Investing

Billionaire Investor Warns America Could Have 'Economic Heart Attack' If This Is Not Fixed in 3 Years

Published:

It wouldn’t be America without a rich person telling us the world is going to end for some reason or another. It seems every other day some oligarch or politician is telling us our world is over due to some social issue they disagree with. Which one is it this time?

Ray Dalio says that unless we cut the government deficit to 3% of GDP, we will face an economic heart attack.

The current budget cuts made by Musk and Trump run counter to the recommendations of Ray, and are likely to make the problem, and ensuing crisis, even worse.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Recently, billionaire Ray Dalio said that he believes the United States is headed for an economic heart attack. Why does he think this? What can we do to avoid it? Is he right? What other reasons might Ray want or expect a financial crisis? We explored the topic and Ray himself to find out.

The rich and powerful love economic crises. Sorry if this is how you found out, but every financial crisis has led to the rich getting richer and the poor getting poorer. The 2008 financial crisis and the COVID-19 pandemic saw two of the largest transfers of wealth from the middle class and poor to the wealthy, increasing the number of billionaires in the world by a significant amount each time. So, when one starts talking about an upcoming crisis, we should help each other better protect ourselves from what is to come.

Raymond Dalio founded the world’s largest hedge fund, Bridgewater Associates in 1975, and currently serves as its co-chief investment officer, a position he has held since 1985. According to a 2020 Bloomberg list, Ray is the 79th richest person in the world.

Ray has spent his whole life in trading and stocks after graduating from Harvard in 1973, and Bridgewater quickly grew to become the biggest hedge fund in the world in 2005. It managed to prepare for the 2008 financial crisis and avoid the risky investments that other companies bought into heavily. As a result, it managed to grow by 9.5% during the crisis while other companies all lost value.

He is regularly included on the list of the most influential people in the world.

Even though he is extremely wealthy and relies on oppressive capitalist markets to make his money, Ray has said that he believes capitalism needs to be reformed because it is “not working well for most Americans”. He has also said that income inequality in our country is a national emergency and has repeatedly called for reform, refinement, and regulation in our capitalist system. On a number of occasions, he has said that too much money, unfunded social programs, and government deficits all combine to create a recipe for disaster.

He has pointed out, correctly, that there has been little-to-no income growth for the average American citizen over the last 20 years, and that the bottom 60% of Americans have had no income growth (adjusting for inflation) since the 1980s! As a result, income inequality is at its highest point since the 1930s.

Over time, Ray points out, it is becoming harder for low-wage workers to move to higher levels of wealth and that Americans have less economic and social mobility due to the rich hoarding all the wealth. According to Ray, a better form of capitalism would be better at creating not only a bigger pie of profit but also be better at redistributing it fairly among all participants.

At the World Government Summit in Dubai in 2025, Ray spoke with right-wing grifter and extremist Tucker Carlson about his predictions for the future and the dangers posed by significant government debt if it is not addressed. We recommend you watch the entire interview for full context. As much as we wanted to ignore Tucker Carlson’s brain-numbing comments and interjections, we will cover those as well.

Essentially, Ray says that there are five major forces that contribute to the coming financial crisis:

Ray points out that everything economists and political scientists talk about usually falls into one of these five forces and they all move in cyclical patterns. When these forces, in their own cycles, line up in certain ways, a financial or national crisis will occur. He says that they are lining up now with the first force, money debt, driving most of the concern.

