Investing

Amazon Stock (AMZN) Price Prediction and Forecast 2025-2030 for February 24

Published:

Shares of Amazon.com Inc. (NASDAQ: AMZN) have retreated 3.7% in the past week and are down by about the same amount since the beginning of the year. Compared to a year ago, the stock is 21.3% higher, narrowly outperforming the Nasdaq in that time.

During its fourth-quarter 2024 earnings call on Feb. 6, Amazon announced that its advertising revenue surged to $17.3 billion as Thursday Night Football set streaming records by averaging 13.7 million viewers. That ad revenue represented 18% quarter-over-quarter growth. Additional revenue drivers included strong retail holiday spending and AI services through AWS, the largest cloud provider in the world.

On Feb. 4, Amazon shares hit its all-time high closing price of $242.52. Over the past five years, the e-commerce giant has posted a gain of 106.7%. In January, the stock jumped when Raymond James increased its price target from $230 to $260. That follows a similar increase from BMO Capital Markets, which on Jan. 17 increased its price target for Amazon stock from $236 to $265 with an Outperform rating. Citigroup, Goldman Sachs, Wells Fargo, and many others maintained Buy-equivalent ratings after the fourth-quarter report.

Outside of Nvidia Corp. (NASDAQ: NVDA), Amazon has been a Wall Street darling since the company’s initial public offering in May 1997 at a split-adjusted price of $0.07. Today, Amazon trades for about $216, meaning the stock is up more than 9,900% since January 2005. However, the only thing that matters from this point on is what the stock will do for the next one, five, and 10 years and beyond.

Let’s crunch the numbers and give you our best guess about Amazon’s future share price. No one has a crystal ball, and even the Wall Street “experts” are often wrong more than they are right in predicting future stock prices. We will walk through our assumptions and provide you with the story around the numbers (other sites just pick a share price without explaining why they suggest the price they do).

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2017.

| Year | Share Price | Revenues* | Net Income* |

| 2014 | $19.94 | $89.0 | ($.241) |

| 2015 | $15.63 | $107.0 | $.596 |

| 2016 | $32.81 | $136.0 | $2.371 |

| 2017 | $37.90 | $177.9 | $3.03 |

| 2018 | $58.60 | $232.9 | $10.07 |

| 2019 | $73.26 | $280.5 | $11.59 |

| 2020 | $93.75 | $386.1 | $21.33 |

| 2021 | $163.50 | $469.8 | $33.36 |

| 2022 | $167.55 | $514.0 | ($2.72) |

| 2023 | $85.46 | $574.78 | $30.42 |

| 2024 | $219.39 | $637.96 | $59.2 |

*Revenue and net income in billions

From 2014 to 2024, Amazon’s revenue grew by 616.80%. The ride up wasn’t always smooth, however. For example, in 2020, sales jumped 38%, and net income nearly doubled. 2021 saw a continued boom as people moved to e-commerce shopping during Covid. However, all those sales being “pulled forward” led to challenges in 2022, and the company swung to a surprise loss. As Amazon embarks into the back half of the decade, a few different key areas will determine its performance.

The current consensus one-year price target for Amazon stock is $266.48, which is about 23.0% upside from the latest closing price. All but four of 69 analysts covering Amazon recommend buying shares, 18 of them with Strong Buy ratings.

