Market News

Nasdaq Composite Today: TSM Leads Another AI Stock Frenzy (TSM, NVDA, AVGO)

Published:

Last Updated:

Just past the 12:20 p.m. ET and the markets are still holding their gains, while small caps turn red.

NVIDIA (NVDA) stock hit a new record high of $140.89, surpassing its previous June high of $140.76. Nvidia’s GPUs are in high demand from tech giants like Microsoft, Meta, and Google, boosting expectations for significant revenue growth from its next-generation AI chips.

NVIDIA’s stock is up 180% year-to-date and is again the second largest company in the United States with a $3.43 trillion market cap. To put this growth into perspective, NVIDIA has gained more than $800 billion in the past month. That is more than the total market value of Tesla, gained in just the past 30 days.

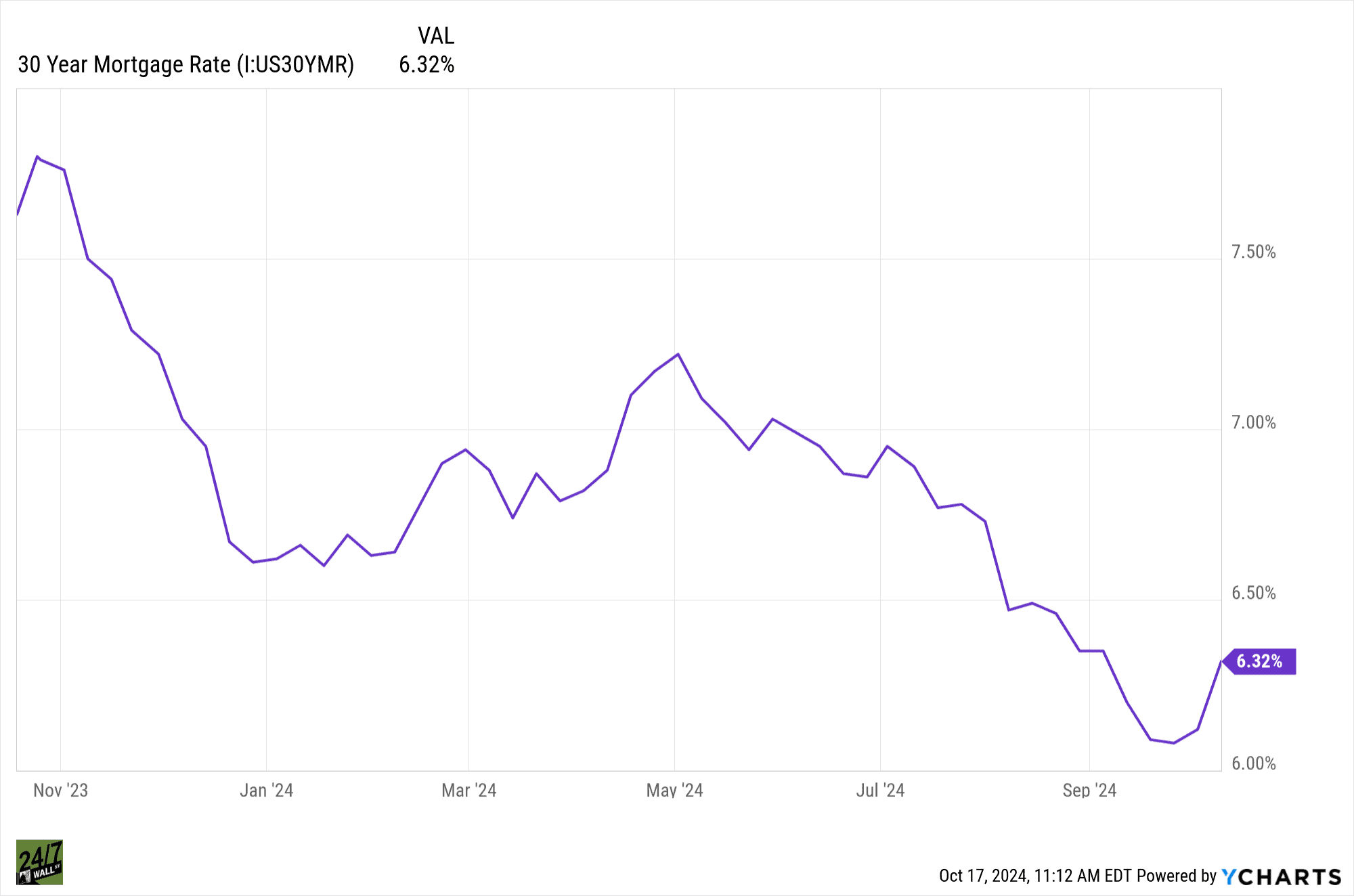

The monthly figures from the NAHB/ Wells Fargo U.S. Housing Market Index (HMI) came in today and homebuilders were 4.88% more confident in the health of the U.S. housing market and 7.50% more confident than this time last year.

The positive outlook is due to stabilized demand supply constraint easing. Builders are more optimistic about future sales as 30-year interest rates are close to yearly lows after the Feds .50 basis point interest rate cut last month.

Just after 10:30 a.m. ET markets are still in the positive.

The market news is still being dominated by Taiwan Semiconductor’s earnings release and optimistic outlook on chip demand.

Let’s look at the Nasdaq upgrades and downgrades for the day.

Upgrades

Downgrades

At 9:30 a.m. ET, the broad markets opened in the green.

Tech stocks are leading the morning charge as Taiwan Semiconductor (TSMC) updated its sales forecast from mid 20% rise to 30%. Investors are more optimistic afterASML Holdings (ASML) sour outlook earlier in the week.

Stocks pulling the Nasdaq higher this morning:

Stocks pulling the Nasdaq lower:

