Norges Bank Investment Management is the Norwegian government’s in-house investment manager. It is responsible for managing the Government Pension Fund Global (GPFG) for the government. It is the world’s largest sovereign wealth fund.

You might have read in early February that President Trump wants to create an American sovereign wealth fund to rival the world’s most prominent. No sovereign wealth fund is more prominent than Norway’s.

Using one of the many executive orders issued in the president’s first five weeks, Trump ordered a plan to create a sovereign wealth fund within 90 days. Whatever strategy is developed, the fund itself must be approved by Congress, and that could take a while given all of the other subjects on the agenda for Trump’s first 100 days in office.

While Norway’s sovereign wealth fund is a good template for getting America’s up and running, there are existing funds right here in America, such as the Alaska Permanent Fund, which was created in 1976 to grow Alaska’s wealth beyond oil and gas revenues.

GPFG was created in 1990, and the first funds were deposited (23.29 billion Norwegian kroner) by 1996. On Feb. 25, Norges Bank Investment Management released GPFG’s 2024 annual report. It finished the year with 19.74 trillion Norwegian kroner ($1.76 trillion).

While you can undoubtedly get investment ideas from learning about what billionaire hedge fund managers are buying, every investor should look closely at GPFG, because its annual report is chock full of gold.

Here are some nuggets from 2024.

Key Points About This Article:

- Norges Bank Investment Management manages Norway’s $1.76 trillion sovereign wealth fund. It just released its 2024 annual report.

- Equities did very well for the fund in 2024 thanks to the Maginificent Seven.

- The average weight of the 8,659 stocks was reasonably high at 1.5%.

- Look for quality over quantity when it comes to dividend stocks in 2025.

- Sit back and let dividends do the heavy lifting for a simple, steady path to serious wealth creation over time. Grab a free copy of “2 Legendary High-Yield Dividend Stocks” now.

Equities Had a Good Year in 2024 for GPFG

GPFG’s investments delivered a 13.1% return in 2024, with equities leading the way, up 18.2%. That’s excellent news for the people of Norway, as equities account for 71.4% of its assets.

The fund’s overall annual performance from 1998 through 2024 was 6.3%. That might not seem like a lot, but over 26 years, the risk-adjusted returns are more than adequate for a fund of its size.

The fund’s global nature means all its equity investments are outside Norway. In 2024, North America accounted for 56.9% of the equities portfolio, followed by Europe (25.2%) and Asia (14.2%).

Over the past five years, its average annual return was 11.4%, with only one year (2022) in negative territory. As they say, slow and steady wins the race.

Despite GPFG’s conservative nature, its investment managers aren’t afraid to add growth investments to the portfolio. As a result, the three sectors with the highest equity returns in 2024 were technology (up 35.1%), financials (27.8%), and consumer discretionary (19.3%).

And, of course, its U.S. equities had the best performance this past year, gaining 23.5%, excluding currency, and 27.4% with the exchange. The only country to deliver better returns was Taiwan, which gained 40.9% locally, and 36.1% with currency baked in.

It was a good year all around for its equity portfolio.

