Investing

Amazon Stock (AMZN) Price Prediction and Forecast 2025-2030 For January 22

Published:

Last Updated:

Shares of Amazon (NASDAQ: AMZN) gained 1.86% on Wednesday, continuing the momentum that has seen the stock rise 6.72% so far this year. The company is set to announce earnings in one week, on Jan. 29, 2025, after market hours. Analysts are forecasting earnings per share of $1.48.

Today’s jump in share price comes on the back of Raymond James increasing its price target for AMZN from $230 to $260. That follows a similar increase from BMO Capital Markets, which on Jan. 17 increased its price target for Amazon’s stock from $236 to $265 with an “Outperform” rating.

Outside of NVIDIA (NASDAQ: NVDA), Amazon has been a Wall Street darling since the company IPO’d in May 1997 at a split-adjusted price of $0.07. Today, Amazon trades for $231.40, meaning the stock is up more than 10,533%% since January 2005. However, the only thing that matters from this point on is what the stock will do for the next one, five and 10 years and beyond.

Let’s crunch the numbers and give you our best guest on Amazon’s future share price. No one has a crystal ball and even the Wall Street “experts” are often wrong more than they are right in predicting future stock prices. We will walk through our assumptions and provide you with the story around the numbers (other sites just pick a share price without explaining why they suggest the price they do).

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2017.

| Share Price | Revenues* | Net Income* | |

| 2014 | $19.94 | $89.0 | ($.241) |

| 2015 | $15.63 | $107.0 | $.596 |

| 2016 | $32.81 | $136.0 | $2.371 |

| 2017 | $37.90 | $177.9 | $3.03 |

| 2018 | $58.60 | $232.9 | $10.07 |

| 2019 | $73.26 | $280.5 | $11.59 |

| 2020 | $93.75 | $386.1 | $21.33 |

| 2021 | $163.50 | $469.8 | $33.36 |

| 2022 | $167.55 | $514.0 | ($2.72) |

| 2023 | $85.46 | $574.78 | $30.42 |

*Revenue and Net Income in Billions

In the last decade, Amazon’s revenue grew about 540% while its net income moved from losing money to 30.42 billion in profits this past year. The ride up wasn’t always smooth, however. For example, in 2020, sales jumped 38%, and net income nearly doubled. 2021 saw a continued boom as people moved to e-commerce shopping during Covid. However, all those sales being “pulled forward” led to challenges in 2022, and the company swung to a surprise loss. As Amazon embarks into the back half of the decade, a few different key areas will determine its performance.

The current consensus 1-year price target for Amazon stock is $220.00, which is a -0.23% upside from today’s stock price of $220.50. Of all the analysts covering Amazon, the stock is a consensus buy, with a 1.37 “Buy” rating.

24/7 Wall Street‘s 12-month forecast projects Amazon’s stock price to be $225. We see AWS continue its current 12% growth rate but see Amazon’s advertising business outperforming analyst expectations, particularly in the 4th quarter of 2024 with more streaming ad impressions being sold.

Add all these numbers up and take out some amount for “new bets” the company will surely be investing in (and a potential dividend boost)and we see revenue in 2030 at $1.15 trillion and $131 billion in net income. Today, the company trades for about 50X earnings, which we’ll take down to 35 times as the company matures (but continues showing growth). In our analysis, Amazon is worth $2.6 trillion in 2030. Here are our revenue, net income, and company size estimates through 2030:

