Citing data from the U.S. Bureau of Labor Statistics (BLS), outplacement firm Challenger, Gray & Christmas is predicting that the number of seasonal jobs offered this year will be no better than equal to last year. Seasonal retail jobs fell by 6.4% year over year, from 668,400 in 2017 to 625,600 in 2018, the lowest total since 2009.

In 2018, companies in retail, transportation and warehousing announced a total of 714,000 seasonal jobs, an increase of 16.3% compared to 2017. Transportation and warehousing firms like UPS, FedEx and Versant Supply Chain hired 259,500 seasonal workers last year, a drop of 2.2% compared to the 2017 total of 265,200.

As of last Friday, U.S. retailers have announced the closure of 8,558 stores in 2019, according to Coresight Research, and the number could reach 12,000 by the end of the year. In all of 2018, a total of 5,844 retail stores closed.

Andrew Challenger, Vice President of Challenger, Gray & Christmas, commented: “The shift to online shopping in Retail means traditional Retailers will likely not hire the numbers they once did. However, these holiday jobs seem to be appearing in Transportation and Warehousing, as Retailers rely more and more on fulfillment centers.”

Among companies that traditionally add a lot of seasonal workers, Kohl’s Corp. (NYSE: KSS) and Lowe’s Corp. (NYSE: LOW) announced seasonal hiring had begun during the summer, but neither issued a specific number of jobs offered.

United Parcel Service Inc. (NYSE: UPS) announced last week that it planned to hire about 100,000 seasonal workers this year, equal to the number it hired in 2018.

Target Corp. (NYSE: TGT) announced plans to hire 130,000 seasonal employees this year, about 10,000 more than it hired last year. The company expects about 125,000 of the jobs to be added at its more than 1,800 stores. Included in that number are jobs filling orders placed online at particular stores. Another 8,000 jobs will be filled at Target’s distribution and fulfillment centers.

Consumer spending drives seasonal hiring, according to Challenger, and consumers are spending now, especially using credit cards. Yet, that could change quickly he noted, “Perceptions of the current economy, which is not as strong as last year or in 2017, could curtail seasonal hiring plans as well. Although new tariffs likely won’t go into effect at the moment, Retailers will keep a close eye on trade negotiations in October, as they will impact consumers going into the holidays.”

The University of Michigan’s preliminary September report on consumer sentiment showed month-over-month increase of 2.4% but a decline of 8.1% year over year. While future expectations also declined year over year the overall outlook is for continuing slow growth.

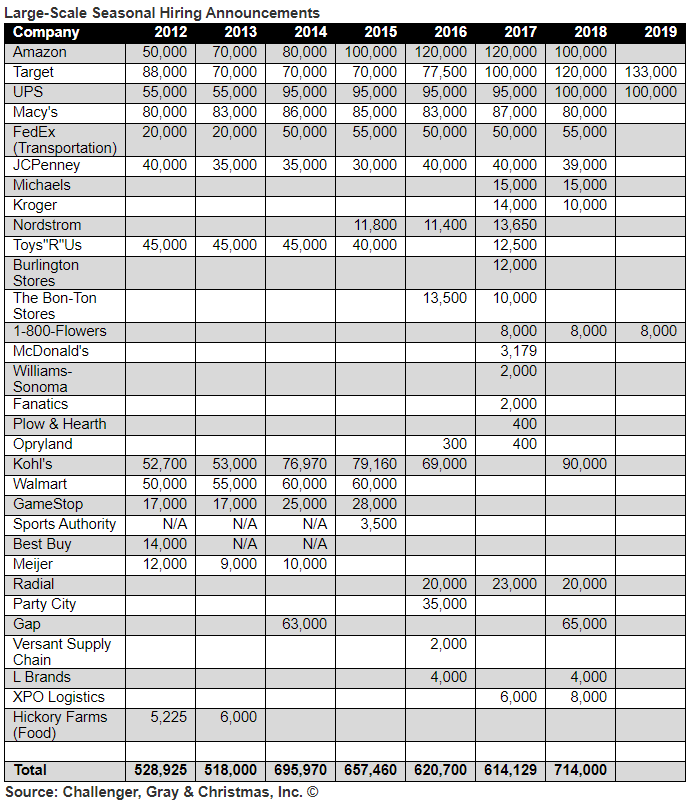

Here is Challenger’s scorecard on seasonal hiring since 2012.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.