Bank of America downgraded the rating all the way down to Underperform from Buy with a price target of $72 per share. It says basically, “Take the money and run.” The report also sees risks to its streaming additions as concerns have grown surrounding the health of the domestic streaming business and also on the timing of international streaming profitability.

The rise apparently has just been too much to endorse. Bank of America said, “With the stock increasing 31% over the past two-weeks, we now believe the risks outweigh the reward heading into Q3. We see net additions significantly below estimates as the biggest risk to the stock.”

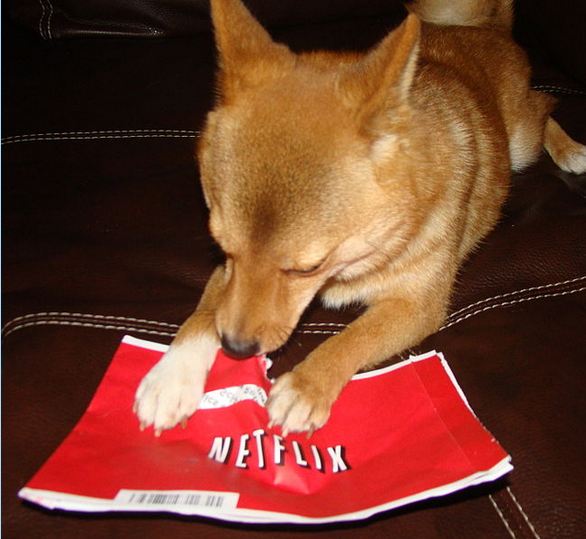

The report says that Netflix appears to have reached the second inflection point on its penetration curve. It also said that domestic streaming subscribers will plateau sooner than expected and that will pressure 2013 estimates. “The bears still have plenty of long-term concerns to sink their teeth into the likelihood that content prices will be increasing due to competition and Netflix’s exclusive and original content emphasis, which could pressure streaming Margins.”

Netflix shares are down 3.5% to $70.90 in premarket trading.

JON C. OGG

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.