Investing

Nio (NIO) Stock Price Prediction and Forecast 2025-2030 for March 6

Published:

Last Updated:

Shares of Nio Inc. (NYSE: NIO) are down more than 9% in the past week, despite a 3% bounce on Wednesday. The electric vehicle maker just reported that it delivered 13,192 vehicles in February 2025, representing a year-over-year increase of 62.2%. Last month, jumped on the announcement that in Q4, AlphaStar Capital Management bought a new stake in the electric vehicle (EV) maker to the tune of 123,270 shares valued at approximately $537,000. However, the company’s institutional ownership remains relatively low at 8.19%.

The stock is trading in the same neighborhood as at the beginning of the year, despite being up about 10% and down about 7% in the interval. Compared to a year ago, Nio’s share price is more than 20% lower. Analysts remain cautiously optimistic, with 15 out of 27 of them recommending buying shares. The $6.10 mean price target suggests they see more than 40% upside in the next 12 months, but that may be skewed by a high price target up at $12.50. J.P. Morgan downgraded Nio from Overweight to Neutral last month and has a price target of $4.70. Some other analysts consider the stock to be oversold, despite the company not being profitable.

There are some encouraging tailwinds for shareholders, though. In January, Nio rolled out its latest software update to European customers — version 2.4.0 of the Banyan operating system. This update introduces over 50 new features and enhancements, including a new driving mode specifically for the ET5 and ET5 Touring models. Inspired by Nio’s electric supercar, the EP9, this new “EP Mode” driving experience was previously only available in the Chinese market.

The Chinese carmaker’s high-performance models, which feature a +600-mile range, have caught the eye of vehicle enthusiasts and investors, while addressing range anxiety issues by creating battery swap technology as a supplement to charging. Nio is one of the 10 largest vehicle manufacturers in the world and the third largest in China.

