There is an assumption, whether fair or not, that the more well-educated someone is, the better their earning power. The U.S. Census Bureau shows that 42% of Americans over 25 years of age have an associate, bachelor’s, graduate or professional degree. To get these degrees, people need to stay in school for two years or more after high school. For some degrees, like an M.D., the period may be many years longer. Does a college degree pay off? That has become the subject of more and more analysis as the number of student loans people carry has grown larger.

[in-text-ad]

While college-educated workers are more likely to have higher compensation than average, a four-year degree by no means guarantees a high salary. More than two dozen occupations that require at least a bachelor’s degree have an average annual wage that is either in line with or below the average annual earnings of $56,310 across all occupations.

Using wage data from the Bureau of Labor Statistics, 24/7 Wall St. identified the lowest-paying job for college graduates. Average annual wages for the occupations we considered range from about $36,000 to just under $57,000. We excluded all non-specific occupation classifications from consideration, specifically those jobs labeled as “all other,” a catch-all designation.

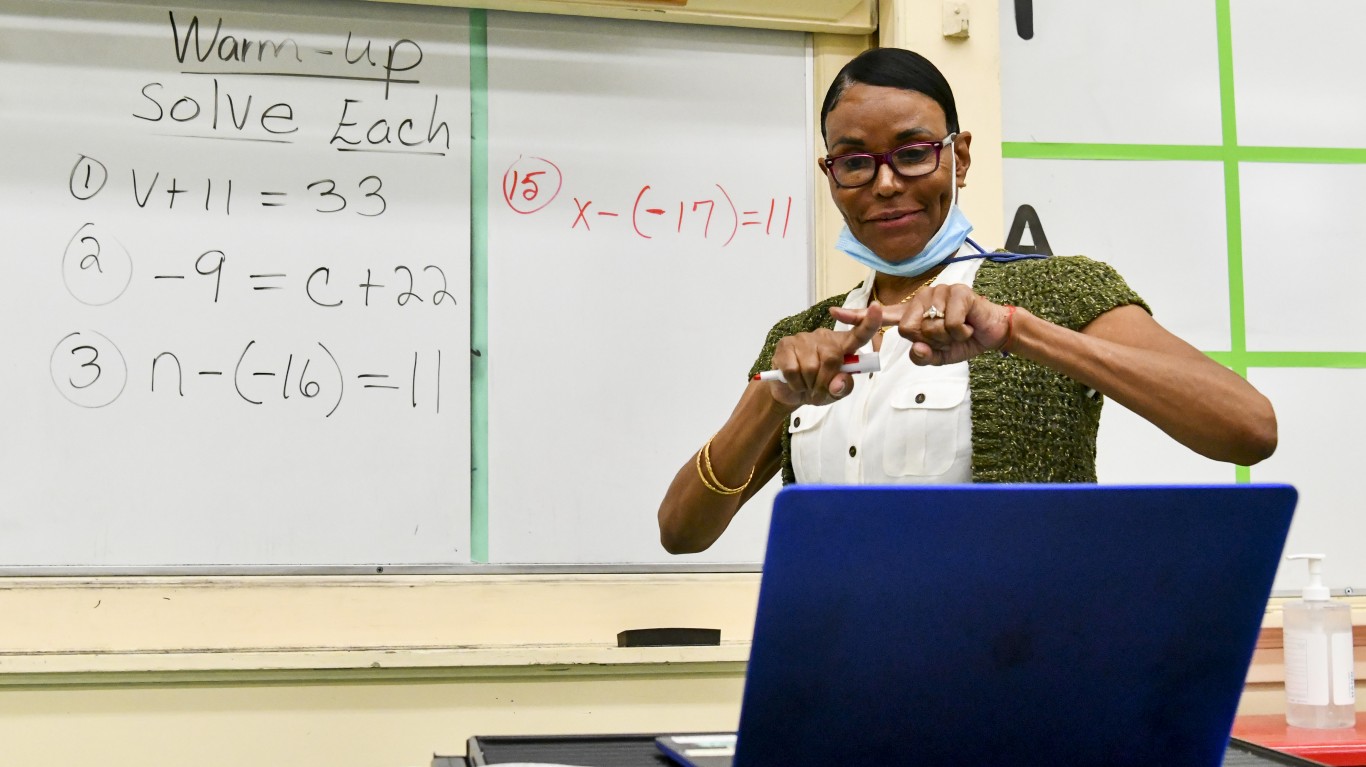

The lowest-paying job for college graduates is short-term substitute teachers. Here are some details:

- Average annual wage: $36,090

- Typical entry-level education: Bachelor’s degree

- Total employment: 512,030

- Projected employment change (2019 to 2029): +2.6%

Click here to see all the lowest-paying jobs for college graduates.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.