Investing

Wall Street Price Prediction: NVIDIA's Share Price Forecast for 2025

Published:

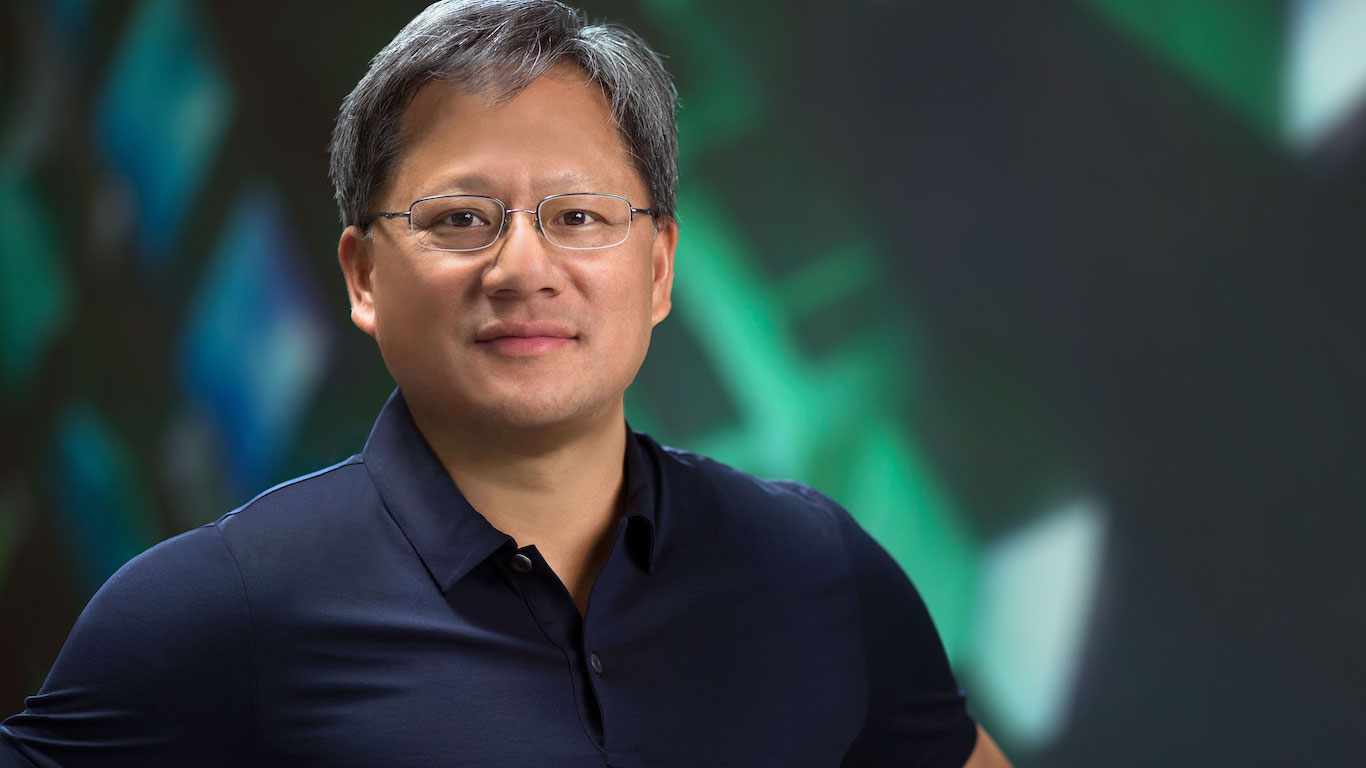

Chipmaking giant and Magnificent Seven member Nvidia (NASDAQ:NVDA) is among the top growth stocks investors continue to keep their eyes on. There’s good reason for this, too. The company’s high-performance chips are used for across industries in growth-heavy applications, which resulted in the stock gaining nearly 240% in 2023 and over 176% in 2024. And given the nature of our technology-driven economy, this is great news for shareholders forecasting future demand for the company’s core chips.

