Bank of America downgraded the rating all the way down to Underperform from Buy with a price target of $72 per share. It says basically, “Take the money and run.” The report also sees risks to its streaming additions as concerns have grown surrounding the health of the domestic streaming business and also on the timing of international streaming profitability.

The rise apparently has just been too much to endorse. Bank of America said, “With the stock increasing 31% over the past two-weeks, we now believe the risks outweigh the reward heading into Q3. We see net additions significantly below estimates as the biggest risk to the stock.”

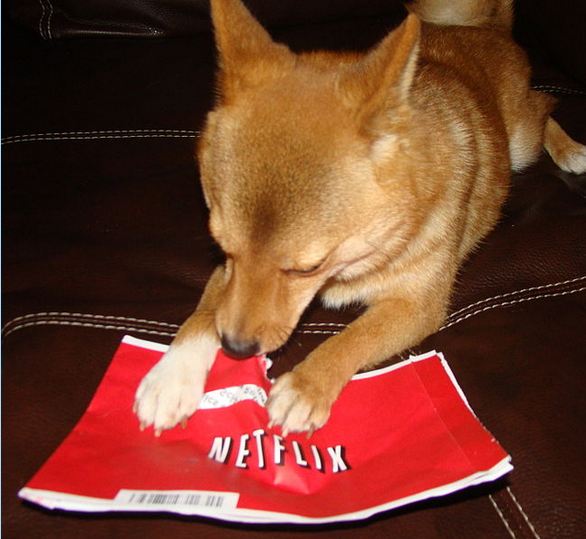

The report says that Netflix appears to have reached the second inflection point on its penetration curve. It also said that domestic streaming subscribers will plateau sooner than expected and that will pressure 2013 estimates. “The bears still have plenty of long-term concerns to sink their teeth into the likelihood that content prices will be increasing due to competition and Netflix’s exclusive and original content emphasis, which could pressure streaming Margins.”

Netflix shares are down 3.5% to $70.90 in premarket trading.

JON C. OGG

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.