This past week was not kind for social media investors by any stretch of the imagination. Most of the key social media stocks were sold off so much that one has to wonder if they are becoming oversold, or if they are at least close to being in an oversold chart setup. The reality is that the earnings reports just did not live up to what could still justify such high valuations, and the stock market has removed billions of dollars from the social media valuations combined.

24/7 Wall St. wanted to see what was in the cards for the likes of LinkedIn Corp. (NYSE: LNKD), Twitter Inc. (NYSE: TWTR) and in Yelp Inc. (NYSE: YELP). It may seem that the sell-off in each was excessive, but these companies all still have valuations that are excessive on forward price to earnings (P/E) ratios and against future revenues.

We have reviewed just how much these companies sold off by during the week. We have also included additional color on the earnings reports, trading history and analyst calls.

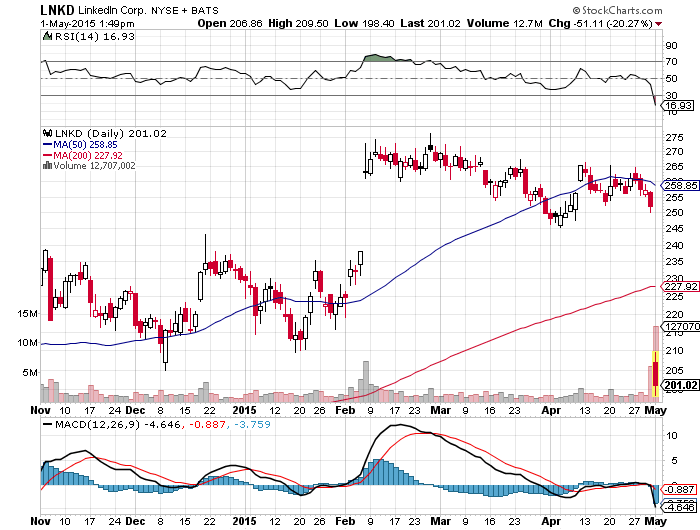

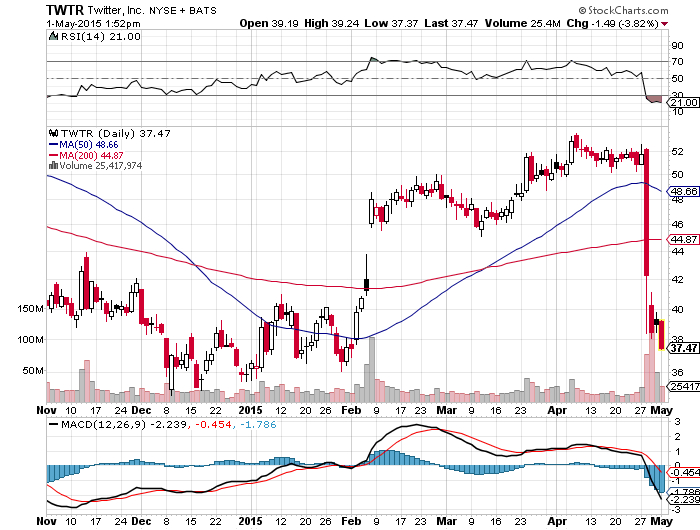

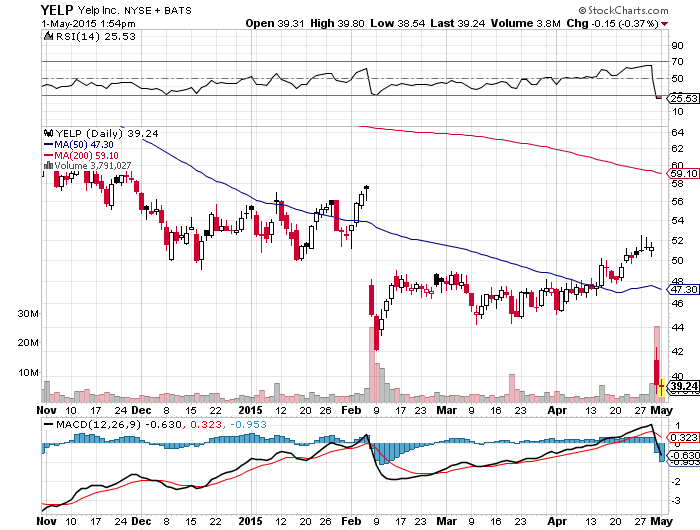

Another issue that was shown for each is a six-month stock chart from StockCharts.com. These show 50-day and 200-day moving averages for trend lines.

