Rivian (NASDAQ: RIVN) delivered its Q4 2024 earnings report on yesterday, and while the electric vehicle (EV) market faces headwinds, the company offered plenty of reasons for optimism. From finally hitting positive gross profits to its hyped midsize SUV launch, here are five positives from Rivian that investors should be following closely on the road ahead.

Key Points

-

Rivian hits positive gross profit, cutting costs by $31,000 per vehicle.

-

R2 SUV debuts 2026 at $45,000, targeting triple the market size.

-

$7.7 billion cash plus $10.1 billion potential funds R2 ramp-up.

-

If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. The report includes a complete industry map of AI investments that includes many small caps.

1. Finally turning the corner on positive growth profit

Rivian hit a major milestone that has been hinted at for numerous quarterly earnings announcing leading up to this quarter- finally turning a profit.

The automotive segment posted $110 million (7% margin), while software and services added $60 million (28% margin). This was fueled by a $31,000 reduction in cost of goods sold (COGS) per vehicle—from $130,000 in Q4 2023 to $99,000—alongside higher average selling prices (ASPs) of $86,000, thanks to strong Tri-Motor R1 sales.

CEO RJ Scaringe called it “a really important milestone,” which validates years of cost-cutting and operational discipline. For investors, this shift slashes cash burn and signals Rivian is nearing financial sustainability—a huge win for a young EV maker in a capital-intensive industry.