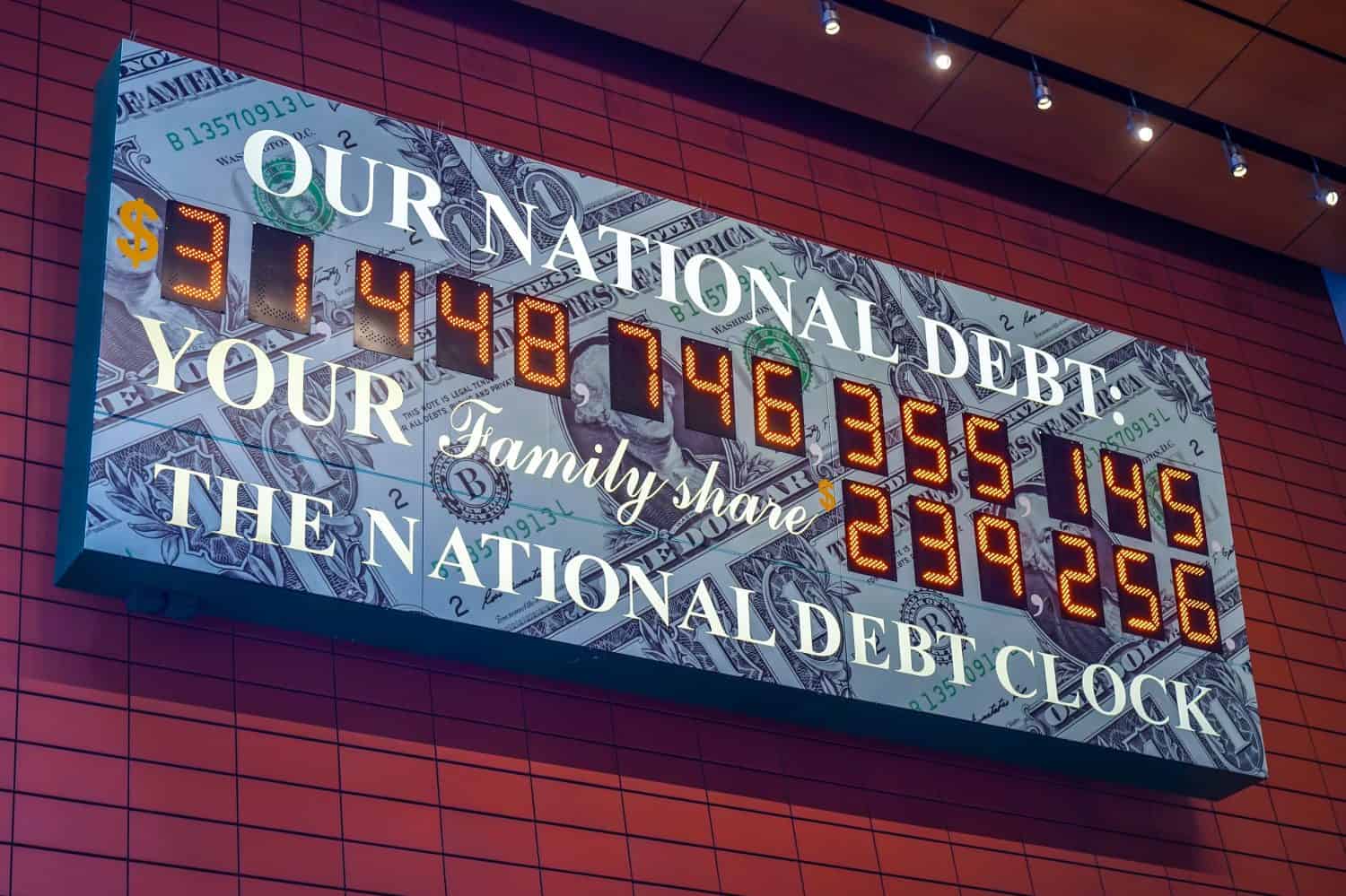

Ray says that the level of debt today is unprecedented in all of human history. After a short explanation of how the debt force cycle works, he says that debt slowly restricts the ability of the borrower to spend and borrow money.

He says that the United States pays about $1 trillion every year just paying the interest on the debt it already has, and in the next year it will have $9 trillion that it has to pay or roll forward. He then points out that debt is an asset to whoever holds it, and that debt will continue to be a valuable asset as long as the debtor pays returns on that debt. But once the creditor believes the debt no longer is valuable, or the debt stops paying returns, then we have a problem.

Central banks have a choice when this happens: either raise interest rates as the creditors begin to sell their debt and let the economy suffer, or print more money to pay those debts and cause significant inflation.

Ray estimates that the amount of debt is not serviceable and the U.S. position is not strong enough to maintain the level of debt it has, and if something is not done in the next three years, we will face a significant crisis.

He calls this a “supply and demand” issue, meaning if there is too much debt (supply) and not enough demand (people wanting to buy that debt), the debt loses value and the U.S. can no longer borrow money to pay for itself.

He says that if Trump passes his proposed tax cuts, the United States will run a budget deficit of around 7.5% of GDP, but he says that deficit must be cut to, at most, 3% of GDP if we want to avoid this crisis. He says that this can be done, but any deficit higher than that will likely lead to a significant problem.

Besides the problem of a crisis, Ray also points out that high levels of debt contribute to political instability, which can exacerbate existing issues and lead to other problems.

When asked if there was anything we could do to prevent, avert, or mitigate this disaster, Ray had a few ideas.

Ray admitted that there is a lot of politics involved with reducing the deficit to 3% of GDP, but reiterated that that should be the top priority no matter what. He says that everybody has to be on board and that no matter what you have to do to get there, you have to get there.

