Generating solid stock market gains can be daunting for younger investors or those on a tight budget because many top technology stocks trade anywhere from $25 to over $100 per share and much more. Realizing any significant return on investment can be challenging with a small capital base of $1,000. Many firms these days tempt those on a tight budget to buy “partial shares” or an “odd lot.” That’s any stock purchase of less than 100 shares. At current prices, an odd lot of Tesla Inc. (NASDAQ: TSLA) will yield 2.4 shares of the EV giant. That’s not much to build a portfolio on.

24/7 Wall St. Key Points:

-

Stocks trading under the $10 level can be more volatile.

-

Many Wall Street firms will not cover stocks trading under $3 as they are not marginable.

-

Investors with a higher risk tolerance can hit home runs with stocks trading below $10.

-

Could your portfolio have some money carved out for more aggressive stock ideas under $10? Why not meet with a financial advisor in your area and find out? Click here to get started finding one today. (Sponsored)

Many investors, especially more aggressive traders, look at lower-priced stocks to make good money and get a higher share count. That can help the decision-making process, especially when you are on to a winner, as you can always sell and keep half. For low-price stock skeptics, many of the world’s biggest companies, including Apple Inc. (NASDAQ: AAPL) and Amazon. com Inc. (NASDAQ: AMZN), Netflix Inc. (NASDAQ: NFLX), and Nvidia Corp.(NASDAQ: NVDA) once traded in the single digits.

We screened our 24/7 Wall St. research database, looking for smaller-cap companies that could offer patient investors enormous returns for the rest of 2025 and beyond.