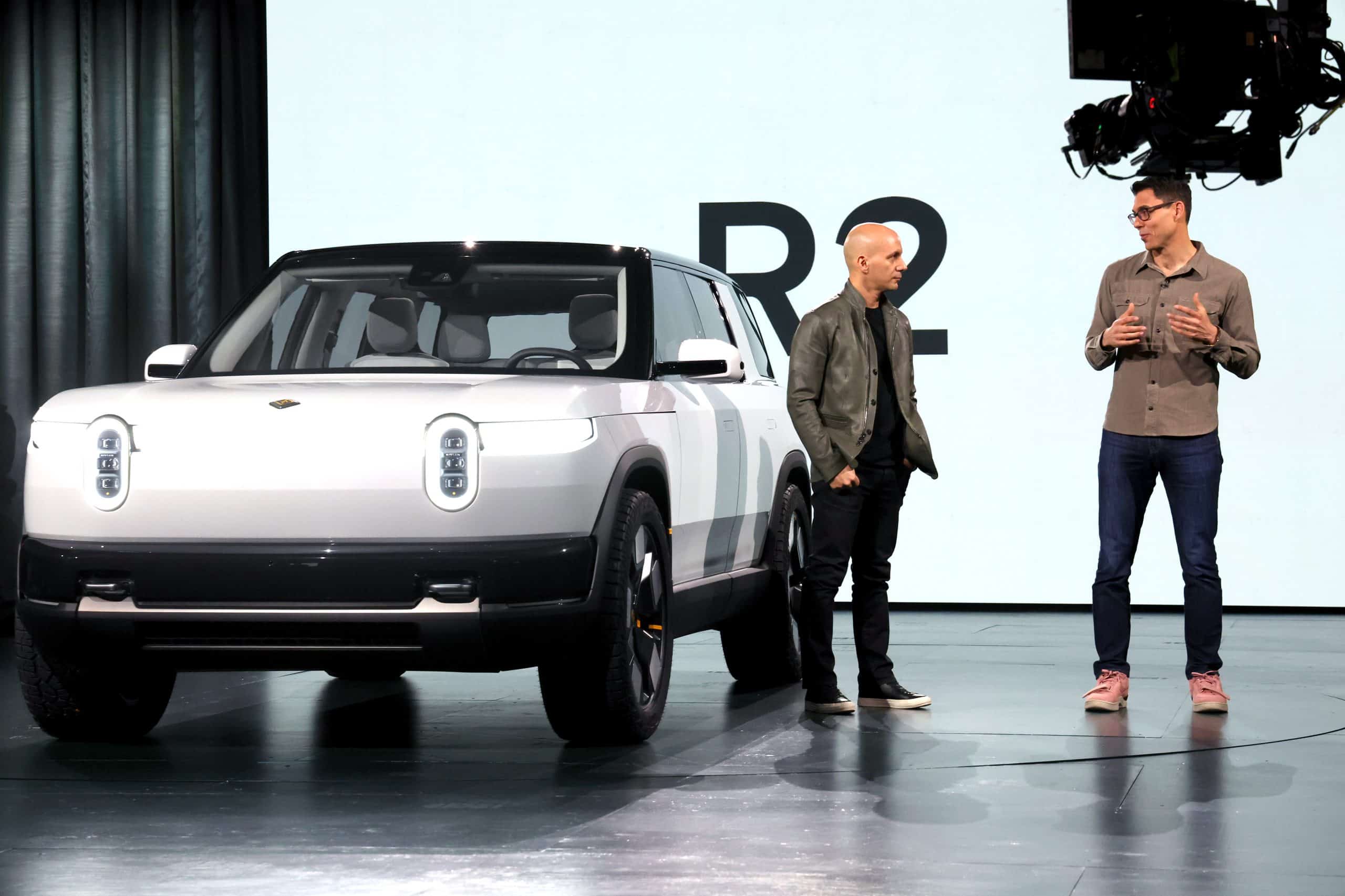

2. R2 set for its 2026 debut

The midsize SUV with a much discounted starting price of $45,000 was a highlight on the company earnings call, with a planned launch expected in the first half of 2026. Targeting a broader market than the premium R1 line, R2 boasts a cost structure roughly 50% lower than R1’s.

This move compares favorably to Tesla’s (NASDAQ: TSLA) Model Y launch in March 2020 at $39,000. CEO RJ Scaringe’s excitement was palpable: “We couldn’t be more excited about this program.” If executed well, R2 could triple Rivian’s addressable market, setting the stage for explosive volume growth and potentially sending the stock soaring post-2026.

3. Hoarding much needed cash

Rivian ended 2024 with $7.7 billion in cash, up from $6.7 billion, helped by $1.3 billion from its Volkswagen joint venture —part of a $5.8 billion deal. Add in a pending $6.6 billion Department of Energy (DOE) loan and remaining JV funds, and Rivian could unlock another $10.1 billion.

CFO Claire McDonough noted this capital “is expected to fund Rivian’s operations through the ramp of R2” This financial runway reduces dilution fears and supports $1.6–$1.7 billion in 2025 capex for R2 and a future Georgia plant, giving investors confidence in Rivian’s ability to scale without stumbling. The cash position again highlights the importance of the R2 launch and consumer appetite for the EV.

4. Software and Self-Driving

Rivian’s Autonomy Platform (featuring 55 megapixels of cameras, five radars, and 10x the compute power of Gen 1) nearing key milestones. A hands-off highway feature launches in weeks, with an eyes-off version slated for 2026, leveraging AI for rapid improvement.

Meanwhile, the Volkswagen JV drove $214 million in Q4 software and services revenue, with $2 billion more expected over four years, targeting over $1 billion in 2025 at 30% margins. CEO Scaringe emphasized, “We believe that it will create economic value for us as a business.” These high-margin segments diversify Rivian’s revenue, offering a lucrative edge that could juice profitability and stock valuation as adoption grows.

5. 2025 Forecast

Analysts and stockholders did not look favorably on 2025 forecast of 46,000 to 51,000 deliveries, which would show negative growth or best case, flat year-over-year growth rates in sales. 1Q 2025 numbers reflect external setbacks like the LA fires, but the focus should be on adjusted EDITDA losses which are expected to shrink to $1.7 to $1.9 billion from $2.69 billion. The focus on efficiency gains in 2025 should lead to a stellar 2026, making this coming year a speed bump rather than a massive calamity.

For those betting on Rivian’s electric future, these five bright spots light the way. But challenges remain and if Rivian doesn’t execute in any of the areas above in the coming year, it might be time to jump ship before 2026.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.