Ray says that you shouldn’t break too many things while cutting money from the government budget, but it has to be done fast. If the government is able to deliver on cutting costs and reducing debt and deficit, then the markets will respond by lowering interest rates, which will make it even easier to service the debt because less money will be going toward interest payments.

His top recommendation, however, was to not let the ideological reasons behind the cost cuts, or the ideological causes paid for or prevented by the money involved influence the cuts themselves.

At this point in the interview, unfortunately, Tucker Carlson chimes in and asks if making cuts to discretionary spending and eliminating “wasteful nonsense” is the best way to achieve this. He was obviously looking for Ray to support Trump and Musk’s current destruction of the federal government, but Ray was having none of it.

After struggling to give a polite answer, Ray replied “I don’t see it.”

“If you can go through and say ‘I’m not going to unacceptably break these things and I’m going to achieve those things’, great!” He says, in support of a more humane and common-sense approach to reducing government spending.

He elaborates his point by saying that technological advancement and incorporating new technology into government processes is one of the best ways to reduce costs.

He says that if the government can make quick increases to the income of Americans or increase productivity, that will have a bigger impact on reducing government spending than gutting entire departments.

Ray goes on to say that it is unlikely that any single solution will be likely to solve the issue and he warns Tucker, and Trump by extension, that if they choose this path (meaning the cutting of costs by gutting the federal government) then they own the consequences and that there are so many unknown variables and unpredictable outcomes.

Tucker then quickly changes the direction of the conversation and inadvertently gives us a view of what departments he would like to see eliminated when he says that cutting government spending leads to the elimination of some government services that people depend on. This “rewrites the social contract” and leads to violence and even revolution. He asks Ray which he fears more: violent revolution or the financial crisis.

Ray reinforces his point that achieving the 3% deficit is paramount and it’s more important to achieve that in a reliable and sustainable way without permanently damaging the government and then figure everything else out. He says that there are three primary factors that can help do this: tax income (not necessarily tax rates, since governments generate more taxes with high productivity than with higher rates), cutting spending, and managing interest rates.

Ray says that this is achievable, and based on historical precedent it can be done without creating too much shock in any of those three primary areas (unlike what is happening now, with significant shock), but it has to be done now.

What does this mean for normal people? For everyday citizens? Is Ray correct? Does it matter?

Whether or not Ray is correct doesn’t really matter at this point, as President Trump and Elon Musk have already begun eliminating thousands of government positions, cutting huge amounts of funding for essential government services and departments, and obstructing government operations. While this is one of the three primary factors Ray recommended addressing, Trump and Musk are doing so in the worst way possible.

First, these cuts are causing (or the result of) irreversible damage to government agencies and programs, in direct opposition to what Ray recommended. Whether this is by design or accident doesn’t matter at this point. Much of the economy, social cohesion, and health and safety of millions of Americans (and people around the world) rely on these funds and programs. Thousands of people have already been affected and experts agree that disease, poverty, and other negative results will continue to spread in the months and years to come, even if these decisions are reversed.

Second, these budget cuts made by DOGE are clearly politically driven. They have targeted political enemies, politically-aligned programs, and social and economic causes that they disagree with. This includes humanitarian aid, education, DEI programs, disease research, national parks funding, legal protections, and more. Ray said that these cuts cannot be politically driven, and because they are, they will not have the intended effect.

Third, these cuts are not nearly in the amount, or in the area, they should be to have any kind of impact on government debt. By its own admission, DOGE has found “billions” of dollars of discretionary spending that it has cut, which is barely a drop in the bucket of government spending. If Trump and Elon really wanted to cut the deficit, they would focus on military spending and consolidating welfare into more streamlined and cost-efficient programs (like a universal basic income, which would save money and provide better care for Americans at the same time). And that is taking DOGE at its word, whereas investigative reporting has shown that the new department is greatly exaggerating its cuts and even forging official government documents to make it look like they are finding more money than it really did.

Fourth, it is becoming increasingly clear that these government budget cuts are targeting agencies that regulate or are conducting investigations into Elon’s companies, despite Trump’s promises that Elon would excuse himself if he encountered any conflicts of interest, and that Trump does not have any control over Elon or his new department. These cuts are being made without any thought for their future impact or the damage they will cause. People are actively being harmed, and personal data is being given to a power-hungry oligarch without any concern for what will happen next.

According to Ray, these cuts will not avert the incoming financial disaster. Yet, with so many of our regulatory agencies gutted and other benefit programs defunded, our country will be weaker and far less prepared for it when it eventually comes.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.