| Revenue | Net Income | Total Enterprise Value | |

| 2024 | $638 | $48.56 | $1.93 |

| 2025 | $710 | $62.13 | $2.12 |

| 2026 | $788 | $79.68 | $2.19 |

| 2027 | $867 | $96.53 | $2.29 |

| 2028 | $957 | $114.17 | $2.39 |

| 2029 | $1,049 | $136.69 | $2.5 |

| 2030 | $1,149 | $131.39 | $2.6 |

*Revenue and net income reported in billions and TEV in trillions

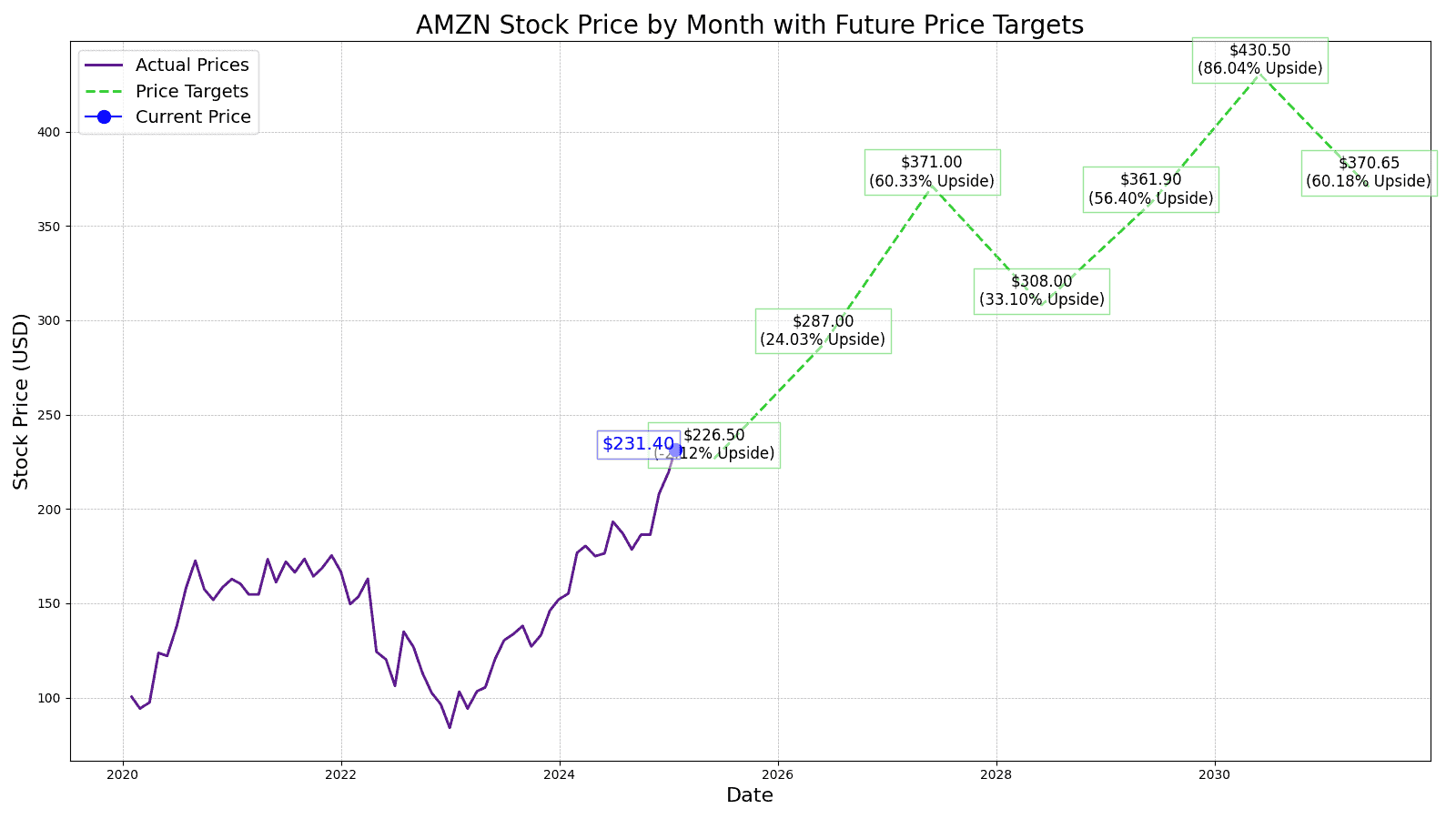

We expect to see revenue growth just over 11% and EPS of $5.74 for the year. We expect the stock to still trade at a similar multiple next year, putting our estimate for the stock price for Amazon at $226.50 in 2025, which is 2.11% lower than the stock is trading today.

Going into 2026, we estimate the price to hit $287, after revenue estimates to come in around 10% higher year-over-year. With an EPS of $7.42 and in our opinion the last year Amazon trades near its current P/E of 50, 2026 could mark the year Amazon starts trading at a more mature valuation closer to 35 times earnings. That would represent a 24.o3% gain over today’s share price.

In 2027, we expect the stock price increase not to be as pronounced as more tempered growth is expected from Amazon and even with earnings estimates of $8.80 per share, the stock price target for the year is $371.00. That is a gain of 60.33% from today’s stock price.

When predicting more than three years out, we expect Amazon to continue growing its top line at 10% but be more efficient and operating margins to grow. In 2028, we have Amazon’s revenue coming in around $957 billion and an EPS of $10.34 suggesting a stock price estimate at $308.00 or a gain of 33.10% over the current stock price.

24/7 Wall Street expects Amazon to continue its 10% revenue growth again and to generate $12.30 per share of earnings. With a price to earnings multiple of 35, the stock price in 2029 is estimated at $361.90, or a gain of 56.40% over today’s price.

We estimate Amazon’s stock price to be $430.50 per share with 10% year-over-year revenue growth but compressed margins from more competition in its AWS unit. Our estimated stock price for Amazon will be 86.04% higher than the current stock price.

| Year | Price Target | % Change From Current Price |

|---|---|---|

| 2025 | $226.50 | Downside of 2.11% |

| 2026 | $287.00 | Upside of 24.o3% |

| 2027 | $371.00 | Upside of 60.33% |

| 2028 | $308.00 | Upside of 33.10% |

| 2029 | $361.90 | Upside of 56.40% |

| 2030 | $430.50 | Upside of 86.04% |

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.