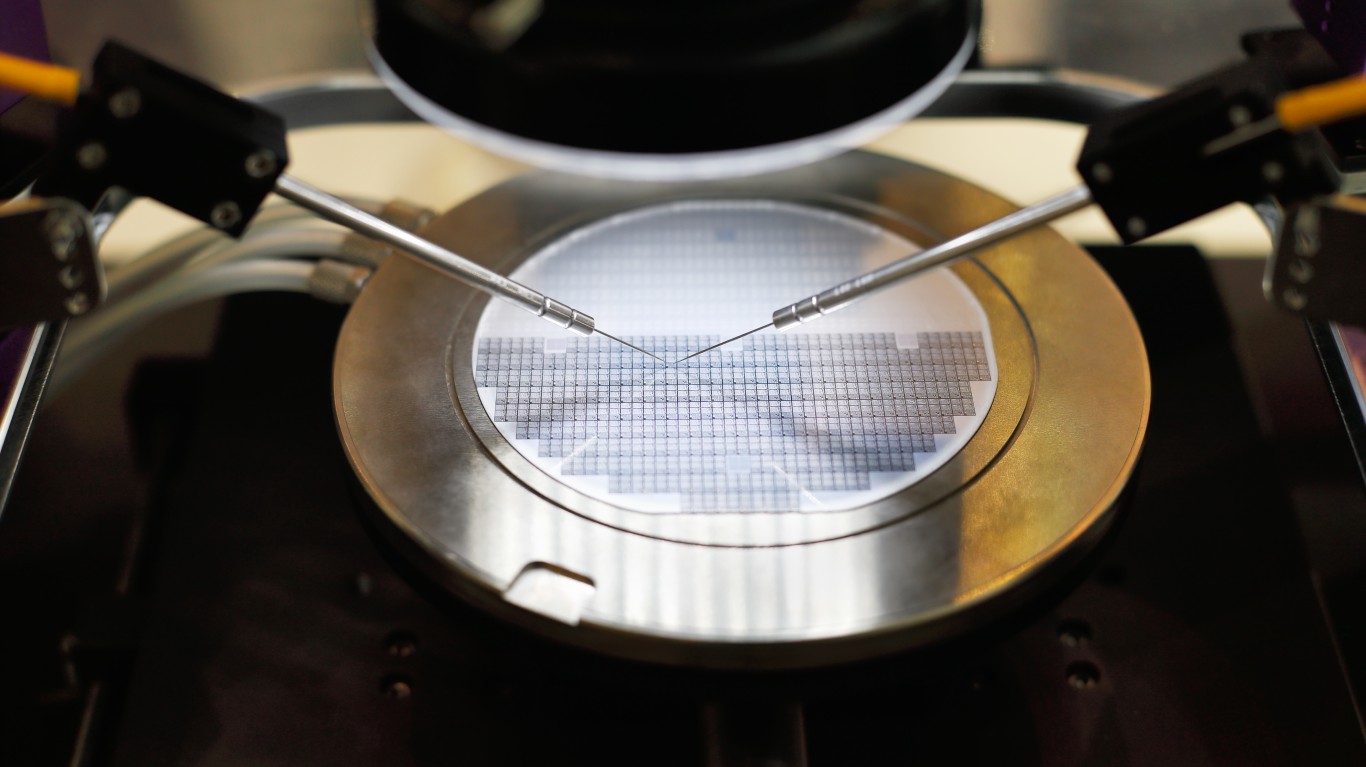

United Microelectronics

This Taiwanese semiconductor company offers massive total return potential with a 5.29% dividend and trades below $10. United Microelectronics Corp. (NYSE: UMC) operates as a semiconductor wafer foundry in:

- Taiwan

- China

- Hong Kong

- Japan

- Korea

- The United States

- Europe

- Internationally

The company provides circuit design, mask tooling, wafer fabrication, and assembly and testing services. It serves fabless design companies and integrated device manufacturers.

United Microelectronics announced last year the availability of its 22 nanometers-embedded high voltage (eHV) technology platform, the most advanced display driver IC foundry solution for powering premium displays for smartphones and other mobile devices.

With unmatched power efficiency and reduced die size, the new platform, 22eHV, enables mobile device manufacturers to enhance the battery life of their products while offering superior visual experiences.

Citigroup has a Buy rating on the shares, but we could not find the price target in U.S. dollars.

SoundHound AI

Revenue surged for this stock in the third quarter and could be poised for a repeat in the fourth quarter. SoundHound AI Inc. (NASDAQ: SOUN) develops independent voice artificial intelligence (AI) solutions that enable businesses across automotive, TV, IoT, and customer service industries to deliver high-quality conversational experiences to their customers.

In the past six months, the company has announced deals with the Torchy’s Tacos restaurant chain, Church’s Fried Chicken fast-food restaurants, and Lucid EV car manufacturers. The stock has been up over 1,000% over the past few years but has been cut in half since the beginning of 2025. It is offering the best entry point in months.

Its products include the Houndify platform that offers a suite of Houndify tools to help brands build conversational voice assistants, such as:

- Application Programming Interfaces (API) for text and voice queries, support for custom commands

- Extensive library of content domains

- Inclusive software development kit platforms

- Collaboration capabilities, diagnostic tools, and built-in analytics

- SoundHound Chat AI integrates with knowledge domains, pulling real-time data like weather, sports, stocks, flight status, and restaurants

- SoundHound Smart Answering is built to offer customer establishments custom AI-powered voice assistant

The company’s products also include:

- CaiNET software that uses machine learning to enhance how domains work together to handle queries

- CaiLAN software that arbitrates responses so users get answers from the right domain

- Dynamic Interaction: a real-time, multimodal customer service interface

- Smart Ordering, which offers an easy-to-understand voice assistant for restaurants

- Employee Assist; automatic speech recognition; natural language understanding; wake words; custom domains; text-to-speech; and embedded voice solutions

Wedbush has a Buy rating with a $22 target price objective. We commended shares last year at under $6.

