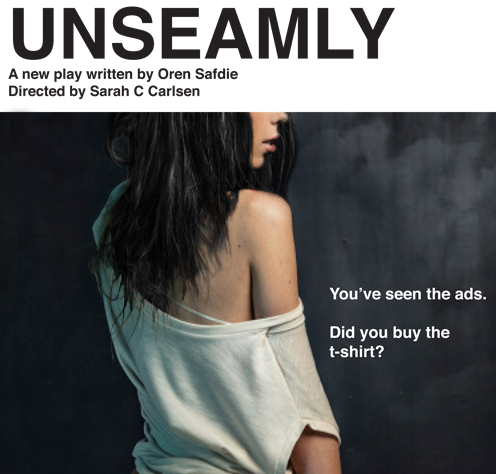

If you think the ups and downs of American Apparel Inc. (NYSEMKT: APP) for the past few years fit the plot outline, you’re right. What you probably do not know is that the play, titled “Unseamly,” was written by former American Apparel CEO Dov Charney’s first cousin, Oren Safdie, and was performed in Canada last year, where it was named to the Montreal Gazette’s Best of 2014 list.

When the play was up in Canada, a spokesperson for American Apparel told BuzzFeed:

Dov hasn’t seen the play yet, but Oren’s themes have often been influenced by the Safdie family, including his father and grandmother. It’s important to emphasize that his plays are works of fiction, loosely inspired by various events that the family has experienced over the years. Dov loves his cousin and is looking forward to seeing the play soon.

There was no follow-up report on whether Charney did see the play or if he enjoyed it.

Performances begin in New York on October 8 at Urban Stages Theatre.

ALSO READ: The 6 Most Shorted NYSE Stocks

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.