It appears that the effort by Chinese truck manufacturer Great Wall to buy Jeep from Fiat Chrysler Automobiles N.V. (NYSE: FCAU) has faltered. Fiat Chrysler has not indicated that it has any real interest in the deal.

A new home price study shows that several geographically diverse cities are targets for home buyers in the third quarter:

ATTOM Data Solutions, curator of the nation’s largest multi-sourced property database, today released its Q2 2017 Pre-Mover Housing Index, which shows that the markets with the highest pre-mover indices during the second quarter — predictive of strong sales activity in the third quarter — were Colorado Springs, Colorado; Chicago, Illinois; Washington, D.C.; Reno, Nevada; and Lexington, Kentucky.

Uber had a lower loss and rising revenue last quarter. According to Bloomberg:

Even as Uber Technologies Inc.’s investors mounted a revolt against the then-chief executive officer over a string of self-inflicted scandals, the ride-hailing company’s financial performance continued to improve in the second quarter of the year, based on financial results provided by the company.

Uber generated $1.75 billion in adjusted net revenue in the second quarter of this year, up 17 percent from the prior quarter. Uber narrowed losses by 9 percent to $645 million.

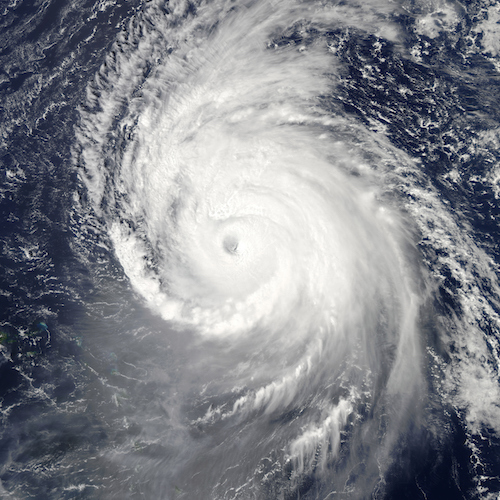

Oil prices could be temporarily affected as a potential hurricane moves closer to Texas and drilling rigs in the Gulf of Mexico. A report from Weather.com says:

Tropical Storm Harvey is expected to strengthen into a hurricane before bringing a extremely dangerous combination of rainfall and storm-surge flooding to areas near the Texas and Louisiana coasts into the weekend or early next week.

The NHC says the center of Harvey is located about 400 miles southeast of Port Mansfield, Texas, but has now picked up some forward speed, moving northwest at 5 to 10 mph.

The single winning $700 million Powerball jackpot number was sold in Massachusetts. The lottery prize was the second largest in U.S. history.

Exxon Mobil Corp. (NYSE: XOM) mislead the public in its comments about global warming. A study published by Harvard researchers concluded:

Available documents show a discrepancy between what ExxonMobil’s scientists and executives discussed about climate change privately and in academic circles and what it presented to the general public. The company’s peer-reviewed, non-peer-reviewed, and internal communications consistently tracked evolving climate science: broadly acknowledging that AGW is real, human-caused, serious, and solvable, while identifying reasonable uncertainties that most climate scientists readily acknowledged at that time. ExxonMobil’s advertorials in the NYT overwhelmingly emphasized only the uncertainties, promoting a narrative inconsistent with the views of most climate scientists, including ExxonMobil’s own

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.