ALSO READ: How Analysts Rate Apple After Earnings

LinkedIn was the last one on the week to be gutted. Shares were down over 20%, almost $52.00, and were fighting to hold on to $200 on Friday.

Revenues in the most recent quarter were $637.7 million, while Thomson Reuters had estimates of closer to $636 million. It was a beat, but not by much. Then LinkedIn gave guidance of $670 million to $675 million for the coming quarter, under what was easily supposed to be a $700 million quarter.

This is against a 52-week range of $136.02 to $276.18, but the earnings report was followed by many analyst downgrades or lowered price targets. LinkedIn was still worth about $25.2 billion. That old $290+ consensus analyst price target is no longer the case. Here were some of the cautious analyst calls:

- FBR Capital Markets kept its Market Perform rating but cut the price target to $180 from $211.

- Needham maintained its Buy rating but cut the target to $250 from $300.

- RBC Capital Markets maintained its Outperform rating but cut the target price to $275 from $300.

- Stifel maintained its Buy rating but cut the target to $250 from $300.

Twitter was also thrashed this past week. The earnings report on Tuesday actually got leaked before the close, providing a serious spoiler. Shares were at $51.66 on Monday, opened at $52.16 on Tuesday, and closed down 18% at $42.27 on Tuesday. The trend was still lower, with analyst downgrades and additional investor selling taking the stock down to $38.49 on Wednesday. Twitter shares were down almost 3% at $37.84 as the trading session ended on Friday. All in all, the microblogging site was down more than 26% this week.

Twitter’s quarterly results were $0.07 in earnings per share on $436 million in revenue, versus Thomson Reuters consensus estimates of $0.04 in EPS on $456.82 million in revenue. The company had weak metrics and said that its first-quarter revenues were affected by a lower-than-expected contribution from its newer direct response products.

ALSO READ: 5 Big Stocks Expected to Outperform Apple

As far as how $37.84 compares to history, Twitter’s 52-week range is $29.51 to $55.99, and the market cap is $24.5 billion. Its consensus analyst price target was closer to $47 by the end of the week, and that likely will be lower after it is adjusted for next week. Here were some of the cautious analyst calls and downgrades we saw:

- Janney Capital Markets cut its rating to Neutral from Buy and cut the price target to $44 from $53.

- Barclays downgraded it to Equal Weight from Overweight, and the price target was slashed to $44 from $60.

- Bank of America Merrill Lynch maintained its Neutral rating but lowered the price objective to $44 from $52.

- BC Capital Markets maintained a Sector Perform rating, but it cut the price target to $47 from $54.

Yelp

Yelp acted like it changed its name to Whimper, or even Ouch. The stock hit a 52-week low, but Yelp’s market cap now is a more reasonable $2.9 billion. It still trades at incredibly high earnings multiples, though.

Yelp reported first-quarter results after the markets closed Wednesday. The local business guide company posted a diluted earnings per share (EPS) loss of $0.02 on revenues of $118.5 million. Thomson Reuters had estimates of $0.01 EPS and $119.98 million in revenue, and the first quarter of 2014 came with an EPS loss of $0.04 on revenues of $76.41 million.

On a non-GAAP basis, Yelp posted EPS of $0.10 per share, which excludes stock-based compensation and amortization of intangible asset charges of $79 billion. Adjusted EBITDA totaled $16.3 million in the quarter.

ALSO READ: 2 Serious Biotech Buyout Candidates

Yelp shares ended the week at $39.76, compared with the pre-earnings price of $51.28. This generates a loss of more than 23% from before earnings. Yelp’s new 52-week range is $38.54 to $86.88, and the consensus analyst target of $56.50 is still compressing down. Here were some of the analyst downgrades and cautious calls:

- RBC Capital Markets cut the stock to Sector Perform from Outperform, and the price target was slashed to $50 from $82.

- Merrill Lynch cut it to Neutral from Buy with a $55 price objective.

- Needham maintained its Buy rating but cut the target to $55 from $80.

- Northland downgraded it to Underperform from Market Perform, and the price target was cut to $35 from $49.

- Sterne Agee CRT cut it to Neutral from Buy.

Again, these sell-offs looked brutal. The problem is that the valuations in these three social media companies by and large are still very high. Generally speaking, companies with high-betas like this have to really prove their worthiness before getting massive recoveries in the shares. That caveat being said, we would also admit that the trend that has reigned for almost four years is that investors have bought their favorite stocks on weakness.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.