Once upon a time, the financial markets cared greatly about good and bad economic numbers. The reality of 2020 is that good and bad economic numbers just do not matter. That will not last forever, but right now that is the case.

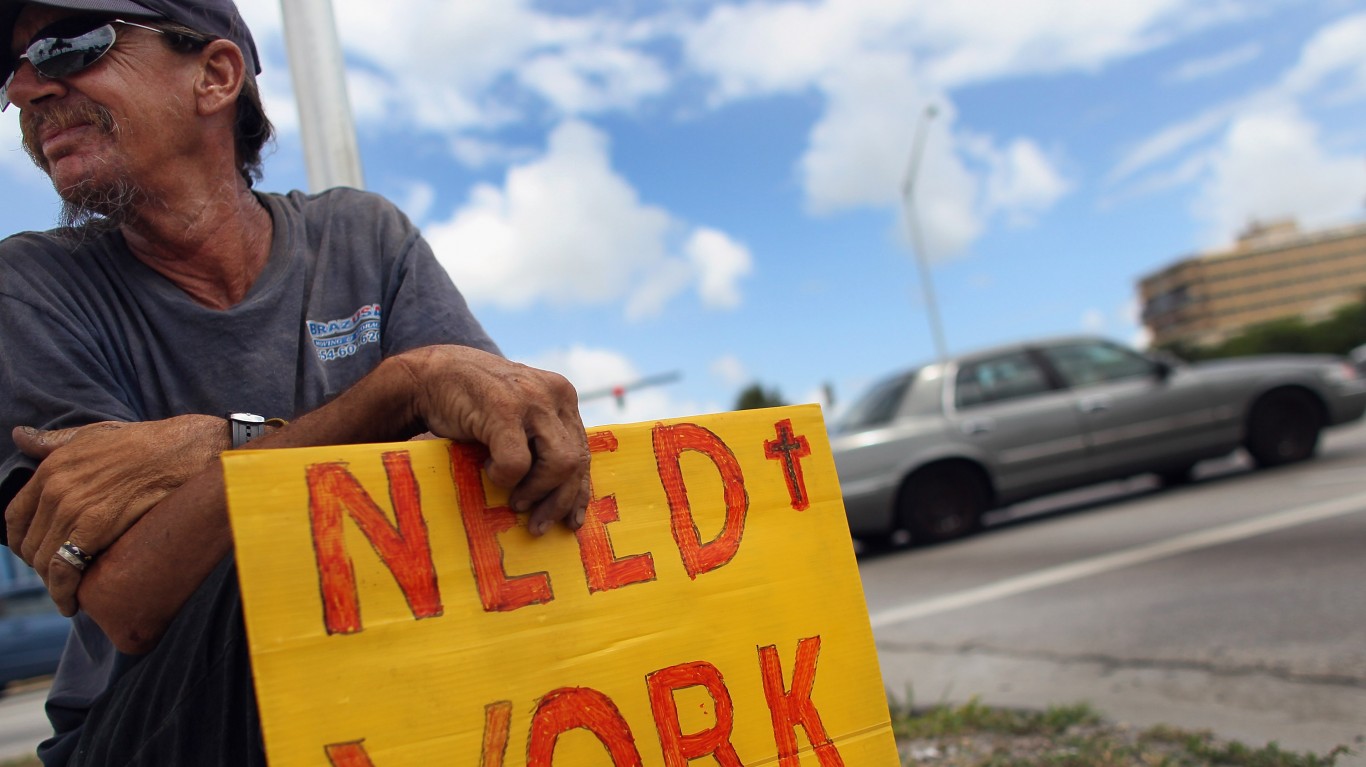

Friday’s U.S. Department of Labor report about November’s payroll gains and unemployment was basically a terrible one. The payrolls gains were weak and the drop in unemployment is artificial. All of this should have been a bad omen, considering that stocks were back at all-time highs. Again, it’s 2020, so that logic is purely rubbish and old-school thinking.

The Labor Department reported that the U.S. economy added just 245,000 nonfarm jobs in November, and the prior month’s revision went down to 610,000 from 638,000. Economists were expecting closer to 500,000 nonfarm payroll gains.

Private sector payrolls were only 344,000 in total, and the prior month’s gain of 906,000 was revised down to 877,000. The manufacturing sector only added 27,000 jobs.

The official unemployment rate did manage to fall to 6.7% in November from 6.9% in October. That’s a good step on the surface, and it is actually better than the 6.8% consensus estimate that had been published in numerous places.

Where unemployment should be scrutinized is that the workforce participation rate was down to 61.6% for the month of November. Econoday was expecting that to be 61.6%, and it was 61.7% in October.

The wages were a tad better, with a 0.3% gain on the monthly reading and a 4.4% gain from November of 2019. Still, the average workweek was static at 34.8 hours.

Bond yields have been rising along with stocks because of expectations that the economy can return to some normality in 2021. The coronavirus vaccine will become more widely available in 2021, and that means people can travel more, go back to restaurants and bars and so on.

If stocks are at all-time highs and the economy is expected to recover handily, the jobs market should be good. Unfortunately, this is a time when shutdowns are taking hold in parts of the country again as COVID-19 cases are spiking. Hospitalizations have surged. Although approvals for treatments and emergency use authorizations are helping to make the death rate lower than at the onset of the coronavirus.

The real issue behind why stocks did not sell-off is that the weak jobs number shows how fragile this recovery is, and that means a stronger hope for government-backed fiscal stimulus. It seems unrealistic to expect a repeat of the massive packages that came to the economy’s aid in April, May and June, but investors seem to feel complacent because they have “seen this movie before.”

In different times, Friday’s Employment Situation figures would have caused a knee-jerk reaction in stocks and sent bond yields lower. When the markets can take the attitude that weaker numbers mean more help and free money is on the way, it just gets swept under the rug.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.