Investing

Amazon Stock (AMZN) Price Prediction and Forecast 2025-2030 For February 19

Published:

Shares of Amazon (NASDAQ: AMZN) gained 0.52% on Wednesday, which was not enough to dig them out of a -1.58% loss over the past five trading sessions. The stock is up 2.91% year-to-date and has gained 27.16% over the past six months.

During its Q4 2024 earnings call on Feb. 6, Amazon announced that its advertising revenue surged to $17.3 billion as Thursday Night Football set streaming records by averaging 13.7 million viewers. That ad revenue represented 18% quarter-over-quarter growth. Additional revenue drivers included strong retail holiday spending and AI services through AWS — the largest cloud provider in the world.

On Jan. 28, AMZN hit its all-time high closing price of $238.15. Over the past year, the e-commerce giant has posted a gain of 35.64%. In January, the stock jumped when Raymond James increased its price target for AMZN from $230 to $260. That follows a similar increase from BMO Capital Markets, which on Jan. 17 increased its price target for Amazon’s stock from $236 to $265 with an “Outperform” rating.

Outside of NVIDIA (NASDAQ: NVDA), Amazon has been a Wall Street darling since the company IPO’d in May 1997 at a split-adjusted price of $0.07. Today, Amazon trades for $231.40, meaning the stock is up more than 10,698%% since January 2005. However, the only thing that matters from this point on is what the stock will do for the next one, five and 10 years and beyond.

Let’s crunch the numbers and give you our best guest on Amazon’s future share price. No one has a crystal ball and even the Wall Street “experts” are often wrong more than they are right in predicting future stock prices. We will walk through our assumptions and provide you with the story around the numbers (other sites just pick a share price without explaining why they suggest the price they do).

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2017.

| Year | Share Price | Revenues* | Net Income* |

| 2014 | $19.94 | $89.0 | ($.241) |

| 2015 | $15.63 | $107.0 | $.596 |

| 2016 | $32.81 | $136.0 | $2.371 |

| 2017 | $37.90 | $177.9 | $3.03 |

| 2018 | $58.60 | $232.9 | $10.07 |

| 2019 | $73.26 | $280.5 | $11.59 |

| 2020 | $93.75 | $386.1 | $21.33 |

| 2021 | $163.50 | $469.8 | $33.36 |

| 2022 | $167.55 | $514.0 | ($2.72) |

| 2023 | $85.46 | $574.78 | $30.42 |

| 2024 | $219.39 | $637.96 | $59.2 |

*Revenue and Net Income in Billions

From 2014 to 2024, Amazon’s revenue grew by 616.80%. The ride up wasn’t always smooth, however. For example, in 2020, sales jumped 38%, and net income nearly doubled. 2021 saw a continued boom as people moved to e-commerce shopping during Covid. However, all those sales being “pulled forward” led to challenges in 2022, and the company swung to a surprise loss. As Amazon embarks into the back half of the decade, a few different key areas will determine its performance.

The current consensus one-year price target for Amazon stock is $268.91, which is 18.65% upside from today’s closing price. Of all the analysts covering Amazon, the stock is a consensus buy, with a 1.37 “Strong Buy” rating.