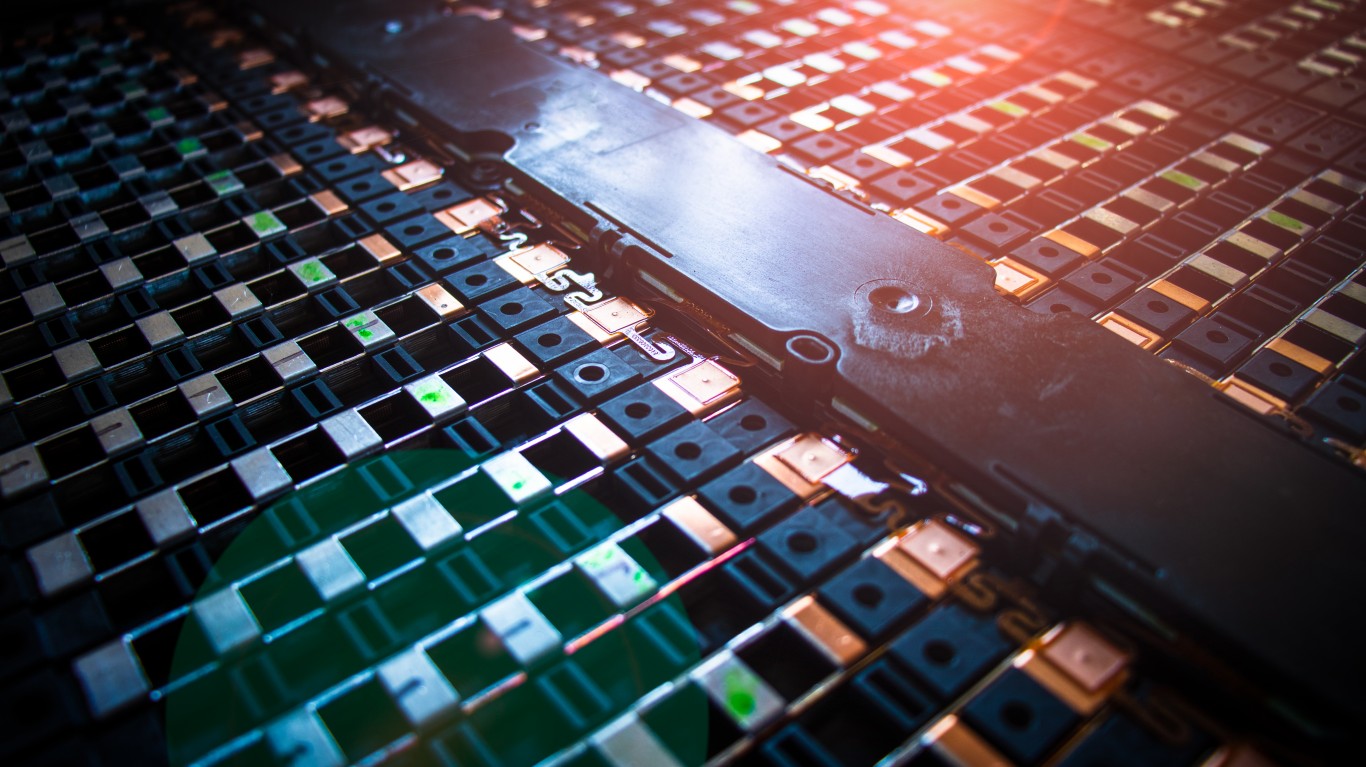

QuantumScape

Trading not far from the 52-week low, QuantumScape Corp. (NYSE: QS) is a rumored takeover candidate in the EV arena. This research-and-development-stage company focuses on developing and commercializing solid-state lithium-metal batteries for electric vehicles and other applications.

The company’s next-generation solid-state lithium-metal battery technology is designed to enable greater energy density, faster charging, and enhanced safety, supporting the transition away from legacy energy sources toward a lower-carbon future.

QuantumScape developed the industry’s first anode-less cell design, which delivers high energy density while lowering material costs and simplifying manufacturing.

The company’s innovative battery cell technology can store energy more efficiently and reliably than today’s lithium-ion batteries.

Truist Financial has a Hold rating on the shares with a $7 target.

Four High-Yield Stocks With 7% and Higher Dividends Are 2025 Home Runs

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.