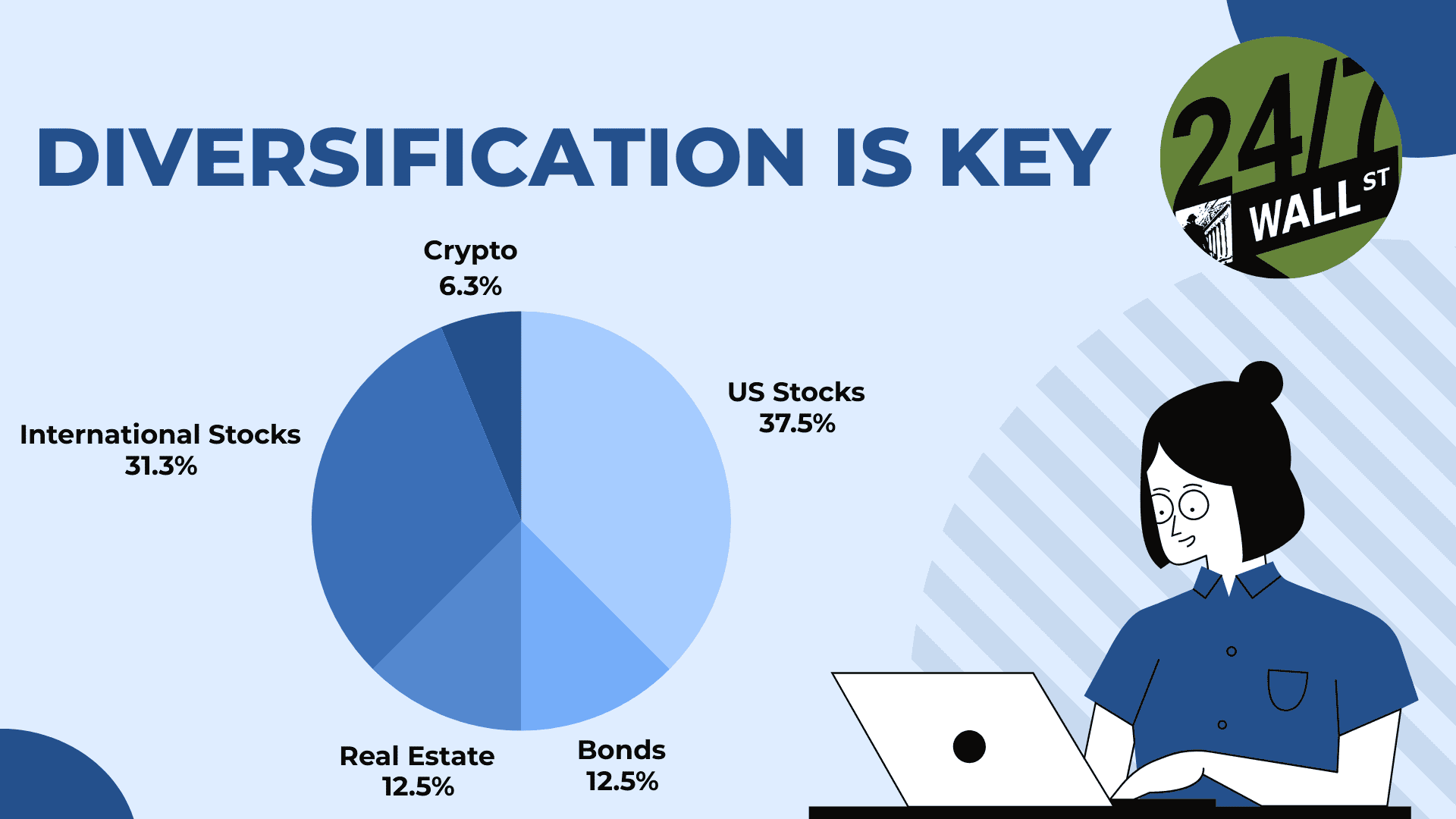

The Diversification Is Second to None

The fund finished 2024 with 8,659 stocks in its equities portfolio, down from 8,859 in 2023, as fund managers made portfolio adjustments. The average weight of each holding was 1.5%, which suggests that it doesn’t like its positions to get too small.

Unlike many hedge funds, which don’t have a problem putting most of their assets in the top 10, leaving the other holdings to wither and die, the fund doesn’t like its positions to get too small.

Approximately 13.8% of its stocks finished the year with weights of 2.0% or higher, with just 69 companies topping 5.0%. Its Q4 2024 13F has the top 10 accounting for 33.4% of the $762.05 billion in U.S. equities. Seven of the top eight holdings are Magnificent Seven stocks. Except for Tesla (NASDAQ:TSLA) and Taiwan Semiconductor (NYSE:TSM), GPFG also owned bonds from eight of the top 10.

Of its stocks, the annual report notes that Nvidia (NASDAQ:NVDA), Apple (NASDAQ:AAPL), and Amazon (NASDAQ:AMZN) made the biggest contributions, while Samsung Electronics, Nestle, and Intel (NASDAQ:INTC) were the biggest detractors to the fund’s performance.

Interestingly, despite its success in equities, the annual report noted, “During the year, the fund was underweight in equities and overweight in bonds, especially in emerging markets.”

Where will it be overweight in 2025?

It finished 2024 overweight in high-volatility stocks and stocks with lower dividend yields than the benchmark equities benchmark, the FTSE Global ALL Cap Index.

A good place to start would be the Magnificent Seven, less Tesla, whose market cap fell below $1 trillion on Feb. 25.

The stocks with lower dividend yields suggest that the investment manager wants quality over quantity regarding dividends early in 2025. That could always change, but the havoc caused by the Trump administration’s tariffs on Canada, Mexico, China, and seemingly all of Europe should keep volatility in the equities markets for the foreseeable future.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.