For six decades, Warren Buffett has dominated the investing world. He has consistently beat the S&P 500 by a 2-to-1 ratio.

Generating cumulative returns of 4,384,748%, he has compiled a compound annual growth rate for Berkshire Hathaway (NYSE:BRK-A)(NYSE:BRK-B) of 19.8%, almost twice the benchmark index’s 10.2% return with dividends invested.

There is a reason Buffett is called the Oracle of Omaha. He is the greatest living investor and he might just be the best of all time.

Warren Buffett is the world’s greatest investor, beating the S&P 500 by a 2-to-1 margin over six decades. Two shocking moves by the Oracle of Omaha could be an indication of what he sees coming for the stock market. If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

24/7 Wall St. Insights:

Buffett has said that the best time to sell is never. That doesn’t mean he doesn’t ever sell stocks, but by holding to his motto of “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price,” and thinking long-term, he has compiled a remarkable record of success.

Yet Buffett just made a move that should give investors pause. He just filed with the Securities & Exchange Commission his fourth quarter 13F-HR form that the wealthiest investors use to declare what stocks they bought and sold over the last three months.

While it doesn’t tell why Buffett was a buyer or seller, it does provide insight into where he thinks the market is heading. And two sales he made in Q4 should have investors wondering if Buffett thinks the stock market is heading for a fall.

Buffett’s startling decision

Since 2019, the Oracle has owned stakes in two exchange-traded funds, the SPDR S&P 500 Trust ETF (NYSEARCA:SPY) and the Vanguard S&P 500 ETF (NYSEARCA:VOO).

These ETFs track the performance of the S&P 500. The primary difference between them is that VOO stock has a significantly lower expense ratio, or 0.03%, a hallmark of almost all Vanguard’s family of funds. SPY stock has a 0.09% expense ratio. In reality, both are dirt cheap compared to the industry average.

Buffett owned 39,400 shares of SPY and 43,000 shares of VOO. He bought both in the fourth quarter of 2019 and has held firm over the past five years.

Since purchasing the ETFs, they have more than doubled in value. He has often told investors the best investment they can make is to buy the market (using ETFs like VOO or SPY) and maybe a few government Treasuries, and that’s all they need to do to accumulate wealth.

While these were relatively small positions by Buffett standards — just $12.6 million in VOO at the time of purchase, and $12.4 million in SPY — they represented only about a half-percent of Berkshire Hathaway’s total portfolio value, and he just completely dumped both of them.

Not all heroes wear CAPEs

Like most of Buffett’s stock positions, we don’t know the rationale behind his purchase or his sale. But it couldn’t have escaped him that both are wildly overvalued.

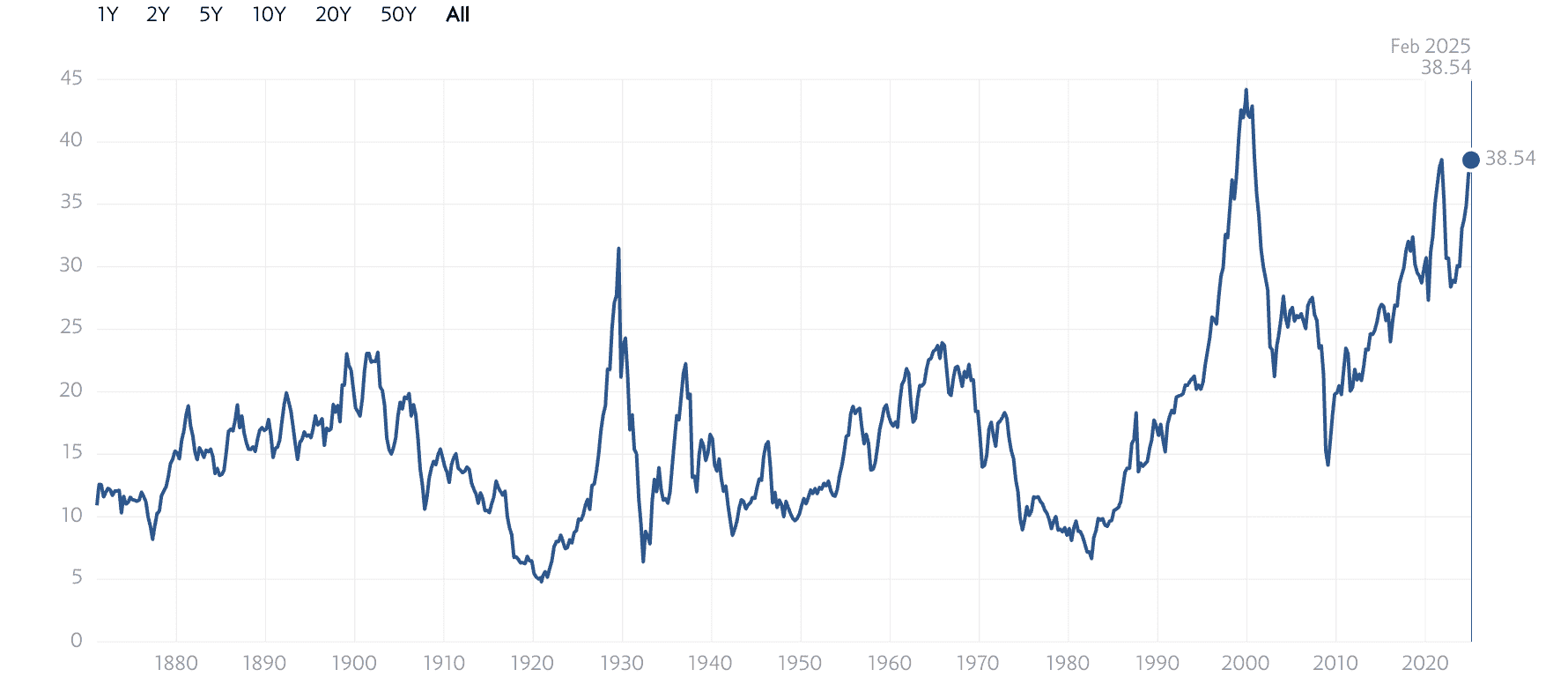

It’s been said that the Oracle’s favorite market metric is what’s come to be known as the Buffett Indicator, but was actually developed by Robert Shiller and popularized during the Dot-com Bubble when Shiller correctly argued that stocks were extremely overvalued. It’s why it is often called the Shiller PE ratio, or CAPE.

It compares the price of all U.S. stocks to the country’s economic output.It is most often used to compare the S&P 500, but it can be used with any index.

The median CAPE ratio is 17.21, but today stands at 38.54. Only twice before has the ratio gone above 35 — in October 1999 and in October 2021 (it reached 34.28 in July 1929).

Today’s reading is screaming that the market is ready for a fall.

What does it mean for investors?

Buffett has been a net seller of stocks for some time now. Although he does add to positions and occasionally buys new stocks, overall he has been selling more than he’s been buying. Berkshire Hathaway’s cash position is over $325 billion.

Now it should be pointed out that many money managers like Buffett use the SPY or VOO ETFs to park cash in advanced of a big purchase. It could be that Buffett was using the ETFs in anticipation of making some big purchases or buying a big company outright.

I would argue, though, that’s not what the Oracle is doing. Because he is a value investor always looking for that “wonderful” stock selling at a fair price, he is waiting for a time when prices become very reasonable. That will happen during a steep downturn.

It doesn’t mean you should sell all your stocks and move to cash yourself, but rather begin considering valuation more closely and owning quality businesses in your portfolio.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.