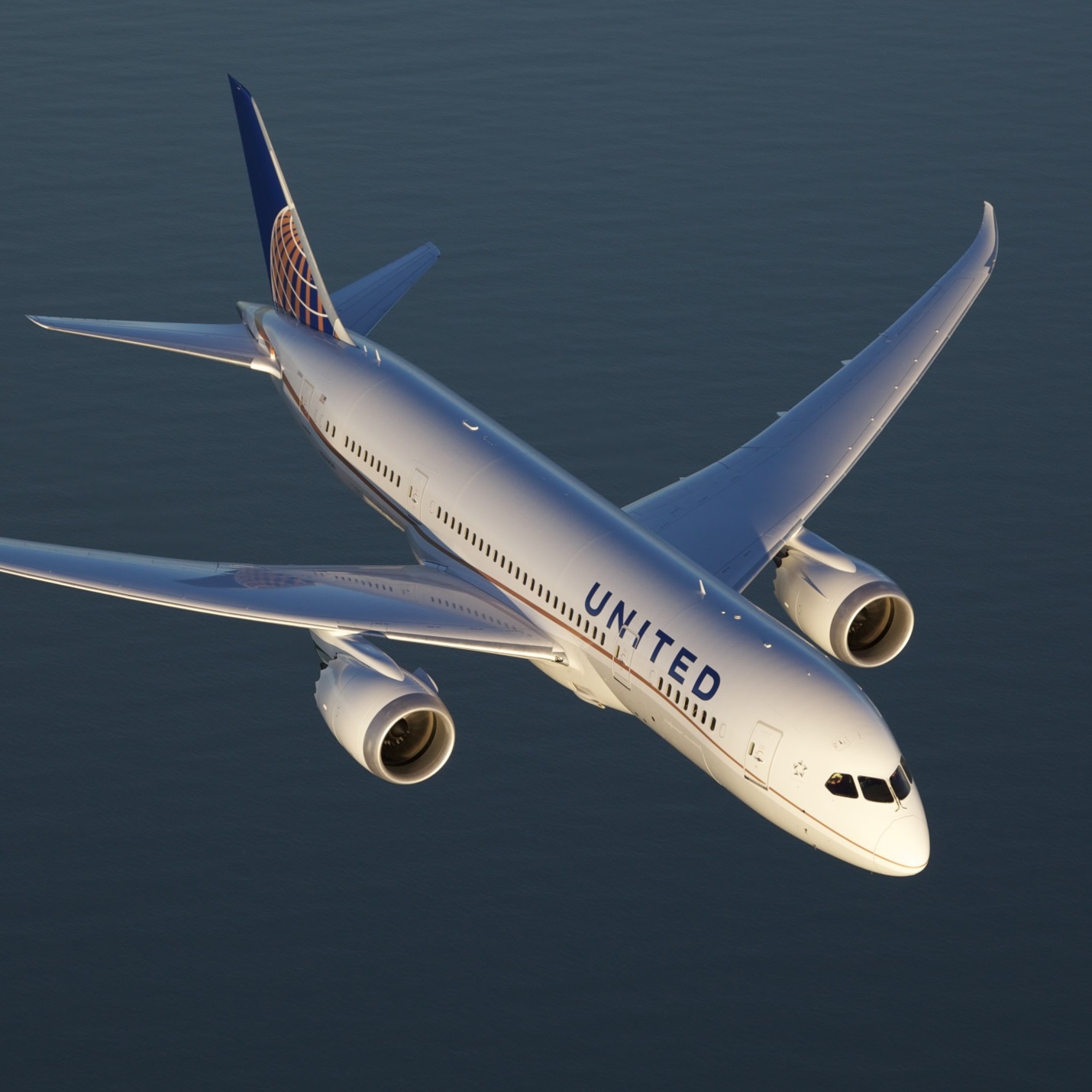

United Continental Holdings Inc. (NYSE: UAL) will appoint a new board chair. According to MarketWatch:

The board of United Continental Holdings Inc. said Monday it will nominate a new chairman from within its ranks after veteran industry executive Robert Milton opted to leave the third-largest U.S. carrier.

Total compensation for Chief Executive Oscar Munoz is also set to almost halve for 2017 compared with the previous year as the airline continues efforts to recover from a series of problems with passengers and investors.

Alphabet Inc. (NASDAQ: GOOGL) and Softbank made large investments in a Chinese transportation startup. According to Reuters:

Japan’s Softbank Group and Alphabet Inc’s venture capital fund CapitalG are among investors pouring $1.9 billion into a truck hailing service platform Manbang, the Chinese company said in a statement on Tuesday.

Manbang, formally known as Full Truck Alliance Group, said the investment was led by SoftBank’s Vision Fund – which counts Apple Inc, Foxconn and Saudi Arabia’s sovereign wealth fund among its backers.

The CEO of Sears Holdings Corp. (NYSE: SHLD) will try to use his hedge fund to buy some of the failing retailer’s assets. According to The Wall Street Journal:

Edward Lampert is once again carving up Sears Holdings Corp. in a bid to save his retail empire, proposing that his hedge fund purchase the Kenmore appliance brand and other Sears units after the struggling company was unable to find other buyers.

The Sears chief executive, through ESL Investments Inc., said in a letter to the Sears board that ESL—which currently owns a controlling stake in the retailer—is willing to submit offers for the Kenmore brand as well as the Sears Home Improvement and Parts Direct businesses, both of which are part of the retailer’s Home Services division.

Sears has been exploring strategic options for the businesses for nearly two years, but Mr. Lampert said in his letter that it couldn’t find buyers. The Kenmore business could fetch at least $500 million in a sale, according to one person familiar with the matter.

Alphabet made a lot of money last quarter. According to CNNMoney:

Google’s business is humming along despite mounting concerns over data privacy.

Alphabet, the parent company of Google, reported Monday that its profits hit $9.4 billion in the first three months of 2018, up from $5.4 billion a year earlier.

The company’s bottom line was helped by the continued strength of its ad sales business. Google’s sales for the quarter jumped 26% to $31.1 billion. Its ads business accounted for $26.6 billion of that.

Uber has a problem in Mexico. According to CNNMoney:

“Viaja con Didi” — “Ride with Didi.”

That’s the message that Didi Chuxing, China’s dominant ride-hailing company, is sending potential drivers and passengers in Mexico.

Didi launched in the Mexican city of Toluca on Monday, the first time the company has introduced its ride-hailing service outside China. It says it plans to move into other major cities in Mexico later this year.

Didi is best known for driving Uber out of China in a vicious, costly battle. Its move into Mexico expands their rivalry.

Newspaper publisher Tronc Inc. (NASDAQ: TRNC) may have a new controlling shareholder. According to the New York Post:

McCormick Media, which already has a definitive agreement to buy the 25.7 percent of Tronc stock owned by ex-chairman Michael Ferro, is in talks with another “significant” shareholder about increasing its stake even further.

The bombshell disclosure was buried in a regulatory filing McCormick Media filed on Monday.

The disclosure of the talks has triggered speculation that the secret talks are with Dr. Patrick Soon-Shiong, the California bio-tech mogul who is set to buy the Los Angeles Times and San Diego Union-Tribune from Tronc for $500 million.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.