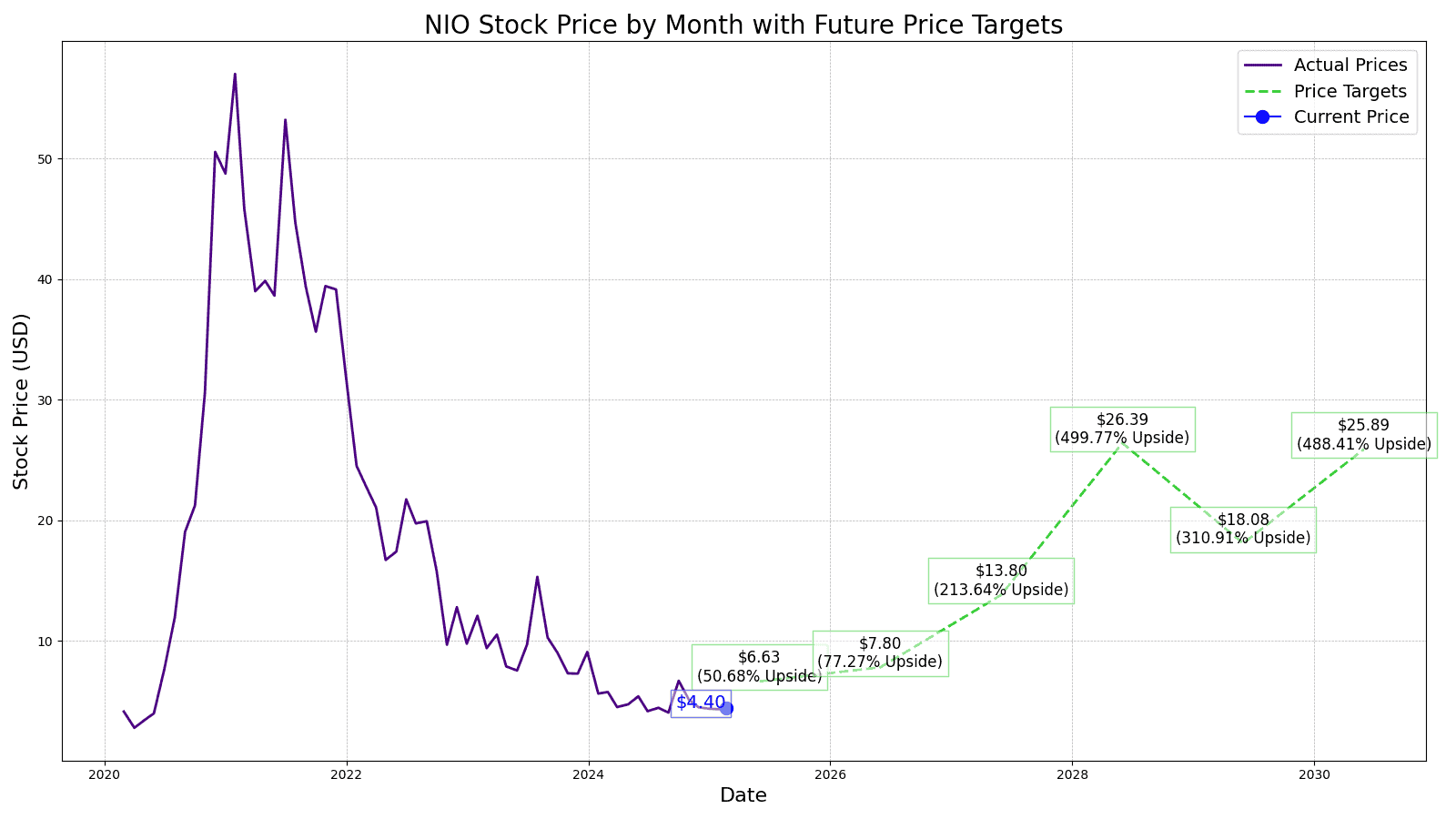

From a stock performance standpoint, Nio has been a tale of two stories. When shares debuted on the New York Stock Exchange on Sept. 12, 2018, at $9.90, they struggled to build that momentum. Not until the summer of 2020 did the stock began to surge, gaining over 810% from June 26, 2020, to Feb. 9, 2021, when the stock hit its all-time high of $62.84. Shares have fallen considerably since, but the long-term outlook remains strong.

24/7 Wall St. aims to provide readers with our assumptions about the stock’s prospects going forward, what growth we see in Nio stock for the next several years, and what our best estimates are for Nio’s stock price each year through 2030.

The following is a table of Nio’s revenues, operating income, and share price for its first few years as a public company.

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2018 to 2023.

| Year | Share Price (End of Year) |

Revenues (CNY)* | Operating Income* |

| 2018 | $5.39 | 4,951.2 | (9,595.6) |

| 2019 | $3.45 | 7,824.9 | (11,079.2) |

| 2020 | $40.00 | 16,257.9 | (4,607.6) |

| 2021 | $16.70 | 36,136.4 | (4,496.3) |

| 2022 | $7.87 | 49,268.6 | (15,640.7) |

| 2023 | $4.71 | 55,617.9 | (22,655.2) |

*Revenue and operating income in Billion CNY (1CNY=.14 USD)

Now let’s take a look at Rivian Automotive Inc. (NASDAQ: RIVN) the first few years it was a publicly traded company (here is Rivian’s stock price forecast):

| Year | Share Price (End of Year) |

Revenues* | Operating Income** |

| 2021 | $50.24 | $55.0 | ($4,220.0) |

| 2022 | $19.30 | $1,658.0 | ($6,856.0) |

| 2023 | $10.70 | $4,434.0 | ($5,739.0) |

| 2024 | $4.36 | $4,997.0 TTM | (5,790.0) TTM |

*Revenues in Billions

** Operating Income in Millions

The revenue growth for both firms is similar, but Rivian’s operating loss is more than double the yearly operating loss of Nio.

Nio formerly contracted its manufacturing to Jianghuai Automobile Group, paying a fee for each vehicle produced in addition to fixed cost. They have since acquired the factory from JAC. This agreement is beneficial for a young start-up in a very capital-intensive market. However, when scale is reached, the variable cost model has its downsides.

| Year | Revenue* | Shares Outstanding | P/S Est. |

| 2025 | 97,052 | 2,050 mm | 1x |

| 2026 | 114,172 | 2,050 mm | 1x |

| 2027 | 134,643 | 2,050 mm | 1.5x |

| 2028 | 257,634 | 2,050 mm | 1.5x |

| 2029 | 176,533 | 2,050 mm | 1.5x |

| 2030 | 189,548 | 2,050 mm | 2x |

*Revenue in CYN millions

Compared to Rivian and Tesla, Nio’s price-to-sales valuation will be moderately discounted. While Nio is in solid financial standing and has a premium brand image, it is still uncertain how much competition the company will face in China and expanding overseas. The company is already spending a quarter of revenues on R&D and if Nio cannot capitalize on this spend, the stock price will be sluggish compared to North American EV manufacturers.

Wall Street analysts give Nio a one-year price target of $5.21, representing 8.54% upside potential from today’s closing share price. Based on nine analysts’ ratings, the stock is a consensus Hold.

Here at 24/7 Wall St., we expect to see a revenue growth of 60% for the year, with a price-to-sales multiple of 1x, which puts our price target at $6.63, an upside of 38.12% from today’s opening share price.

We estimate Nio’s stock price to be $25.89 per share. Our estimated stock price will be 494.5% higher than the current stock price.

| Year | Price Target | Change From Today’s Price |

| 2025 | $6.63 | 52.2% |

| 2026 | $7.80 | 79.1% |

| 2027 | $13.80 | 216.8% |

| 2028 | $26.39 | 505.9% |

| 2029 | $18.08 | 315.2% |

| 2030 | $25.89 | 494.5% |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.