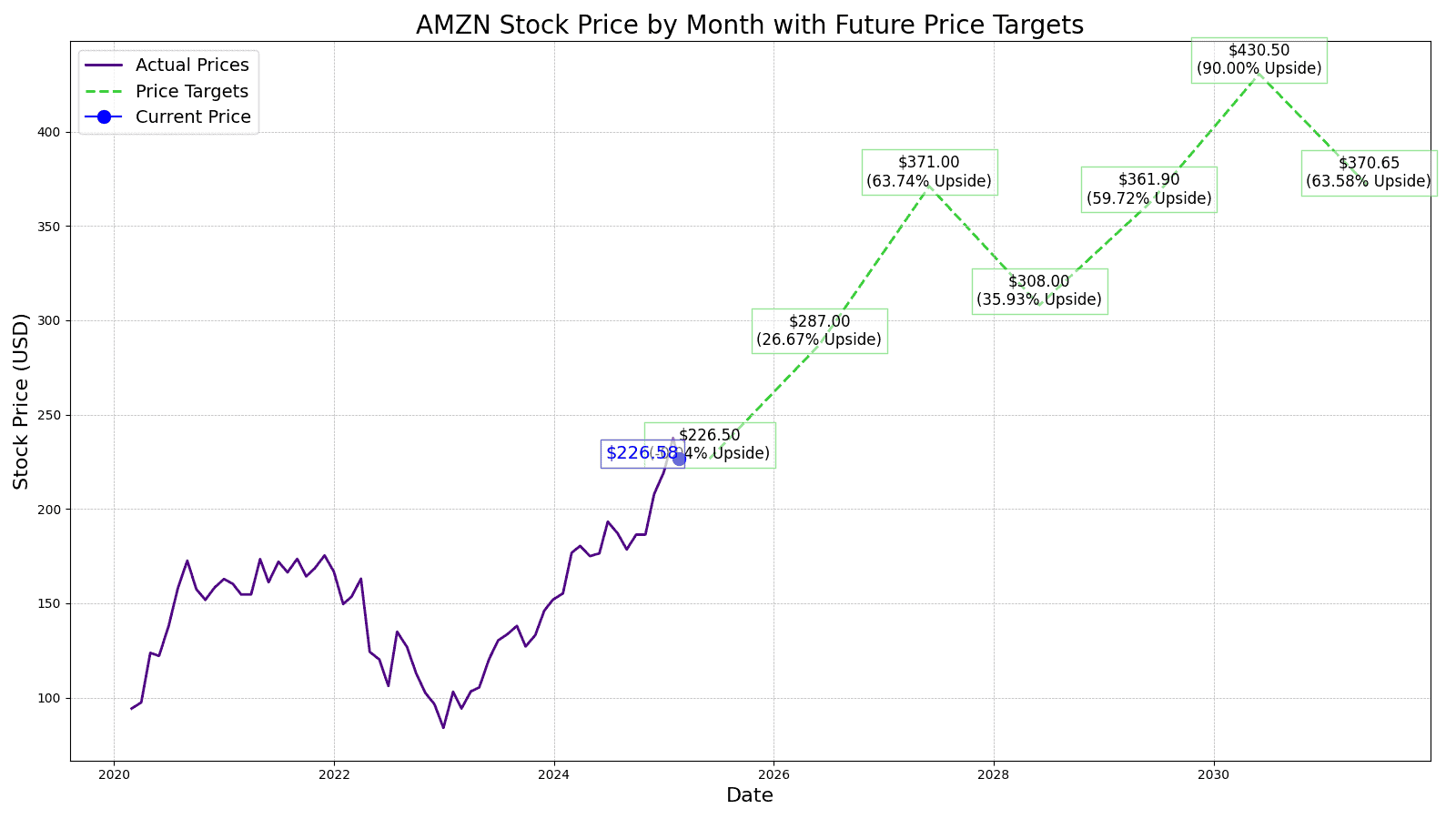

24/7 Wall Street‘s 12-month forecast projects Amazon’s stock price to be $226.50. We see AWS continuing its current 12% growth rate but see Amazon’s advertising business outperforming analysts’ expectations.

Add all these numbers up and take out some amount for “new bets” the company will surely be investing in (and a potential dividend boost)and we see revenue in 2030 at $1.15 trillion and $131 billion in net income. Today, the company trades for about 50X earnings, which we’ll take down to 35 times as the company matures (but continues showing growth). In our analysis, Amazon is worth $2.6 trillion in 2030. Here are our revenue, net income, and company size estimates through 2030:

| Year | Revenue | Net Income | Total Enterprise Value |

| 2024 | $638 | $48.56 | $1.93 |

| 2025 | $710 | $62.13 | $2.12 |

| 2026 | $788 | $79.68 | $2.19 |

| 2027 | $867 | $96.53 | $2.29 |

| 2028 | $957 | $114.17 | $2.39 |

| 2029 | $1,049 | $136.69 | $2.5 |

| 2030 | $1,149 | $131.39 | $2.6 |

*Revenue and net income reported in billions and TEV in trillions

We estimate Amazon’s stock price to be $430.50 per share with 10% year-over-year revenue growth but compressed margins from more competition in its AWS unit. Our estimated stock price for Amazon will be 86.04% higher than the current stock price.

| Year | Price Target | % Change From Current Price |

|---|---|---|

| 2025 | $226.50 | Downside of -2.09% |

| 2026 | $287.00 | Upside of 26.67% |

| 2027 | $371.00 | Upside of 63.74% |

| 2028 | $308.00 | Upside of 35.93% |

| 2029 | $361.90 | Upside of 59.72% |

| 2030 | $430.50 | Upside of 90.00% |

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.