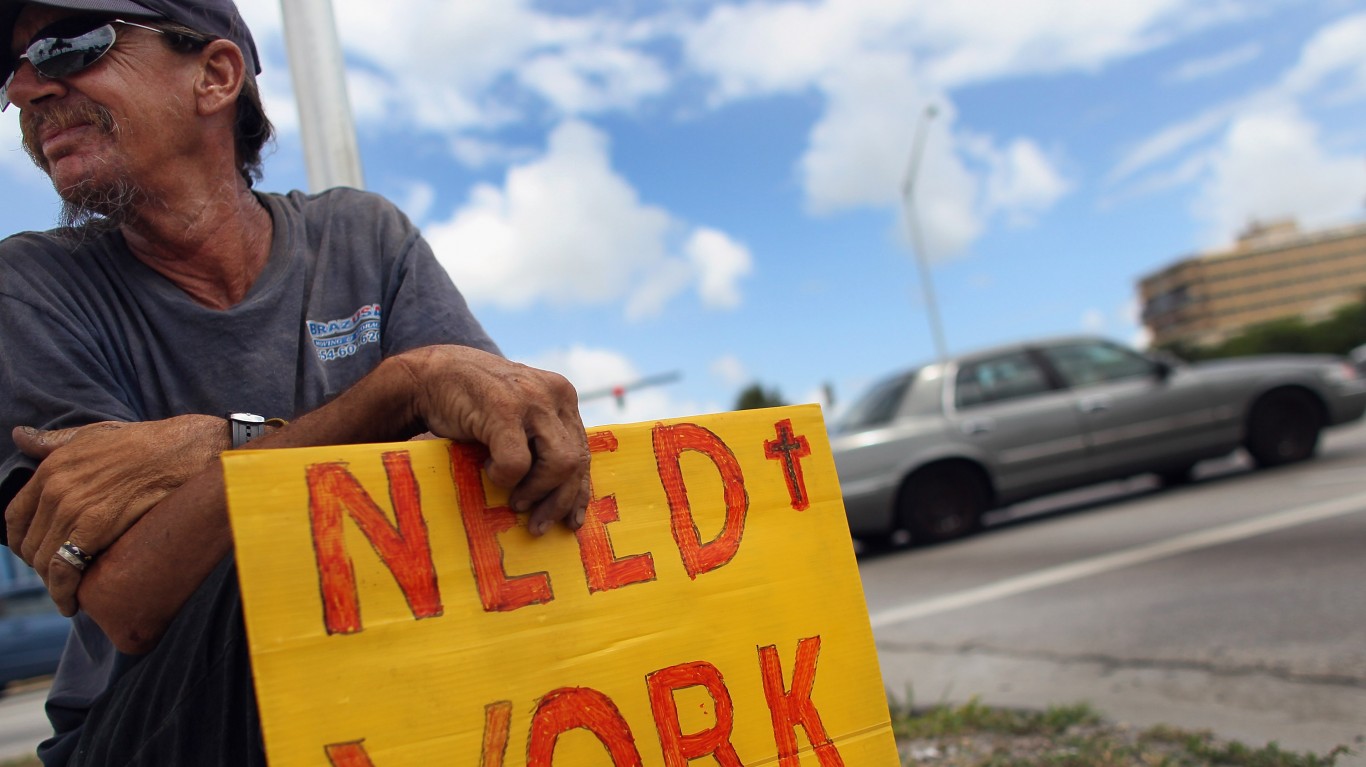

The most recent unemployment report has just surfaced and things appear to be looking up, if only slightly. The U.S. Department of Labor released its Employment Situation report for January on Friday. It showed that 49,000 nonfarm payrolls were added last month, and the official unemployment rate fell 0.4 percentage points to 6.3%.

While the unemployment rate was lower, this still equates to roughly 10.1 million unemployed persons. These numbers are much lower than in April 2020, but they remain well above their pre-pandemic levels in February 2020 (3.5% and 5.7 million, respectively).

In January, the notable job gains in professional and business services and in both public and private education were offset by losses in leisure and hospitality, retail trade, health care and transportation and warehousing.

In terms of the specifics, employment in professional and business services rose by 97,000, with temporary help services accounting for most of the gain (81,000). There were increases in local government education (49,000), state government education (36,000) and private education (34,000).

Leisure and hospitality declined by 61,000, following a steep decline in December (−536,000). Retail trade lost 38,000 jobs in January, after adding 135,000 jobs in December. Also, employment in health care declined by 30,000 last month.

The Labor Department broke down the unemployment rates for major worker groups:

Unemployment rates declined over the month for adult men (6.0 percent), adult women (6.0 percent), Whites (5.7 percent), and Hispanics (8.6 percent). The jobless rates changed little for teenagers (14.8 percent), Blacks (9.2 percent), and Asians (6.6 percent).

The average hourly earnings for all employees on private nonfarm payrolls increased by six cents to $29.96. The average workweek for all employees on private nonfarm payrolls increased by 0.3 hour to 35.0 hours in January.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.