Investing

NIO (NIO) Stock Price Prediction and Forecast 2025-2030 For January 30

Published:

Shares of NIO (NYSE:NIO) have chopped around this week and on Thursday morning remain down -2.08% since Monday’s open. A short-lived rally ended last Thursday, during which time NIO rose 7.39% between Jan. 13 and Jan. 17.

On Tuesday, Jan. 7, HSBC cut its outlook for the company from a “Buy” rating to a “Hold” rating. That is additional frustration for shareholders who have seen the stock slide b -27.12% over the past year. However, the company does have some tailwinds that should see it enjoying growth from now through 2030.

Earlier this month, NIO rolled out its latest software update to European customers — version 2.4.0 of the Banyan operating system. This update introduces over 50 new features and enhancements, including a new driving mode specifically for the ET5 and ET5 Touring models. Inspired by NIO’s electric supercar, the EP9, this new “EP Mode” driving experience was previously only available in the Chinese market.

The Chinese carmaker’s high-performance models, which feature a +600-mile range, have caught the eye of vehicle enthusiasts and investors, while addressing range anxiety issues by creating battery swap technology as a supplement to charging. NIO is one of the 10 largest vehicle manufacturers in the world and the third largest in China.

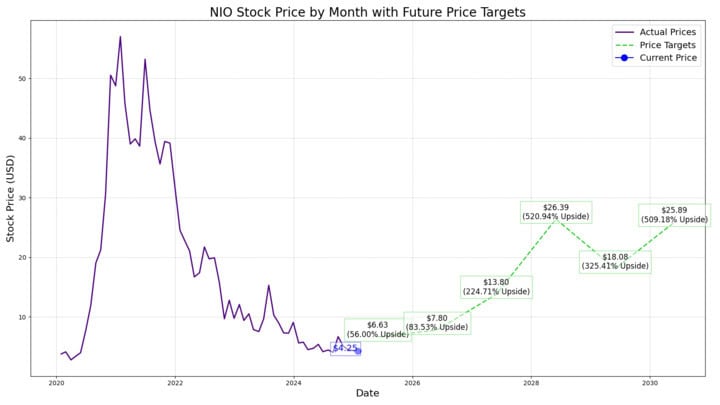

From a stock performance standpoint, NIO has been a tale of two stories. When shares debuted on the New York Stock Exchange on Sept. 12, 2018, at $9.90, they struggled to build that momentum. It wasn’t until the summer of 2020 when the stock began to surge, gaining over 810% from June 26, 2020, to Feb. 9, 2021, when the stock hit its all-time high of $62.84. Shares have fallen considerably since, but the long-term outlook remains strong.

24/7 Wall Street aims to provide readers with our assumptions about the stock’s prospects going forward, what growth we see in NIO stock for the next several years, and what our best estimates are for NIO’s stock price each year through 2030.

The following is a table of NIO’s revenues, operating income and share price for its first few years as a public company.

Here’s a table summarizing performance in share price, revenues and profits (net income) from 2014 to 2018.

| Share Price (End of Year) |

Revenues (CNY) | Operating Income | |

| 2018 | $5.39 | 4,951.2 | (9,595.6) |

| 2019 | $3.45 | 7,824.9 | (11,079.2) |

| 2020 | $40.00 | 16,257.9 | (4,607.6) |

| 2021 | $16.70 | 36,136.4 | (4,496.3) |

| 2022 | $7.87 | 49,268.6 | (15,640.7) |

| 2023 | $4.71 | 55,617.9 | (22,655.2) |

Revenue and operating income in Billion CNY (1CNY=.14 USD)

Now let’s take a look at Rivian (NASDAQ:RIVN) the first few years it was a publicly traded company (here is Rivian’s stock price forecast):

| Share Price (End of Year) |

Revenues | Operating Income | |

| 2021 | $50.24 | $55.0 | ($4,220.0) |

| 2022 | $19.30 | $1,658.0 | ($6,856.0) |

| 2023 | $10.70 | $4,434.0 | ($5,739.0) |

| TTM | $15.35 | $4,997.0 | (5,790.0) |

The revenue growth for both firms is similar but Rivian’s operating loss is more than double the yearly operating loss of NIO.

NIO formerly contracted its manufacturing to Jianghuai Automobile Group, paying a fee for each vehicle produced in addition to fixed cost. They have since acquired the factory from JAC. This agreement is beneficial for a young start-up in a very capital-intensive market. However, when scale is reached, the variable cost model has its downsides.

| Year | Revenue | Shares Outstanding | P/S Est. |

| 2025 | 97,052 | 2,050 mm | 1x |

| 2026 | 114,172 | 2,050 mm | 1x |

| 2027 | 134,643 | 2,050 mm | 1.5x |

| 2028 | 257,634 | 2,050 mm | 1.5x |

| 2029 | 176,533 | 2,050 mm | 1.5x |

| 2030 | 189,548 | 2,050 mm | 2x |

Revenue in CYN millions

Compared to Rivian and Tesla, NIO’s price-to-sales valuation will be moderately discounted. While NIO is in solid financial standing and has a premium brand image, it’s still uncertain how much competition the company will face in China and expanding overseas. The company is already spending a quarter of revenues on R&D and if NIO can’t capitalize on this spend, the stock price will be sluggish compared to North American EV manufacturers.

Wall Street analysts give NIO a one-year price target of $5.52, representing a 30.80% increase from today’s share price. Based on 12 analysts’ ratings, the stock is a consensus “Hold.”

Here at 24/7 Wall Street, we expect to see a revenue growth of 60% for the year, with a price-to-sales multiple of 1x, which puts our price target at $6.63, an upside of 56% from today’s price.

Going into 2026, we estimate the price to be $7.80, with another strong 50%+ revenue bump. However, with EBITDA still well in the negative, we see the market not rewarding the stock as much and giving it a lower valuation multiple, resulting in an upside of 83.53%.

Heading into 2027, we expect the stock price increase to leap forward to $13.80 with another strong 50%+ revenue growth year-over-year. That is a 97% year-over-year gain and up 224.71% from today’s stock price.

When predicting more than three years out, we expect NIO’s P/S ratio in 2028 to be 1.5x and top-line growth of 50%. In 2028, we have NIO’s revenue coming in around $36 billion, suggesting a stock price estimate at $26.39 or a gain of 520.94% over the current stock price.

24/7 Wall Street expects NIO’s stock to continue its revenue growth and to generate $25 billion in revenue. The stock price in 2029 is estimated at $18.08, or a gain of 325.41% over today’s price.

We estimate NIO’s stock price to be $25.89 per share. Our estimated stock price will be 509.18% higher than the current stock price.

| Year | Price Target | % Change From Today’s Price |

| 2025 | $6.63 | 56% |

| 2026 | $7.80 | 83.53% |

| 2027 | $13.80 | 224.71% |

| 2028 | $26.39 | 520.94% |

| 2029 | $18.08 | 325.41% |

| 2030 | $25.89 | 509.18% |

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.