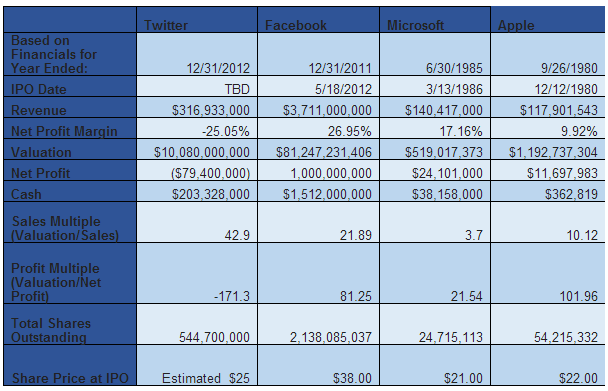

How does that stack up with some other IPOs in the tech world? Financial analysis firm Sageworks Inc. has prepared a handy chart comparing Twitter’s pending IPO with those of Facebook Inc. (NASDAQ: FB), Microsoft Corp. (NASDAQ: MSFT), and Apple Inc. (NASDAQ: AAPL). Apple went public in 1980, Microsoft in 1985, and Facebook just last year. In the following chart, Sageworks uses the number of Class A common shares outstanding to compute Twitter’s valuation.

As Sageworks’ chairman notes, “[Twitter] is still losing money, and at least Facebook was profitable when they went public. Proponents of the stock are talking about the potential of Twitter, but most companies that go public have potential, so this is immaterial to the conversation.” Ouch.

The IPO is set to price on Wednesday night and begin trading on Thursday on the NYSE under the ticker symbol “TWTR.”

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.