The U.S. Department of Labor reports a sharp rise in its number of weekly jobless claims. Thursday’s Bureau of Labor Statistics (BLS) report showed that jobless claims for the week ending October 10 rose by 53,000 to 898,000. This was the highest level of jobless claims since August and was handily above the Econoday and Dow Jones consensus estimate of 825,000.

The previous week’s level was revised higher by 5,000 to 845,000. The BLS also reported that its four-week moving average was 866,250, a gain of 8,000 from the previous week’s revised average.

Continuing jobless claims measures the number of people who have been collecting benefits for more than a week. The number of Americans collecting unemployment through state programs decreased to 10.02 million for the week of October 3 from a revised 11.18 million the prior week.

While these numbers are not moving in the right direction at all, they may be off and may have significant revisions in the coming weekly reports. The BLS included a technical note that said the state of California has announced a two-week pause in its processing of initial claims for unemployment insurance benefits resulting from an internal review of state operations.

The BLS also added that the advance seasonally adjusted insured unemployment rate was 6.8% for the week ending October 3. That was down 0.9 percentage point, and the previous week’s rate was revised up by 0.2 point from 7.5% to 7.7%.

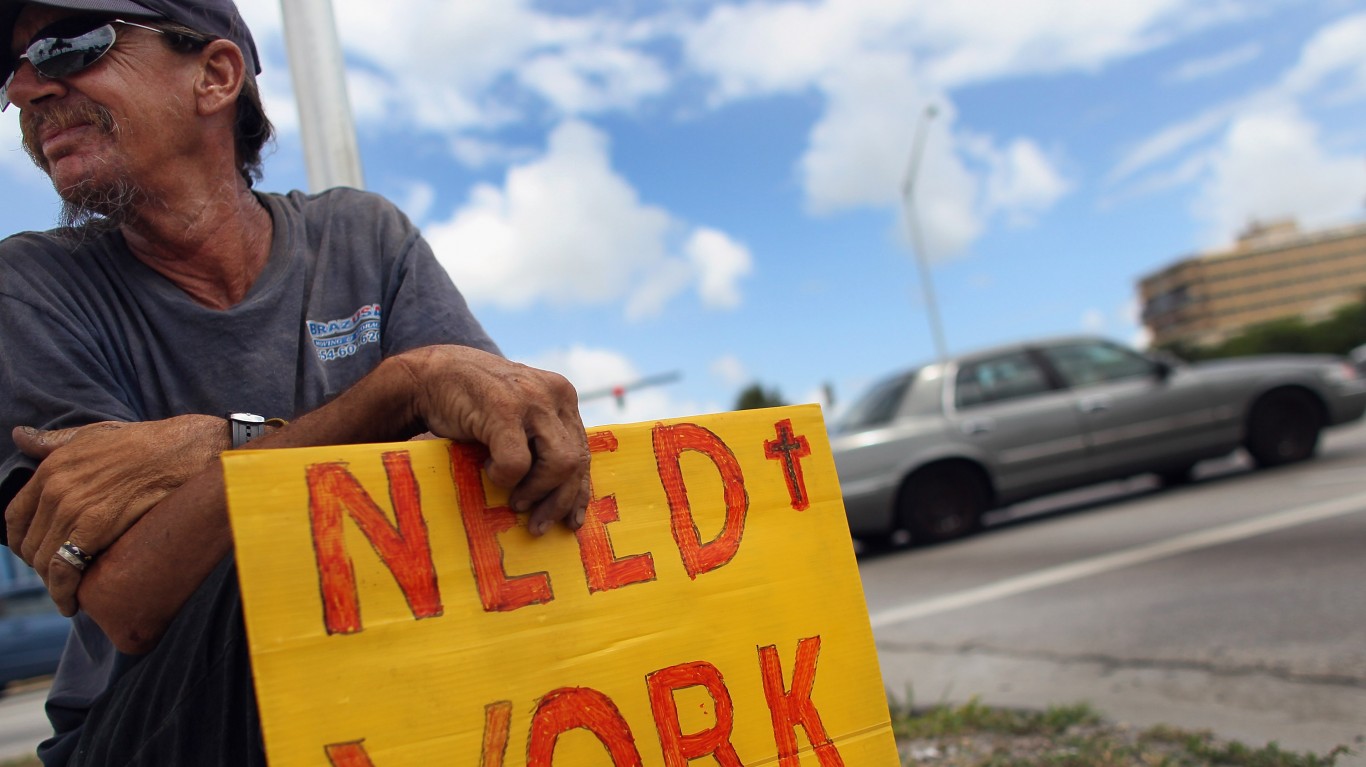

Whether these numbers were going to be higher or lower, it is becoming universally clear that the number of people on unemployment and other programs remains far too high for this to be a good economy. The BLS reports this with a lag, but it showed that the total number of people claiming benefits in all programs for the week ending September 26 was 25,290,325. This was down by 215,270 from the previous week, but the year-over-year comparisons remain atrocious. There were 1,415,539 persons claiming benefits in all programs in the comparable week in 2019.

With stimulus talks looking less and less likely to result in a grand bargain, the workforce appears to be on its own.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.