Most big-cap stocks and your favorite tech stocks may be rallying right now, but the market is still walking a tightrope this year as inflation is stickier than expected and the recent round of government layoffs could end up lifting unemployment. And as Powell said, tariffs could also bring inflation up again.

As such, it’s a good idea to always have some defensive stocks in your portfolio. Dividend stocks are the best option here, as their lower long-term base returns are offset by the dividends they pay. Dividend stocks with high yields could be much more attractive in the coming quarters if the Fed gets pressured to lower interest rates as this would make dividend stocks much more attractive.

Undervalued dividend stocks that have underlying businesses with staying power should give you the best of both worlds. They generally have limited downside risk and offer you significant upside potential once they eventually recover. In the meantime, you could sit on the stock and either collect or reinvest these dividends. Here are three such stocks to look into:

24/7 Wall St. Key Points:

- Not many investors are looking into dividend stocks as their returns have been overshadowed by the tech rally.

- However, these dividend stocks are now undervalued and as rates eventually come down, they could look a lot more attractive.

- These dividend stocks have relatively little downside risk and significant upside. In the meantime, grab our free “The Next NVIDIA” report. It includes a software stock with 10X potential.

Realty Income (O)

The real estate market has been surprisingly resilient despite the sharp increase in interest rates from 0.25% to 5.5%. Interest rates have come down by 1% from those highs, and while Powell has been more hawkish recently, the real estate market hasn’t budged.

Realty Income (NYSE:O) has a diverse real estate portfolio but specializes in single-tenant, net-leased commercial properties. The company has a focus on industries that are less vulnerable to economic downturns as 79.4% of its portfolio is retail and 14.6% is industrial. Even then, the market has already priced in recession levels of pessimism into the stock as it is down almost 32% in the past five years.