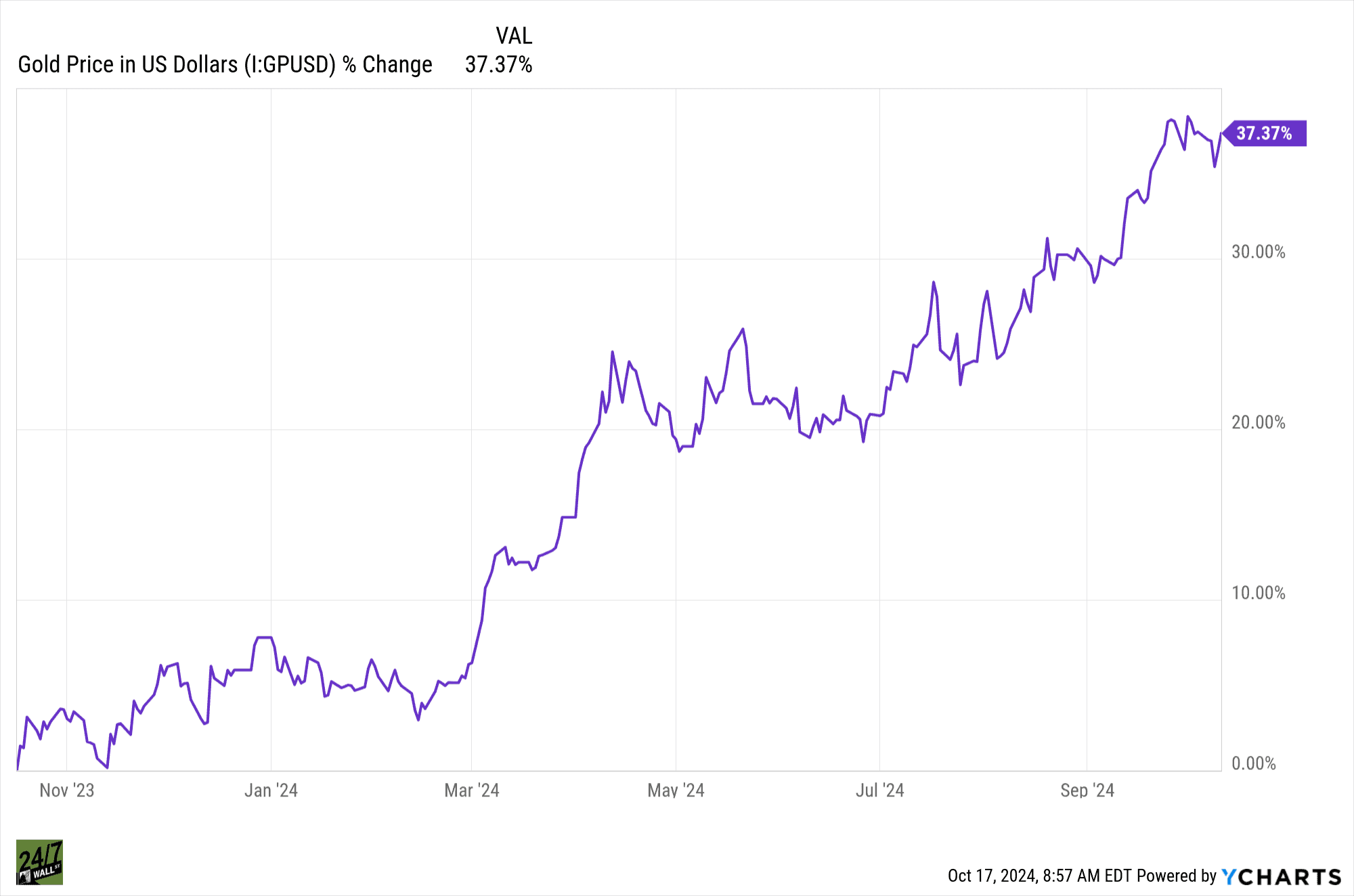

The price of gold is once again in record territory, moving above $2,700 per ounce despite the U.S. dollar strengthening by 3%. While these assets typically move in opposite directions, safe-haven investors likely remain uncertain about whether inflation risks will stay under control.

September retail sales showed a monthly increase of .4% versus expectations of .3%. Initial jobless claims were 241,000, a reduction of 19,000 from the prior week.

Shortly after the release of this economic data Nasdaq futures are now up .90% while S&P futures are up .50%.

Among widely followed stocks, the biggest loss premarket is Lucid (Nasdaq: LCID). The electric car maker is down 19% after announcing a secondary offering to shore up its balance sheet. The company will offer 262.5 million shares and currently trades for just $3.28.

In earnings news, M&T Bank (NYSE: MTB) just released earnings and beat expectations. Banks have done very well this earnings season.

Stock futures are currently up across indexes, but that may change at 8:30 a.m. ET. Two key pieces of macroeconomic data are being released at that time: Initial Jobless Claims and September retail sales numbers.

Jobless claims hit 258,000 last week, but that number was boosted by Helene. With another major hurricane having hit Florida – Hurricane Milton – numbers may once again be skewed.

Shortly before 8 a.m. ET markets are looking up across the board on Thursday.

The big news for the day that is driving the Nasdaq Composite to outsized gains is Taiwan Semiconductor (NYSE: TSM) releasing earnings that point to a continuing boom in AI demand.

