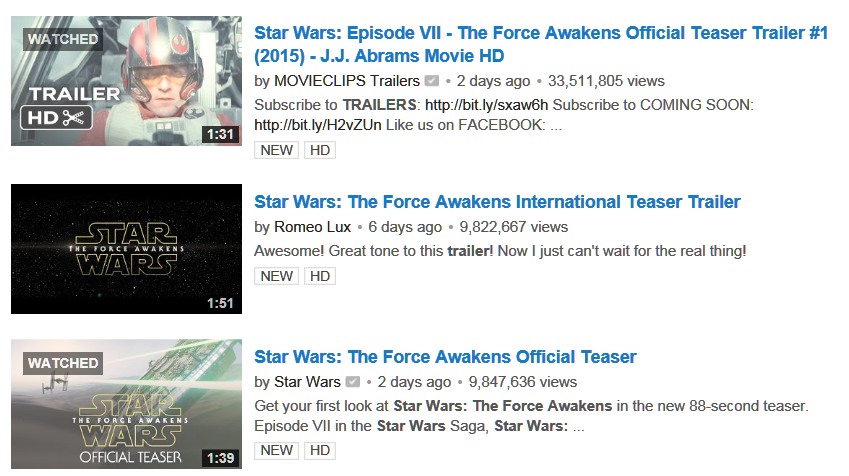

When George Lucas sold the Star Wars franchise to Walt Disney Co. (NYSE: DIS) for a sum of nearly $4 billion, our first look analysis was that the movie studio owner and entertainment giant was getting a steal on its acquisition. Now we have yet even more proof: the top three YouTube previews of “Star Wars Episode VII: The Force Awakens” have been watched almost 50 million times.

UPDATE as of 3 p.m. Eastern Time, Monday, December 1: The same top three previews had been watched a whopping 54 million times. Now, keep in mind that the Star Wars film is not going to be released for another year!

What Disney bought here was the greatest movie franchise in history. We even projected before the buyout was announced that Star Wars was so big it even could have conducted its own IPO, had George Lucas wanted it to. Our own estimate was close to $30 billion in total franchise sales, and many of those sales were in dollars from more than a decade ago.

ALSO READ: The 20 Most Profitable Companies in the World

This new Star Wars franchise will open up all sorts of new avenues for Disney. With Disney having theme parks, toy making, video games, merchandise and media angles that are unrivaled by any company in the world, Disney can just accomplish more and milk more money out of the franchise than any other company.

Even in June, there were $100 calls for Disney’s stock price. The stock is still about 8% under that price, but our take remains that Disney could get there, with or without the Star Wars franchise.

Disney shares closed at $92.51 on Friday, in a 52-week range of $68.80 to $92.96. This remains effectively at all-time highs, with a market cap that is now over $150 billion. The consensus analyst price target is $95.44, while the highest analyst price target is now up at $106.

It seems that the Mouse House just keeps finding new reasons for investors to love the company.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.