The number of notable insider purchases has slowed since the beginning of the year. Yet one huge buy in the past week stood out. In addition, another return buyer added to a biotech stake, some insiders took advantage of an initial public offering, and a financial giant saw an insider buck a selling trend. Let’s take a quick look at these transactions.

24/7 Wall St. Key Points:

-

The number of notable insider purchases has slowed since the beginning of the year.

-

Yet one huge buy in the past week stood out.

-

Take this quiz to see if you’re on track to retire. (sponsored)

Is Insider Buying Important?

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

The earnings-reporting season is ramping up, so many insiders are prohibited from buying or selling shares. Below are some of the more notable insider purchases that were reported in the past week, starting with the largest and most prominent.

TKO

- Buyer(s): 10% owner Silver Lake West HoldCo

- Total shares: around 350,000

- Price per share: $141.98 to $146.45

- Total cost: almost $50.3 million

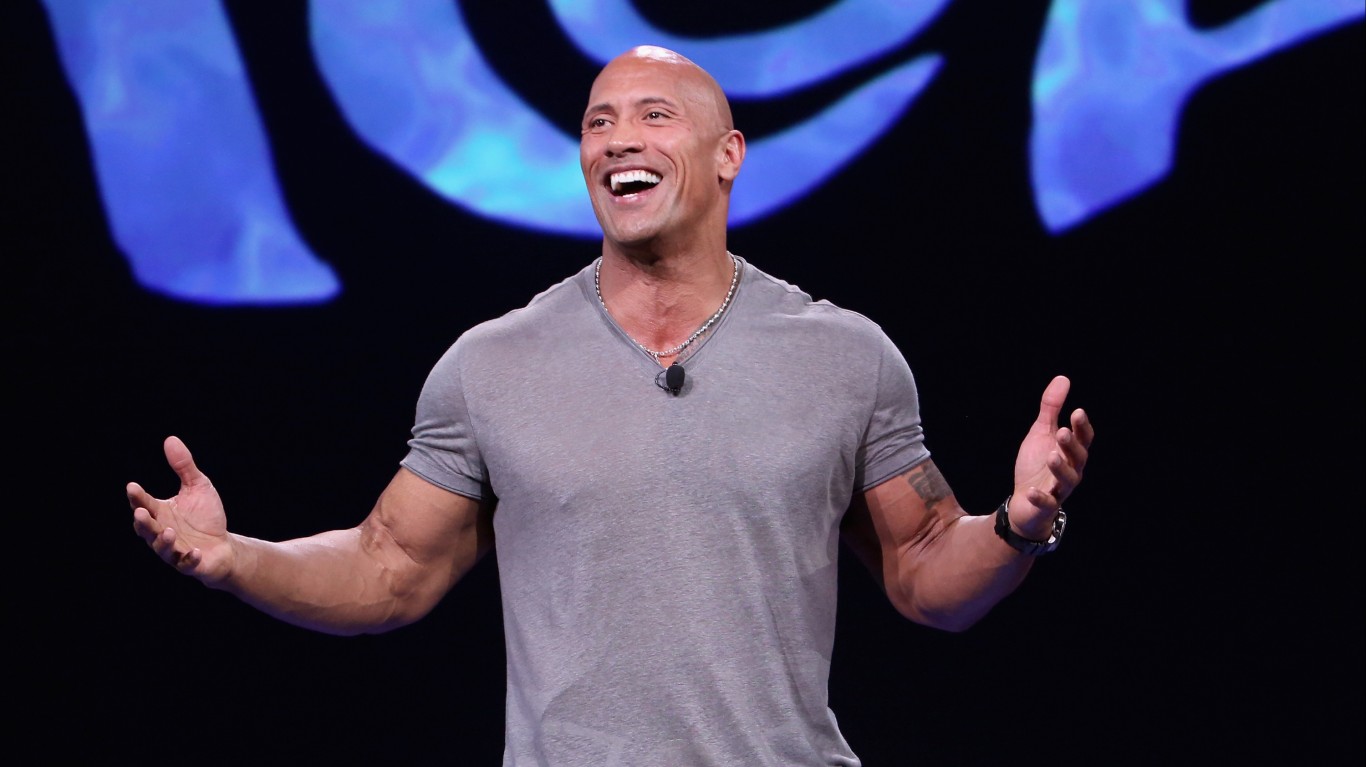

TKO Group Holdings Inc. (NYSE: TKO) is the parent of Ultimate Fighting Championship and World Wrestling Entertainment. There has been speculation that UFC programming could end up on Netflix, and UFC recently named an official wireless provider in the United States. Since the third-quarter report, the stock is up 21% and trading near an all-time high above $150 per share. The $152.70 consensus price target suggests about 4% upside in the next 12 months, and all but three out of 18 analysts recommend buying shares, three of them with Strong Buy ratings. Citigroup and UBS recently maintained their Buy ratings. Note that Dwayne “The Rock” Johnson is on the TKO board of directors.

Zymeworks BC

- Buyer(s): 10% owner EcoR1 Capital

- Total shares: almost 392,800

- Price per share: $13.12 to $14.08

- Total cost: more than $5.2 million

Though some officers recently sold shares, this beneficial owner returned to the buy window to increase its stake in Zymeworks BC Inc. (NASDAQ: ZYME). The Delaware-based biopharmaceutical company, along with Jazz Pharmaceuticals PLC (NASDAQ: JAZZ), received an FDA nod for a cancer treatment candidate back in November. The share price is about the same as back then, and when last seen it was greater than the purchase price range above. Compared to a year ago, the stock is up over 27%, a little more than the Nasdaq’s gain in that time. Analysts anticipate 41% or so further growth in the coming year to their $20.44 consensus price target. Of the eight analysts who cover the stock, six have a Buy or better rating.

Flowco

- Buyer(s): CEO Joseph Edwards and others

- Total shares: 78,600

- Price per share: $24.00

- Total cost: almost $1.9 million

Oilfield services company Flowco Holdings Inc. (NYSE: FLOC) just went public, and officers and other directors bought in to the initial public offering. The chief executive scooped up 50,000 of those shares and now has a stake of almost 184,800 shares. The stock has traded in a range of $28.25 to $30.50 thus far, and the share price was last seen near the bottom of that range. Flowco does not yet have a consensus price target or analyst recommendation.

Goldman Sachs

- Buyer(s): a director

- Total shares: 2,400

- Price per share: $619.02

- Total cost: almost $1.5 million

At a time when some Goldman Sachs Inc. (NYSE: GS) officers were selling shares, a director bucked the trend. This transaction was in the wake of stellar quarterly results, attributed to strong trading results. The CEO recently said that the financial institution would focus on a growth-oriented agenda going forward. Shares were last seen well above the director’s share price, but only marginally lower than the consensus price target of $635.52. Of the 23 analysts who cover the stock, 13 have Buy or better ratings. JPMorgan and Morgan Stanley reiterated Overweight ratings after the earnings report.

And Other Insider Buying

In the past week, some insider buying was reported at Ardelyx, Constellation Brands, Home Bancshares, Lions Gate Entertainment, and UnitedHealth as well.

Prediction: This REIT Stock Will Be the Best Performer in 2025

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.