Walt Disney Co. (NYSE: DIS) still thinks it will close a deal to buy Twenty-First Century Fox Inc. (NYSE: FOXA) assets even with a challenge from Comcast Corp. (NASDAQ: CMCSA). According to The Wall Street The Journal:

Walt Disney Co Chief Executive Robert Iger expressed confidence that his company would prevail in its bid for key assets of 21st Century Fox, despite recent moves by Comcast Corp. to make a competing offer.

Appearing to brush aside reports Monday that the cable giant was preparing for a potential attempt to outbid Disney for Fox, Mr. Iger on Tuesday said on a conference call discussing his company’s financial results with Wall Street analysts that he is “confident the assets we’re in the process of acquiring” will easily fit within Disney once the deal is approved.

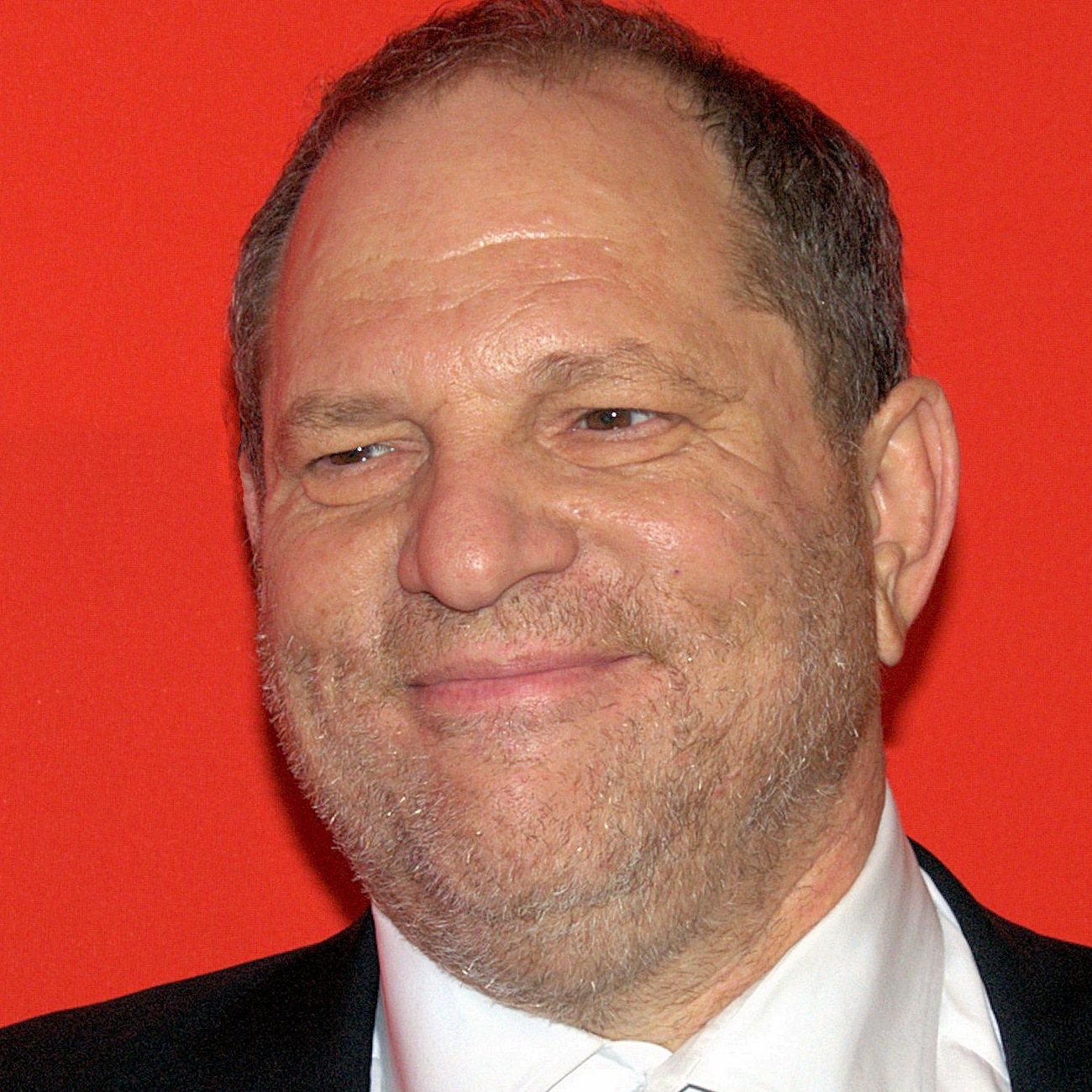

The Weinstein Company will finally be sold. According to The Wall Street Journal:

A judge said Tuesday she will approve the sale of the bankrupt television and film studio co-founded by Harvey Weinstein to private-equity firm Lantern Capital Partners for $310 million.

The sale of Weinstein Co. assets, subject to closing conditions, is expected to give the troubled studio a second life under new ownership.

The transaction was approved by Judge Mary Walrath in the U.S. Bankruptcy Court in Wilmington, Del. The company filed for chapter 11 protection in March, six months after allegations of sexual assault and sexual harassment were first published against Mr. Weinstein and after attempts to sell the studio outside of bankruptcy failed.

Ford Motor Co. (NYSE: F) has encountered problems producing its top-selling F-150 full-sized pickup. According to CNBC:

Just as auto sales start to heat up, Ford is facing the daunting prospect of seeing a major drop in the supply of its best selling and most profitable vehicle, the F-150 pickup truck.

Final assembly of the F-150 is crippled by the lack of critical components after a fire knocked out production at a supplier’s plant in Michigan.

Tuesday afternoon the United Automobile Workers union alerted members who build the F-150 at the Dearborn Truck Plant that production could be stopped later this week

The president’s rejection of a nuclear proliferation deal with Iran could hurt Boeing Co. (NYSE: BA). According to CNNMoney:

Boeing stands to lose billions of dollars in sales due to the sanctions on Iran President Trump just announced. But it can stand to take the hit.

Treasury Secretary Steven Mnuchin on Tuesday told reporters that licenses for Boeing and Airbus to export commercial planes and related parts to Iran will be revoked after a 90-day period. The company is not trying to beat that deadline.

Sales and profits at the aircraft maker are very strong, and it has a backlog of orders for nearly 6,000 commercial jets, worth about $486 billion. That doesn’t even include the 110 jets Iran ordered.

Elon Musk bought more shares in Tesla Inc. (NASDAQ: TSLA). According to CNNMoney:

Elon Musk doesn’t have much tolerance for critics of Tesla. And he just spent nearly $10 million of his own money to prove it.

The electric automaker’s CEO spent $9.9 million to buy 33,000 additional shares of Tesla at market prices. The purchase is unusual, since CEOs typically don’t buy shares of their company stock on the open market. Most of their shares come via stock grants from the company, or from exercising stock options. This was the first purchase of Tesla stock Musk has made in more than a year.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.