Tesla Inc. (NASDAQ: TSLA) recently raised prices on some cars in China, which is the world’s largest electric vehicle (EV) market. On the other hand, it is offering low financing rates in the United States. Now, it has sharply increased what it charges for its vehicles in Canada.

24/7 Wall St. Key Points:

-

Tesla Inc. (NASDAQ: TSLA) recently raised prices on some cars in China.

-

Now, it has sharply increased what it charges for its vehicles in Canada.

-

Take this quiz to see if you’re on track to retire. (sponsored)

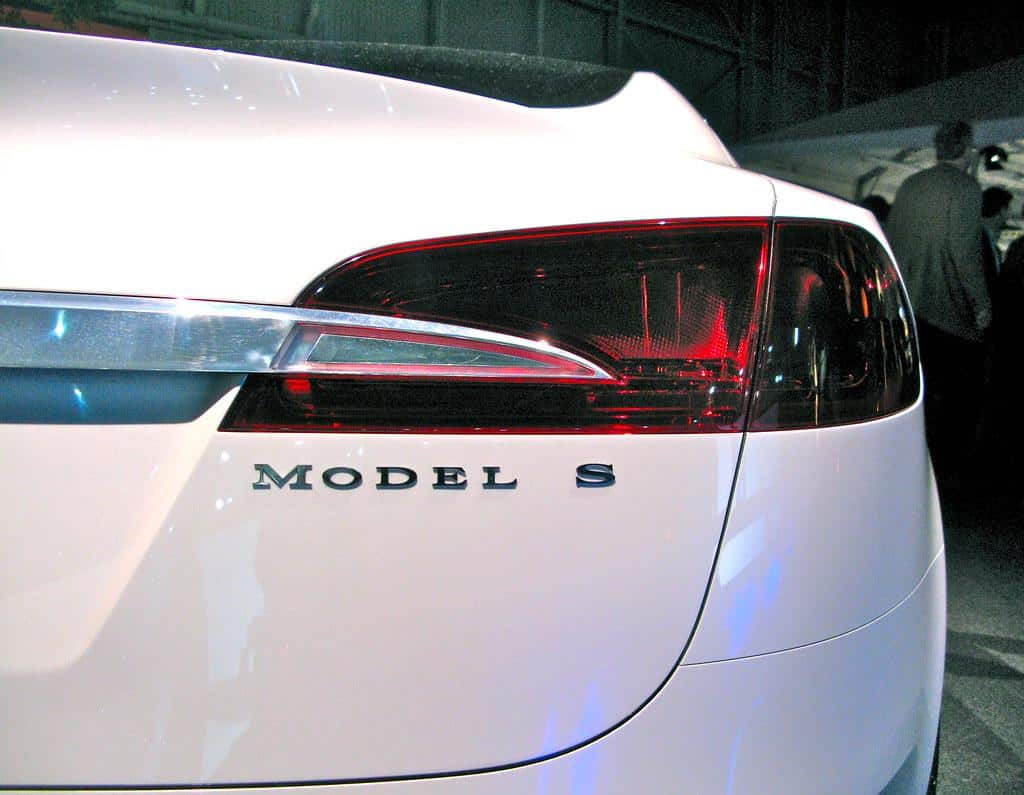

Reuters reported about the price increase, “Tesla will raise prices of all its cars in Canada from Feb. 1, according to notices on its Canadian website, with prices of Model 3 going up by as much as C$9,000 ($6,254.78). Model Y variants will see increases of up to C$4,000, while all versions of Model S and X will rise by C$4,000, according to the website.” (C$4,000 is the equivalent of $2,800.)

What This Means for Investors

The Tesla news says something about what the EV company has to do to make money, and in some markets, make more money.

Tesla’s margins have become an increasingly larger issue because it has to measure them against demand. The Chinese market is crowded with local companies, led by BYD. In the United States, the competitors are legacy companies like Ford, GM, and Hyundai/Kia.

Tesla’s global unit sales last year were 1.8 million, down about 1% from 2023. It appears, based on these figures, the company will need to be aggressive in pricing if it wants to grow. According to WhichEV, when Tesla announced its most recent earnings, “To achieve the jump in sales, Tesla sacrificed its profit margins – with the company’s net profit margin for the quarter falling by 47%, dropping from 11% in Q3 2023 to just 5.8% in the latest quarter.” The EV maker did have modest unit growth in that quarter.

Interestingly, it seems Tesla’s investors are not focused on unit sales or margins. Its stock is up 98% in the past year. The focus on its market cap has moved to whether it will lead the emerging AI self-driving car sector.

Maybe what Tesla changes for its cars has become less important to Wall Street. That has not stopped speculation about why it raises prices in some markets and lowers them in others.

Are Electric Cars Really Better for the Environment?

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.