Thursday’s initial public offering of Intelsat S.A. (NYSE: I) appears to be off to a bit of a disappointing start, at least on the surface. The world’s largest commercial satellite operator is private equity backed, and it came public with a lower share price and a lower number of shares than what was expected.

Lead underwriters were listed as Goldman Sachs, J.P. Morgan, Morgan Stanley and Bank of America’s Merrill Lynch. The company sold just over 19.3 million shares, versus the 21.7 million shares previously projected. Its price went off at $18 per share, and that was under its expected range of $21 to $25 per share we originally tracked.

Obviously the increased volatility in the equity and risk-based markets have thrown a wrench into the IPO market. At least that is the case for a leveraged satellite player backed by private equity, where the net proceeds will only pay down a small portion of a very large debt burden. We could not help but notice that Intelsat had almost $16 billion worth of debt on its balance sheet. Also, that it was trading at about eight times EBITDA, and that after losing $151 million in 2012 and losing $434 million in 2011. Revenue was up less than 1% in 2012 to $2.61 billion.

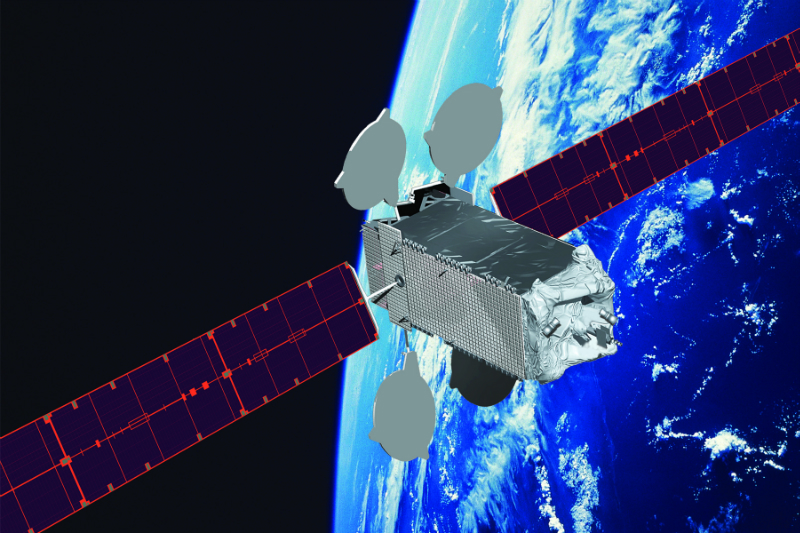

Intelsat has a fleet of more than 50 satellites. It serves about 1,500 customers in telecom, government, media and data markets. Those satellites are tied into terrestrial infrastructures via teleports and fiber optic networks.

The company also sold a concurrent public offering of 3,000,000 Series A mandatory convertible junior non-voting preferred shares at a price of $50.00 per share. BC partners and Silver Lake Partners were the private equity firms behind Intelsat. The good news is that investors jumped on a weak opening price of $17.00. Now the stock is up almost 6% to $19.10, with more than 5 million shares trading hands.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.