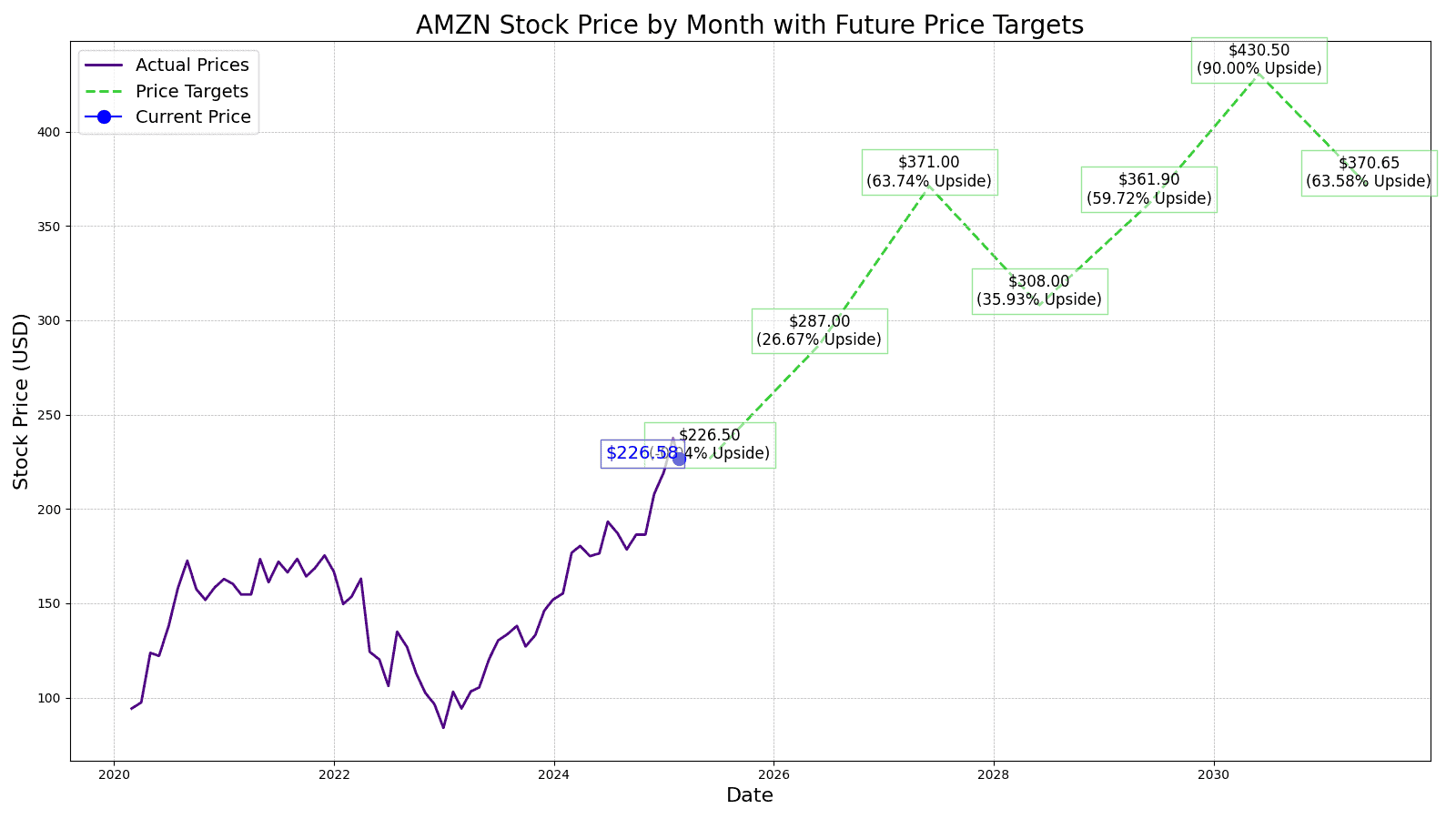

24/7 Wall St.’s 12-month forecast projects Amazon’s stock price to be $226.50. We see AWS continuing its current 12% growth rate but see Amazon’s advertising business outperforming analysts’ expectations.

Add all these numbers up and take out some amount for “new bets” the company will surely be investing in (and a potential dividend boost) and we see revenue in 2030 at $1.15 trillion and $131 billion in net income. Today, the company trades for about 50X earnings, which we’ll take down to 35 times as the company matures (but continues showing growth). In our analysis, Amazon is worth $2.6 trillion in 2030. Here are our revenue, net income, and company size estimates through 2030:

| Year | Revenue | Net Income | Total Enterprise Value |

| 2024 | $638 | $48.56 | $1.93 |

| 2025 | $710 | $62.13 | $2.12 |

| 2026 | $788 | $79.68 | $2.19 |

| 2027 | $867 | $96.53 | $2.29 |

| 2028 | $957 | $114.17 | $2.39 |

| 2029 | $1,049 | $136.69 | $2.5 |

| 2030 | $1,149 | $131.39 | $2.6 |

*Revenue and net income reported in billions and TEV in trillions

We estimate Amazon’s stock price to be $430.50 per share with 10% year-over-year revenue growth but compressed margins from more competition in its AWS unit. Our estimated stock price for Amazon will be 86.04% higher than the current stock price.

| Year | Price Target | Change From Current Price |

|---|---|---|

| 2025 | $226.50 | −2.09% |

| 2026 | $287.00 | 26.67% |

| 2027 | $371.00 | 63.74% |

| 2028 | $308.00 | 35.93% |

| 2029 | $361.90 | 59.72% |

| 2030 | $430.50 | 90.00% |

Amazon to Pass Walmart and Become America’s Largest Company

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.