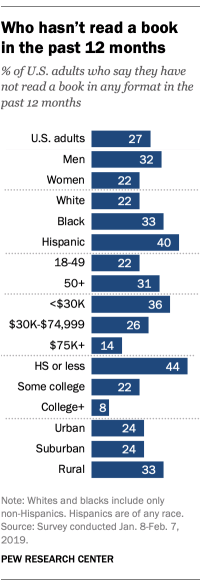

In America, there is a bookstore in almost every town (and hundreds in big cities), a library, people who share books with one another. Amazon allows almost any American to get a book or an electronic copy of it. Yet, 27% of Americans say they have not read a book, either in whole or in part, in the past year.

According to new research from the Pew Research Center, people who are less likely to read books fall into several categories, as do people who read more regularly. Forty-four percent of people who have a high school degree or less did not read a book last year. Forty percent of Hispanics fall into the same category. Thirty-six percent of people with income under $50,000 have not read a book. Thirty-three percent of rural residents have not either. Thirty-three percent also applies to black Americans.

[in-text-ad]

Book reading in the United States has decreased over the years. Nineteen percent of adults said they had not read a book in 2011.

The news is bad for the book industry, which has suffered for many years. It may be equally bad for other industries that rely on active readers among the population. Newspapers have to be at the top of this list. They already are struggling to keep current readership.

If literacy and reading are critical pillars to a democracy as a way for people to be self-taught, another American habit is eroding in a way that undermines that.

Pew Research was in the field from January 8 to February 7, 2019, and polled 1,502 people over 18 years old.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.