Scholastic Corp. (NASDAQ: SCHL) is one stock that doesn’t get the attention that it deserves from investors.

What most people know about the company is its association with Harry Potter, but the New York-based publisher has more going for it than a fictional wizard. Indeed, its education business posted a 17% revenue gain in the latest quarter, outperforming its larger children’s book unit, which reported a 7% gain. But there is reason to be optimistic that better times lie ahead for both businesses.

First, the children’s book business is doing a lot better than the adult book business. Schools are encouraging parents to read books young children because it furthers their development as readers. The results have been remarkable. According to Nielsen, U.S. children’s book sales rose 12.6% between January 2014 and September 2015. They rose 28% in Brazil and 10% in Brazil. An astonishing 11 out of the 20 best-selling books in the United States were children’s titles. The growth in tablets certainly has fueled this boom as well.

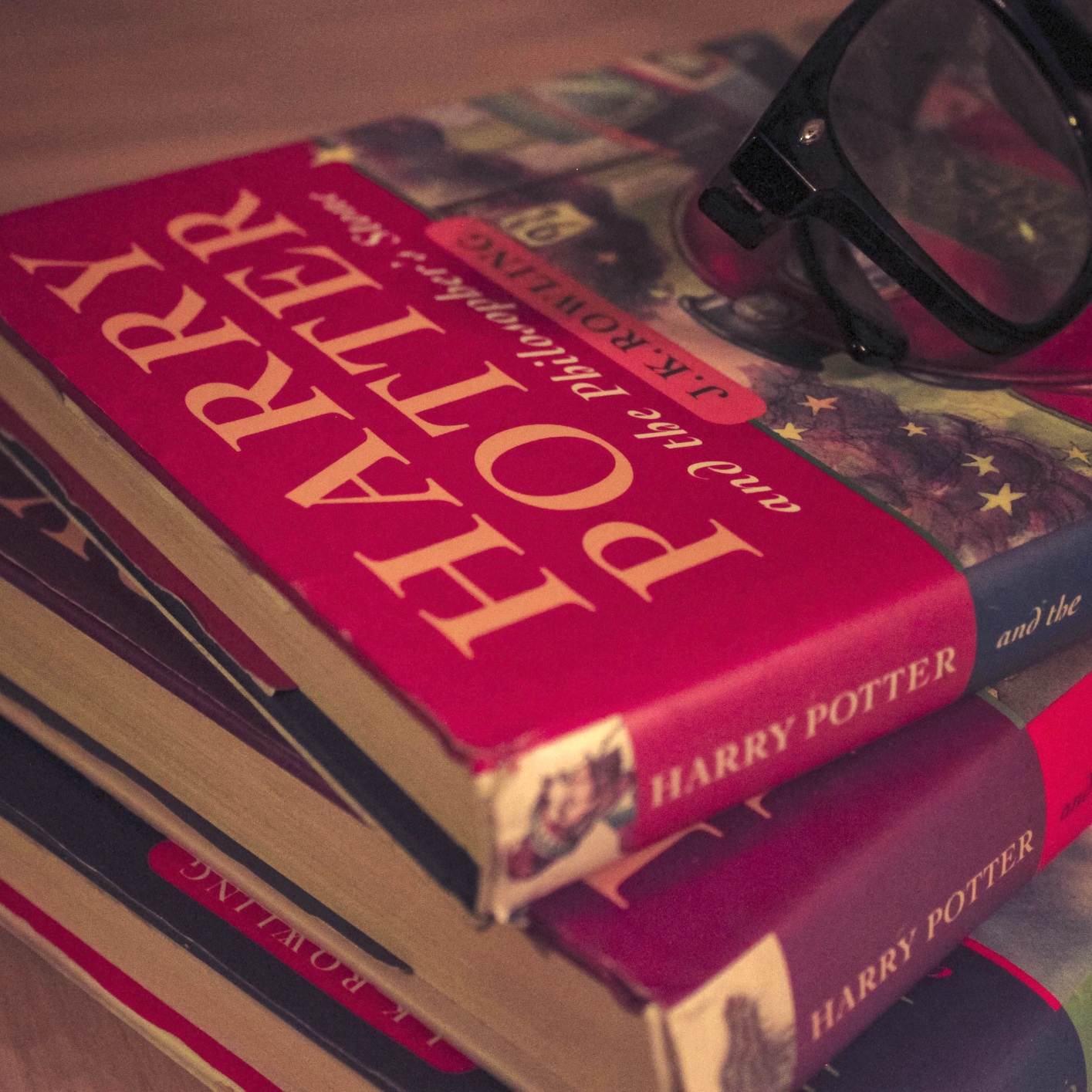

Of course, having Harry Potter at its disposal certainly is an asset for the company, along with other popular series such as The Baby Sitter’s Club and Captain Underpants. But Potter’s importance can’t be underestimated, particularly since it recently announced a multiyear publishing deal with Warner Brothers for books based on the eight Harry Potter films. The company also is planning to release the scripted book, “Harry Potter and the Cursed Child.”

Scholastic’s latest results didn’t do much for the stock. Though its loss was narrower than expected, its 2016 guidance was below expectations. Its shares have slumped more than 10% over the past year. Wall Street has high hopes for the stock, and analysts have a 52-week price target on it that is a whopping 38% above where it currently trades. The stock is dirt cheap too, trading a price-to-earnings multiple under 5.

Investors should consider snapping up shares of Scholastic before a major media company like News Corp. (NASDAQ: NWSA), Walt Disney Co. (NYSE: DIS) or Time Warner Inc. (NYSE: TWX) beats them to it.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.