This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive

compensation for actions taken through them.

Cathie Wood has a reputation for big wagers on technology, and she earned her reputation after returning 153% in 2020. She did well in 2021 too, but the spotlight slowly moved away as most tech-related stocks did not do well in late 2021 and performed badly through 2022. I’d say the 2021 crash is what makes Cathie Wood’s performance look worse than it is. Most people in tech fell victim to the bubble bursting.

However, Cathie Wood has likely learned from those mistakes. And you also can’t deny that Cathie’s portfolio does well when times are good. The stock market has been doing great in the past few months, and tech stocks are spearheading it, just as they did in 2021. With Stargate being announced, perhaps this could be Cathie’s time to shine again.

24/7 Wall St. Key Points:

- Cathie Wood doesn’t have the cleanest record due to the broader tech decline in 2021 and 2022.

- However, her portfolio has delivered solid returns during market booms.

- 4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

I will be looking into three robotics stocks (or at least stocks highly related to automation) that Cathie Wood has piled into. If the current AI and robotics boom continues to get hotter, these three might deliver outsized gains.

Aurora Innovation (AUR)

Aurora Innovation (NASDAQ: AUR) is a self-driving tech company. The core product here is Aurora Driver, which helps vehicles drive autonomously. It’s not exactly a “robot” company, but it’s very much an automation company and one that I think can eventually partner with some pure-play robotics companies too.

AUR stock has been up 112% in the past year due to several partnerships with industry leaders over the past few months. The most important one is the partnership with Nvidia (NASDAQ: NVDA) and Continental. It will integrate Nvidia’s DRIVE Thor system-on-a-chip into Aurora’s autonomous driving tech. The announcement alone caused AUR stock to spike by 44%.

Moreover, Aurora raised nearly $500 million in August 2024 and now has a cash runway into 2026. So, the possibility of AUR stock facing significant dilution is quite low, and combined with the broader AI enthusiasm, the performance so far should be pretty explanatory.

Cathie Wood bought 2.1 million shares of Aurora Innovation in Q3 2024.

