Investing

After Three Decades of No Returns, Ford (F) Insiders Are Dumping Nearly $21m In Shares

Published:

Last Updated:

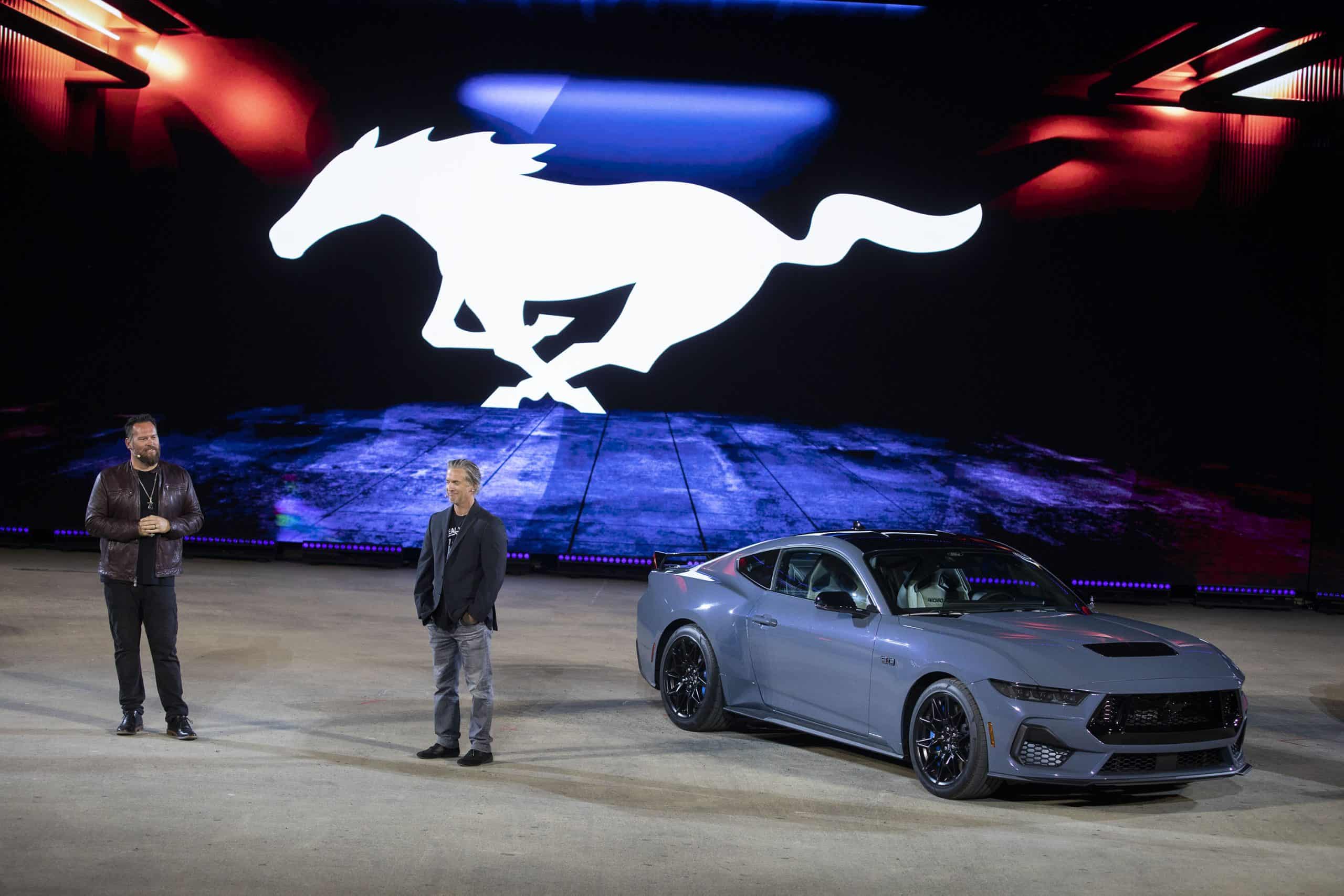

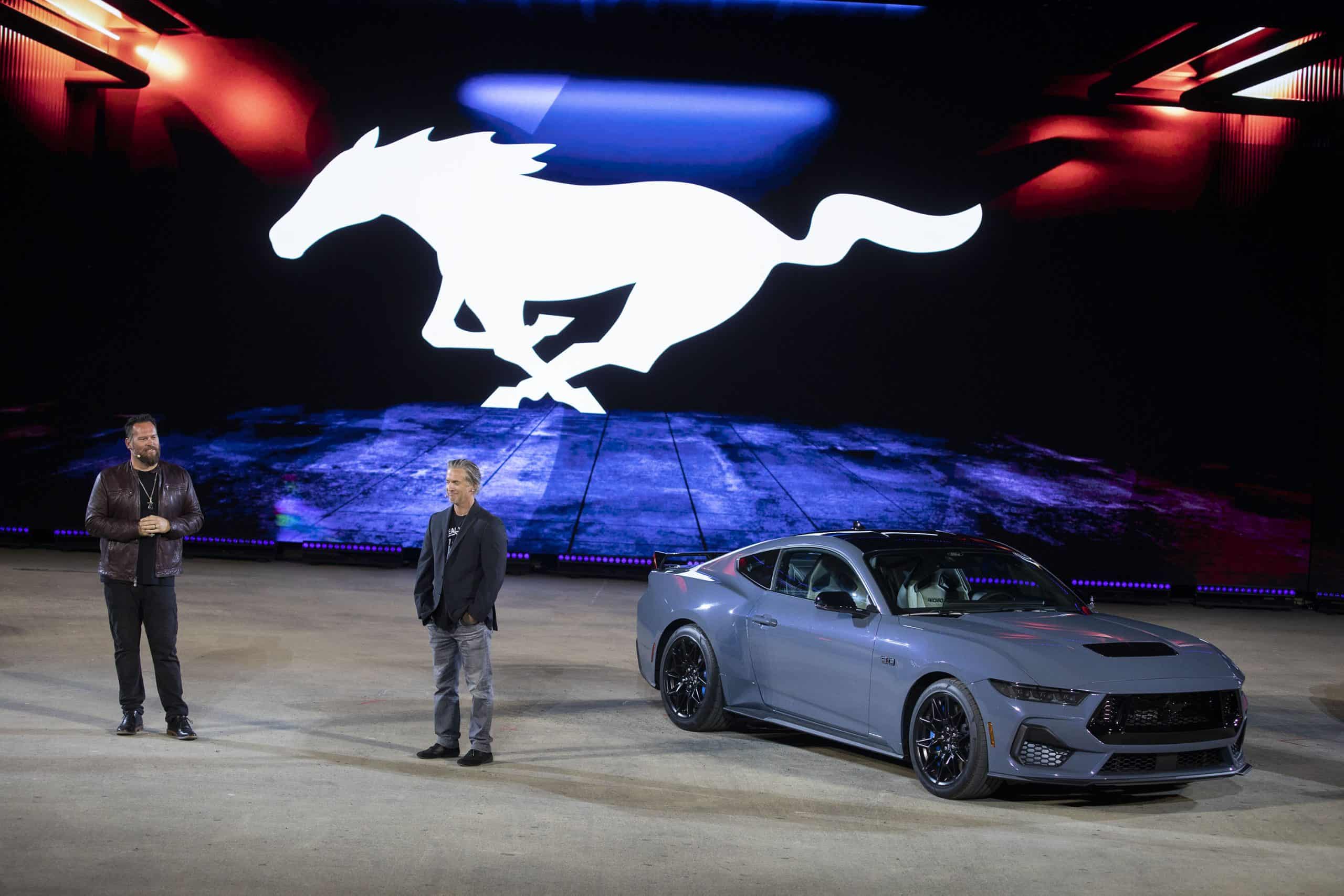

Ford (NYSE:F) is one of the most recognizable brands in the United States. The iconic F-150 is the best selling vehicle in the country, with a proud and loyal repeat buyer base.

For investors in Ford Stock, it’s been a different story. Shares are up down 18% in the last twelve months and currently trade where they did thirty years ago, in 1995.

And insiders have been dumping shares. In the last three months they’ve sold 2,097,919 shares. At the current share price of just under $10, that’s nearly $21m. Let’s see who the main sellers have been.

Former CFO John Lawler is a major seller, dumping 93,848 shares on March 4th. While Lawler still owns 1,131,994 that’s a nearly 10% trim for his position.

New CFO Sherry House also sold shares on the same day as Lawler, dumping 25,105 shares. This is nearly a quarter of her 102,877 shares held.

What does it say when two CFOs are dumping shares, one having just started in their new role?

Other major sellers include Michael Amend, Mark Kosman, and CEO Jim Farley who sold 302,231 shares worth over $3m. Why is everyone rushing for the exists after shares have already been knocked back this year?

As the old saying goes, people can sell for many reasons but the only buy for one. These could be planned sales which were pre-scheduled, financing a new home purchase, or something else. But candidly with Ford is looking particularly weak these last few years. The company had to roll back it’s EV ambitions, they’re struggling to compete with Tesla (Nasdaq: TSLA) and others. The F-150 lightning was a flop, Chinas auto industry is going parabolic. Even Farley himself drove a Chinese EV for 6 months and then declared he ‘doesn’t want to give it up’.

And then there are the tariffs. Where they land, who knows. But one thing is for sure, even the most charitable outcome of tariffs with Canada and Mexico are going to hurt Ford. One is seven vehicles Ford makes is exported to international markets. But even more importantly, Ford has two factories in Mexico producing nearly 400,000 per year.

Why are these sellers dumping? Frankly put they must not see the upside in the shares and there could be much further to fall.

Using the calculator below you can see what a rough ride it’s been. Even with Ford’s generous dividend included, investors have made roughly 5% a year the last few years. That hardly beats inflation.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.