Let’s look at the market’s biggest stories today.

Taiwan Semiconductor has roughly a 90% market share in the advanced chips used in AI, so it’s a widely followed bellwether in the space. The company reported earnings and beat estimates on almost every major line item.

Third-quarter sales came in at $23.5 billion with operating margins at 47.5% versus a guide that popped out at 44.5%. That led to earnings of $10.06 billion, which handily topped analyst estimates of $9.33 billion.

Commentary on the company’s earnings call was also very bullish. Chairman C.C. Wei had this to say about AI demand:

“Demand is real, and I think it is just the beginning of this demand….demand is insane and I think it will continue for many years.” – C.C. Wei

With Taiwan Semiconductor having the broadest view into future purchasing plans of customers ranging from NVIDIA (Nasdaq: NVDA), to larger hyperscalers like Microsoft (Nasdaq: MSFT), to Apple (Nasdaq: AAPL), this commentary is eyebrow-raising.

The earnings were good enough that NVIDIA is trading up 3.09% in premarket trading. Look for other AI-related stocks like Broadcom (Nasdaq: AVGO) and Marvell (Nasdaq: MRVL) to also be up sharply at market open.

There aren’t as many major earnings releases today as we saw on Tuesday and Wednesday when financial services companies generally beat expectations. However, both M&T Bank and Travelers are reporting before market open.

After market close today a couple of widely followed earnings will be Intuitive Surgical and Netflix. In addition, before the market opens on Friday Procter & Gamble, Schlumberger, and American Express will report.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.