Of course, the rise of artificial intelligence technologies, and the abundance of companies entering this space, have revitalized the discussion around just how quickly large companies can grow in this current environment. Nvidia has challenged many investing paradigms in terms of its ability to continue to post triple-digit (or near-triple-digit) growth rates in recent years, despite its market capitalization which has been above $3 trillion in the past.

Of course, this year’s price action with Nvidia stock has been a bit different than what we’ve seen in recent years. Down nearly more than 16% year-to-date, the stock is seeing a number of critical price target revisions of late. It’s clear not every analyst is as bullish on Nvidia as they were to start the year.

Let’s dive into what Wall Street thinks about Nvidia right now, and where this stock could be headed over the next five years.

Let’s not kid ourselves. There isn’t an analyst out there that won’t give Nvidia a buy recommendation (or at least a hold), even after this recent drop. Given the company’s ability to consistently exceed its own lofty guidance and deliver earnings beat after earnings beat, Nvidia is a company at the forefront of what could be a $1 trillion market. This fact alone, as well as the company’s past performance, suggests that those who have been on the wrong side of this trade have vastly underperformed the market.

And while many retail and institutional investors appear to be souring on this stock, it’s also true that the company’s recent results in which fourth-quarter revenue surged 78% to $39 billion have put a relative floor under where the stock can head over the near-term. That’s because this recent decline put the company’s forward price-earnings multiple at just 26.5-times. There are other consumer discretionary stocks out there with lower multiples than Nvidia right now.

We’ll have to see if Wall Street or Main Street is ultimately correct on this recent correction in Nvidia stock. In the past, the company has motored through such near-term price moves. But for now, the market and Wall Street don’t appear to be in sync, which certainly provides an intriguing backdrop for long-term investors.

With Wall Street pricing in upside of more than 53% in Nvidia stock from here, there’s clearly a consensus view among the most informed analysts in the market that this is a stock with some serious upside potential. The thing is, these price targets are just that – targets. Companies very rarely perform even close to the consensus target at a give point in time. These targets change, with investors literally chasing moving targets that shift as rapidly as most company’s given prices.

Recent bullish industry news is just one indication that analysts’ forecasts might be accurate. On March 12, Taiwan Semiconductor Manufacturing pitched U.S. chipmakers Nvidia, Advanced Micro Devices and Broadcom (NASDAQ:AVGO) about taking stakes in a joint venture that would operate Intel‘s (NASDAQ:INTC) factories, according to sources familiar with the proposal. Such an agreement would rapidly and dramatically expand output for Nvidia.

With the company now expecting to report $43 billion in Q1 revenue, it’s true that many bulls appear justified in holding their shares through this period of turmoil. I think many bulls have reason to remain confident in Nvidia’s long-term trajectory. However, competition from AMD and Intel, potential tariffs under a Trump administration, and investor skepticism over AI infrastructure spending pose risks. Additionally, Nvidia’s valuation has adjusted, down to the aforementioned 26.5-times from more than 80-times just a year ago.

This valuation compression is ultimately good for investors over the long-term. This means that investors aren’t overpaying for future growth, at least on a relative basis. And with the company’s forward multiple now mirroring that of the overall market, there’s good reason to believe that Nvidia could have the 50% upside analysts are pricing in.

24/7 Wall Street‘s 2025 outlook for Nvidia remains bullish. We think Wall Street analysts are likely accurate in the revised growth expectations, though we’ll have to see if headwinds such as growing competition from Chinese firms like Huawei and DeepSeek shift the narrative further.

The current consensus one-year price target for NVIDIA, according to Wall Street analysts, is $177.41, which represents 52.95% upside potential over the next 12 months based on today’s share price of $117.41. Of all the analysts covering NVIDIA, the stock is a consensus buy, with a 1.3 “Strong Buy” rating on a scale from 1 (‘Strong Buy’) to 5 (‘Strong Sell’).

However, by the end of 2025, 24/7 Wall Street‘s forecast projects shares of NVIDIA to be trading for $180 — or 55.18% potential upside over the next 12 months — based on a projected EPS of $2.75 and a price-to-earnings (P/E) ratio of 50, with a best-case scenario of $192.50 per share and a worst-case scenario of $82.50 per share.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.