Media

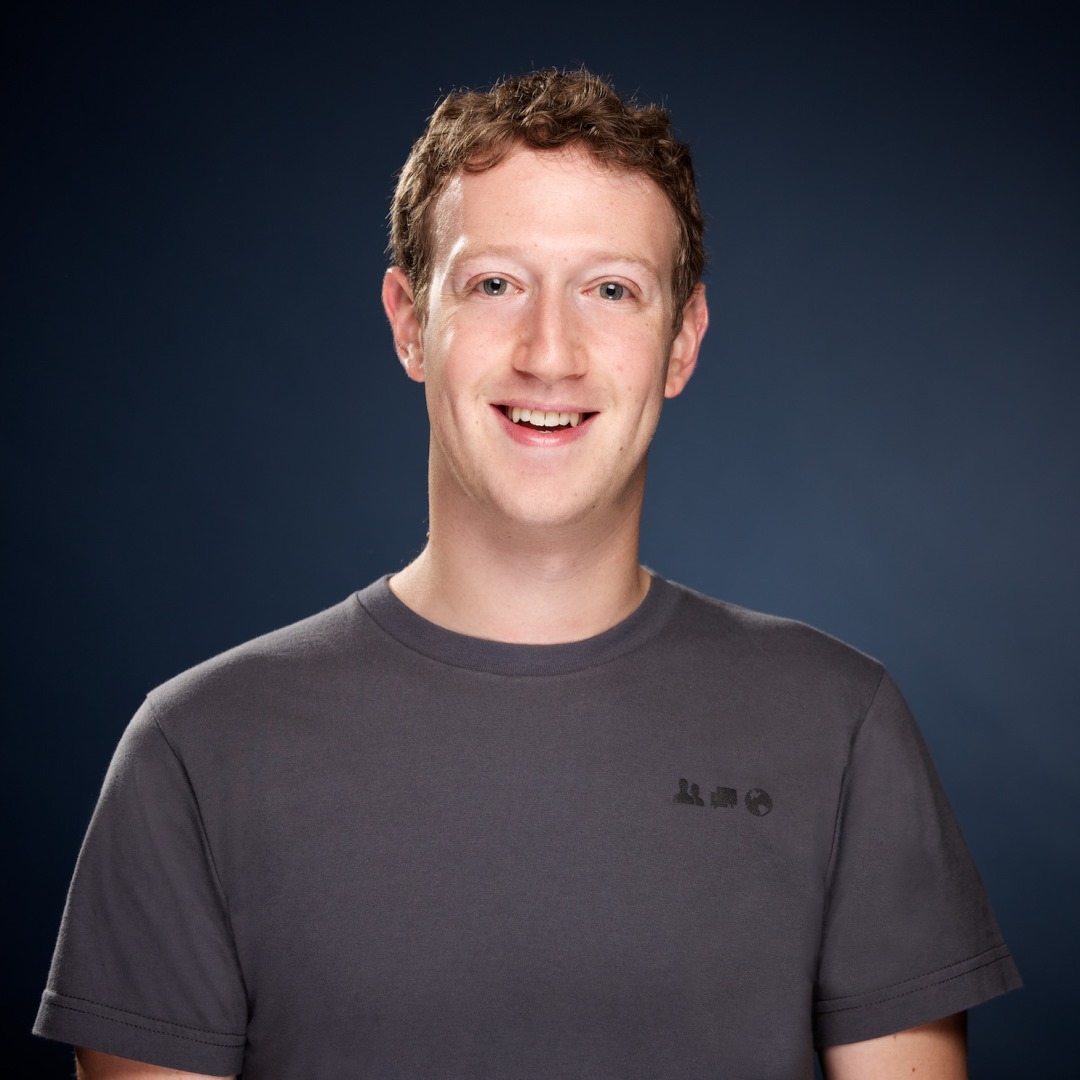

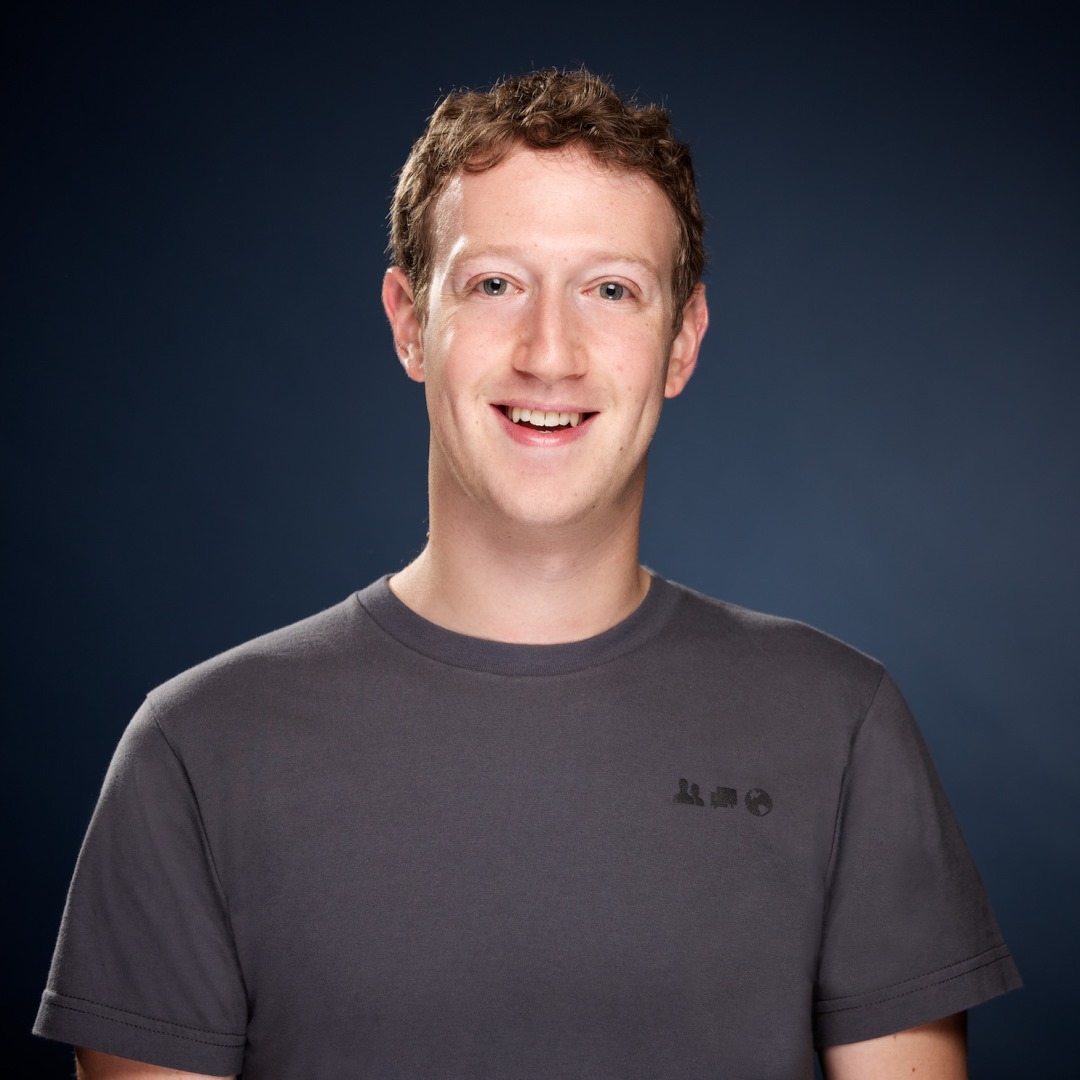

Mark Zuckerberg to Give His Fortune Away Without Punishing Shareholders

Published:

Last Updated:

Facebook Inc. (NASDAQ: FB) has an announcement. First it was Warren Buffett and Bill Gates, and now you can add Mark Zuckerberg to the list for long-term charitable giving. An SEC filing from Facebook laid out how Mark Zuckerberg is going to effectively gift away almost all (roughly 99%) of his Facebook shares to a new charitable entity over the course of his lifetime.

In an effort to keep Facebook’s stockholders from fearing that this will be a huge stock sale or loss of control, Facebook’s SEC filing laid out an instant clarification of what this would entail and over what sort of time it would be.

The Facebook SEC filing specified that Zuckerberg is planning to sell or gift no more than $1 billion worth of Facebook shares each year, and it specified that this would be over the next three years — for up to $3 billion in total. Tuesday’s filing also signaled that Zuckerberg plans to retain his majority voting position in Facebook for the foreseeable future.

Tuesday’s filing said:

On December 1, 2015, our Founder, Chairman and CEO, Mark Zuckerberg, announced that, during his lifetime, he will gift or otherwise direct substantially all of his shares of Facebook stock, or the net after-tax proceeds from sales of such shares, to further the mission of advancing human potential and promoting equality by means of philanthropic, public advocacy, and other activities for the public good. For this purpose, Mr. Zuckerberg has established a new entity, the Chan Zuckerberg Initiative, LLC, and he will control the voting and disposition of any shares held by such entity. He has informed us that he plans to sell or gift no more than $1 billion of Facebook stock each year for the next three years and that he intends to retain his majority voting position in our stock for the foreseeable future. Any sale of shares by Mr. Zuckerberg will be conducted pursuant to a trading plan established pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Sales and gifts of shares by Mr. Zuckerberg will be disclosed publicly in accordance with the rules established by the U.S. Securities and Exchange Commission under Section 16 of the Exchange Act. As of the date of this filing, Mr. Zuckerberg beneficially owns approximately 4 million shares of Class A common stock and approximately 419 million shares of Class B common stock.

Facebook shares closed up 2.7% at $107.07 on Tuesday, with a 52-week range of $72.00 to $110.65. The company’s market cap is also almost $303 billion.

While the question of giving versus being taxed can always come up, this is one of those instances in which Facebook laid out the expectations and the path just right for how to set up a charitable entity without causing a fear that a flood of shares would be hitting the market in a very short time.

ALSO READ: The 100 Largest Private Companies in America

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s made it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.