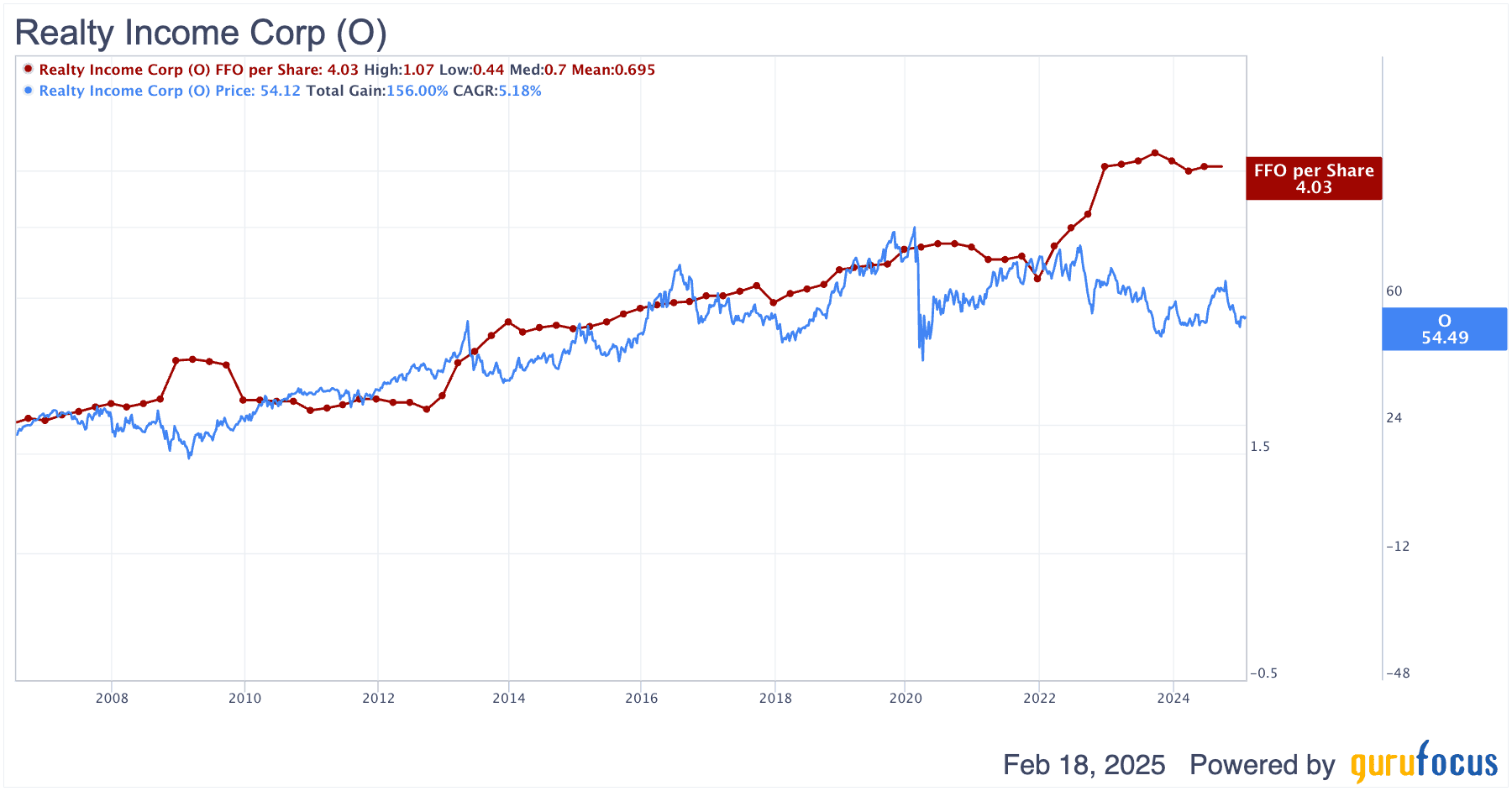

The valuation gap looks pretty unreasonable when you consider that TTM revenue has increased from $2.1 billion in 2021 to over $5 billion as of Q3 2024. EBITDA has more than doubled, and the gap between its price and FFO has widened to record levels.

Both the top line and the company’s FFO is expected to grow at mid-single digits in the coming years. O stock also comes with a dividend yield of 5.81%, so I think it’s a pretty solid stock that is both undervalued and has high dividends.

Flowers Foods (FLO)

Flowers Foods (NYSE:FLO) is a bakery company. It was one of the most consistent stocks in the past two decades but it has fallen off that trajectory recently. The stock is down 38% from its December 2022 peak, but it has the fundamentals to return to course. The current decline is due to lackluster growth in the past two years.

Flowers Foods announced a slightly dilutive acquisition of Simple Mills for $795 million. It had a 1.6% net sales decline in Q4 2024 due to volume declines. Simple Mills grew its revenue by 14% year-over-year to $240 million in 2024. Flowers Foods itself posted $5.1 billion in sales, though it was up only 0.25%. 2025 is expected to be a little better with estimates at $5.37 billion. Statutory earnings per share are expected to decline 7.1% to $1.1, which is likely due to egg prices and weaker-than-expected category performance.

Regardless, it’s not a good idea to think it’s all doom and gloom by just looking at near-term financials. Flowers Foods has a stable foundation and solid cash flow. And as the stock eventually makes a turnaround, you could sit on its dividend yield of 5.19%. EPS is finally expected to start recovering starting next year, and Simple Mills could also start contributing to the top line by then.

Constellation Brands (STZ)

Constellation Brands (NYSE:STZ) is one of the biggest producers of beer, wine, and spirits. This stock won’t pay you that high of a dividend, as it yields about 2.48% as of writing. However, it certainly looks undervalued as it has plunged 33% in just the past six months. Wall Street may have taken things too far based on near-term trends as Constellation Brands owns premium wine brands with staying power.

The decline here has caught the eye of Warren Buffett who is now betting big on its recovery. Buffett’s latest 13-F filing showed he added 5.6 million shares of STZ worth $1.24 billion (at the end of the year) to his portfolio. This was the largest new purchase in Berkshire’s Q4 2024 13-F filing.

But first, let’s look into why the stock is down so much in the first place. Constellation Brands’ revenue fell 0.4% year-over-year to $2.46 billion and missed estimates by 2.8%. Wine and spirits sales declined 14% year-over-year, and it also revised down its EPS guidance to $13.4-$13.8 from $13.6-$13.8 and warned of a 62-65% decline in operating income due to weaker-than-expected sales.

That operating income decline is likely to be temporary, and considering how much the stock has declined, the bearishness seems pretty priced in. The consensus price target of $254.3 now implies 56.3% upside potential. You also have Buffett on your side, so that should sweeten the deal more.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.