quadrupling in value.

Viking Therapeutics’ drug candidate is a more evolved therapy than existing treatments. VK2735 activates both GLP-1 receptors and glucose-dependent insulinotropic polypeptide (GIP) receptors. As semaglutide only targets the GLP-1 receptors, Viking’s treatment helps users achieve more significant weight loss sooner.

H.C. Wainwright analyst Joseph Pantginis recently reiterated his buy rating on Viking while maintaining a $102 per share price target. In a note to investors, the analyst highlighted VK2735’s superior profile to Novo Nordisk’s treatment, both in its oral form and as an injectable. That could allow it to leap to the industry’s forefront.

VKTX stock, though, is having a tough run, especially since the November elections. Donald Trump’s second term as president could roil the industry, particularly if Robert F. Kennedy Jr. is confirmed as secretary of the Health & Human Services Dept. He prefers proper diet and exercise for weight loss, though it’s hard to argue against a treatment helping fight obesity.

Moreover, Eli Lilly’s recent earnings report showed demand for GLP-1 drugs is lower than expected. Sales are still widening, but at a slower rate than anticipated. Novo Nordisk is exhibiting similar stalls, and it’s weighing on VKTX stock.

While Viking has not discussed pricing for VK2735 if eventually approved, it would undoubtedly be well below the $1,000 per month range the big pharmas charge for their therapies. Still, analysts see peak revenue for the biotech hitting $12 billion, primarily limited by availability of the active ingredients needed.

That has sparked speculation Viking Therapeutics could become a takeover target by a larger pharmaceutical stock. All in all, its a bullish sentiment and could see VKTX breaking through analyst price targets.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.