Media

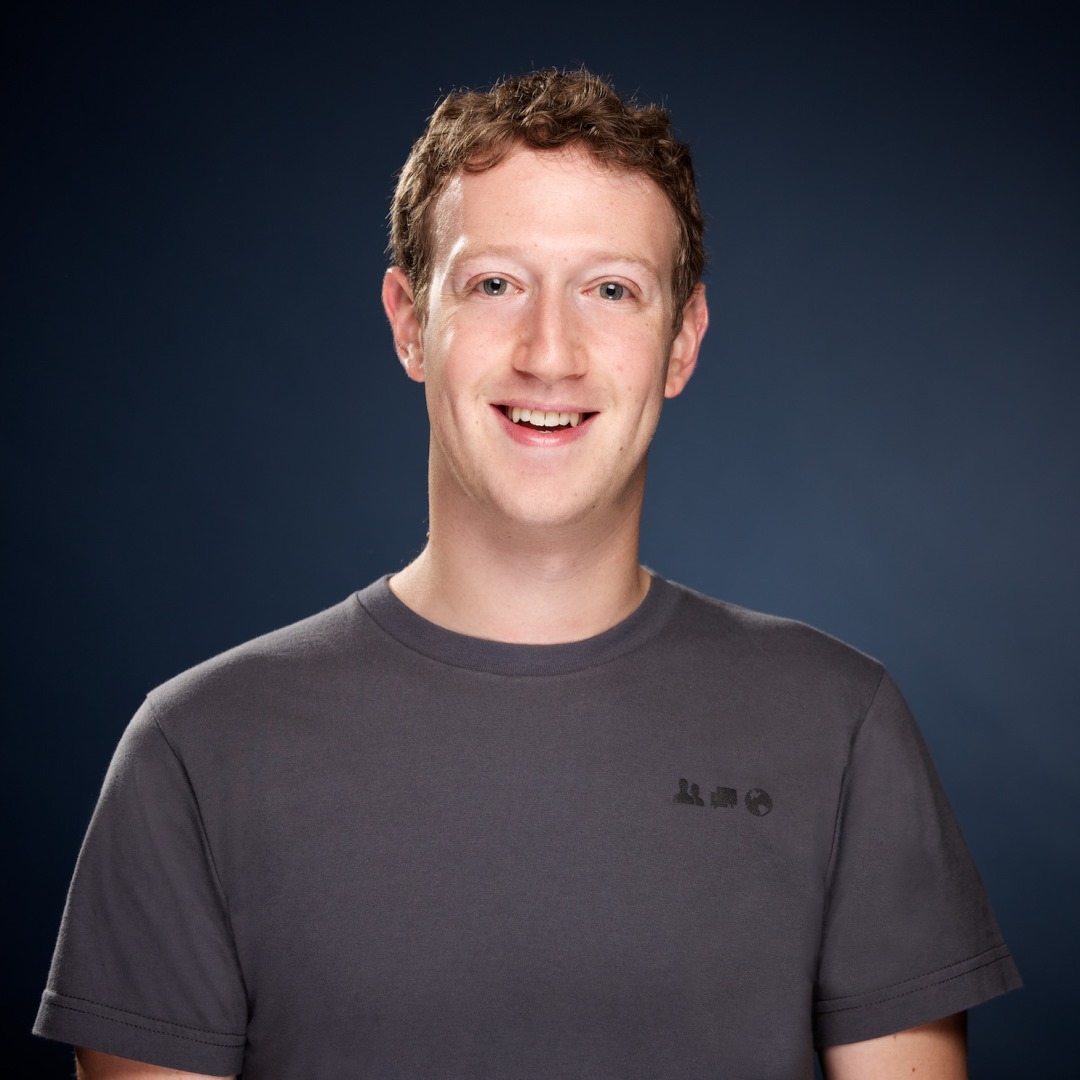

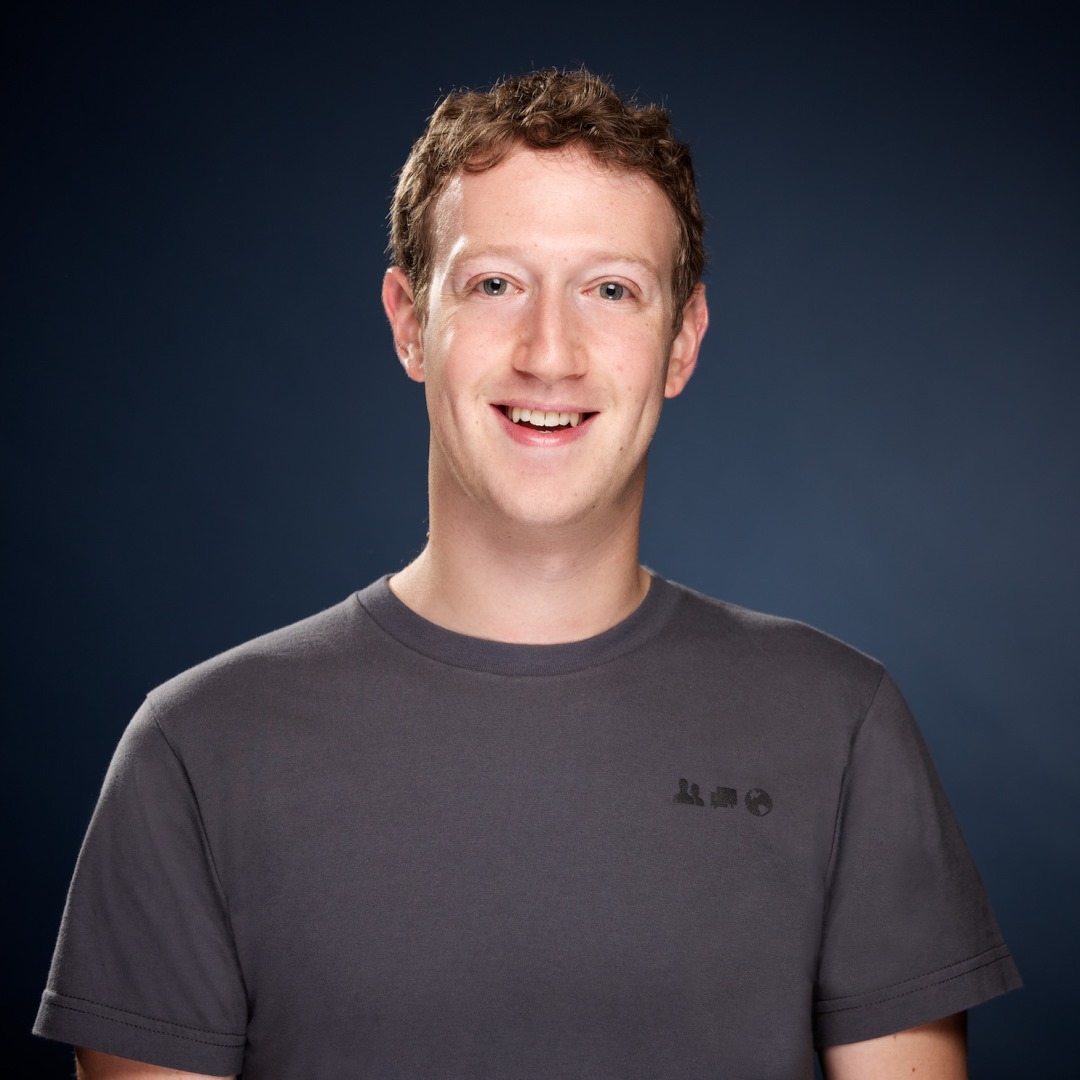

Will CEOs Other Than Facebook's Zuckerberg Take Paternal Leave?

Published:

Last Updated:

Mark Zuckerberg, the chief executive officer and founder of Facebook Inc. (NYSE: FB), wrote in a blog post that he will take two months of paternity leave when his daughter is born. The press and proponents of corporate paid time off for employees having children grabbed onto the decision as a means to show that even the busiest CEO can set aside time for his family. Zuckerberg’s circumstances put him in a position that cannot be used as a reason to support parental leave programs.

Zuckerberg is not only the founder of Facebook but has an arrangement whereby his stock holdings give him virtual control of the public corporation and its board. Viewed from this angle, he can do anything he wants.

In his blog, Zuckerberg wrote:

Priscilla and I are starting to get ready for our daughter’s arrival. We’ve been picking out our favorite childhood books and toys.

We’ve also been thinking about how we’re going to take time off during the first months of her life. This is a very personal decision, and I’ve decided to take 2 months of paternity leave when our daughter arrives.

The CEOs of most companies could not afford to do this, either in the views of their shareholders or their boards. The CEO’s job requires constant attention. A CEO who is not present puts pressure on a board, which is why companies with CEO absences appoint interim CEOs.

Another Zuckerberg advantage is that he runs one of the most successful companies in the world, and one that has so much momentum that it can surge forward without him. Facebook as a market cap of $204 billion dollars, which puts it ahead of Coca-Cola and AT&T. Facebook’s shares have risen 45% in the past year.

Finally, Facebook has an unusually competent management team, led by Sheryl Sandberg. The chief operating officer is often mentioned as a CEO candidate for some of America’s largest public companies. She has had her job since 2008 and is a member of the Facebook board.

Zuckerberg is taking time off because he can. Almost no one else in his position could afford to.

ALSO READ: 6 Big Dividend Hikes Expected Before Year-End

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.