If Monday’s futures trading is any indication, by the time the closing bell rings, U.S. equity markets will post their biggest percentage loss since 2008. The impact of the coronavirus outbreak on the global economy may be coming into focus, and what people are seeing is not good news.

Challenger, Gray & Christmas, a firm best known for its services for fired employees and its monthly tracking of job cuts, warns Monday that a global recession that may have begun on February 21, the first day that markets started declining, is picking up speed.

The “catalyst for the recession,” according to company vice-president Andrew Challenger, is “the impact of the coronavirus on the global economy.”

Challenger said that the first wave of layoffs will come primarily among firms most affected by disruption to their supply chains. That disruption began in late January, when China shut down much of its manufacturing capacity as COVID-19 began spreading outside Hebei province and the city of Wuhan.

A survey of Chinese manufacturing activity in February dipped to its lowest point on record, and shipping container traffic fell by 2 million units, a bigger drop than recorded during the peak of the recession in 2009. Companies that depended on intermediate goods from China were able to rely on inventories, but those are being or have already been used up. New shipments from China may not be coming for months yet.

Challenger’s second wave of job losses “will come from the industries at ground zero: cruise ships, international tourism, hotels, conferences, and airlines, as these industries begin to experience Demand Shock.” More big events are being canceled in an effort to slow the spread of the disease. One of the country’s biggest technology and music events, South by Southwest, has been canceled, and both Facebook and Google have canceled their developer conferences. Those last two events were scheduled for May, not next week, as SXSW was.

The third wave of job losses is likely to come “from in-person, service businesses and manufacturing jobs. These include restaurants, retailers, and entertainment venues where customers stop shopping, as well as manufacturers, bus drivers, and schools where workers refuse to come in due to outbreak fears.”

Schools are closing in some areas (Westchester County in New York, for example) to slow the fast-spreading disease. Aside from the effects on student learning, parents will now have to think about how to meet the challenge of childcare. If parents have to stay home with their kids, how will employers respond?

The fourth wave of job losses, said Challenger, “will come from companies [whose] revenues drop because the recession has started. We may, in fact, be in recession now.”

While that is technically not the case yet, the loss of more than 10% in the value of U.S. stocks since February 21 could well mark the start of a new recession, and two consecutive quarters of shrinking economic output is within the range of possibilities.

Apple already has warned that quarterly revenues will not meet guidance, and very few companies reporting prior-quarter results have not mentioned the coronavirus outbreak as an uncertainty for revenues and earnings in the current quarter.

Challenger thinks that companies will be slow to reduce their workforces because of the difficulties they have faced in finding those workers: “No company wants to make quick decisions about cutting workers, especially if employers find that the Coronavirus is really a Y2k-type crisis. They may be unable to bring back their laid-off talent that were so hard to find in the first place.”

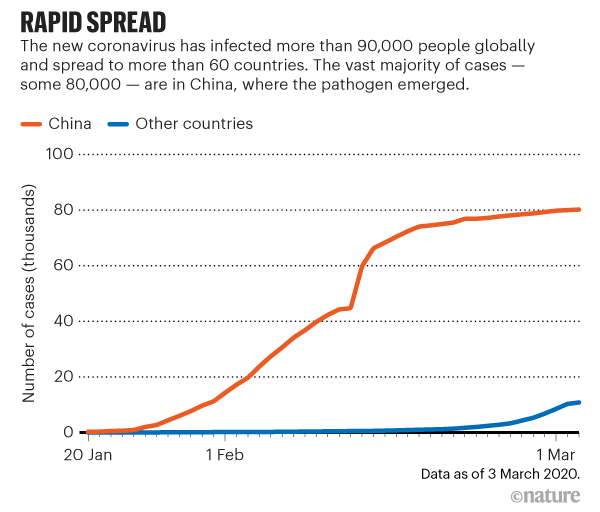

The following graph from Nature magazine and Johns Hopkins University shows that the number of new cases is leveling off in China but picking up speed in the rest of the world. That indicates that the impacts Challenger expects on U.S. jobs are only just beginning.

There are some precautions Americans can take to reduce their risks of contracting or spreading the COVID-19 virus.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.