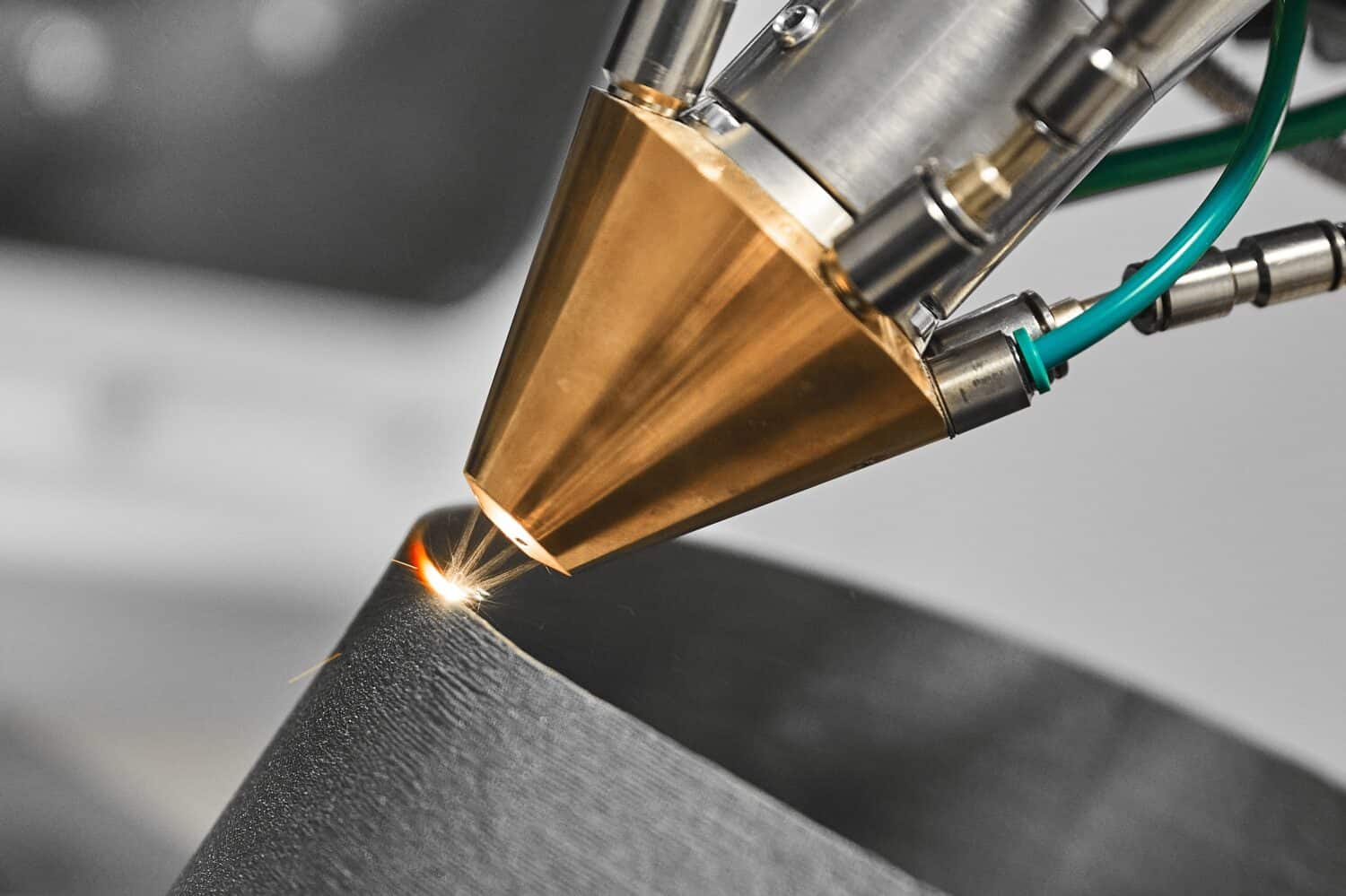

3D Systems Corporation (DDD)

3D Systems Corp (NYSE: DDD) makes 3D printing tech. It sells to both industrial and healthcare clients. Products (such as hardware and consumable materials) make up most of its revenue, and about 70-74% of 3D Systems’ top line comes from them.

3D Systems has recently been focusing more on its high-value industrial and medical targets. It sold its Geomagic software portfolio to hexagon for $123 million to sharpen its concentration on core solutions like 3D Sprint, 3DXpert, and Oqton’s Industrial Manufacturing OS software.

Management now expects to post $440 million to $450 million for all of 2024. This would actually be a decline from its $488 million sales figure in 2023. However, analysts expect an accelerating recovery in the coming years due to AI and robotics. The stock is down 41% in the past year, so a recovery in its financials should reverse the trend. Q3 results weren’t the best, and it reported a net loss of $178.6 million due to a $143.7 million goodwill impairment. Losses are expected to halve next year, but there’s no guidance for when it might become profitable. The cash balance of $190 million should be more than enough to tank the losses for at least a few more years.

Cathie seems to be drawn in more by the potential top-line recovery in the coming years. She bought 799,000 of the stock in Q3 2024.

Advanced Micro Devices (AMD)

Advanced Micro Devices (NASDAQ: AMD) doesn’t really need an introduction. It is a semiconductor company that has been in the shadows of Nvidia (NASDAQ:NVDA) for the past year. However, that doesn’t mean it’s all doom and gloom for the company. The rising tide in the AI sector is lifting all boats.

AMD is also set to benefit from the robotics boom. It acquired the FPGA pioneer Xilinx and integrated its tech into AMD’s Embedded and Adaptive Computing Group.

The company being overshadowed by Nvidia is also good since it allows AMD to focus on less saturated high-potential markets like robotics and embedded systems. The stock also has less downside risk after declining 20.6% in the past six months, and many think the expectations are so low that AMD may deliver a solid surprise when it posts its Q4 earnings. Analysts expect revenue of $7.53 billion and an EPS of $1.09, up from $6.82 billion and an EPS of $0.92 last quarter. These expectations are far less aggressive than what Nvidia has.And Cathie Wood sees potential. Ark bought $22 million worth of AMD shares in December 2024 and also increased its stake as a part of its Autonomous Tech and Robotics ETF (BATS: ARKQ). She also bought in November and many times in the past year.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.