After signing up some 54.5 million subscribers in seven months, Walt Disney Co. (NYSE: DIS) must figure that Disney+ no longer needs to offer a seven-day free trial to attract more subscribers.

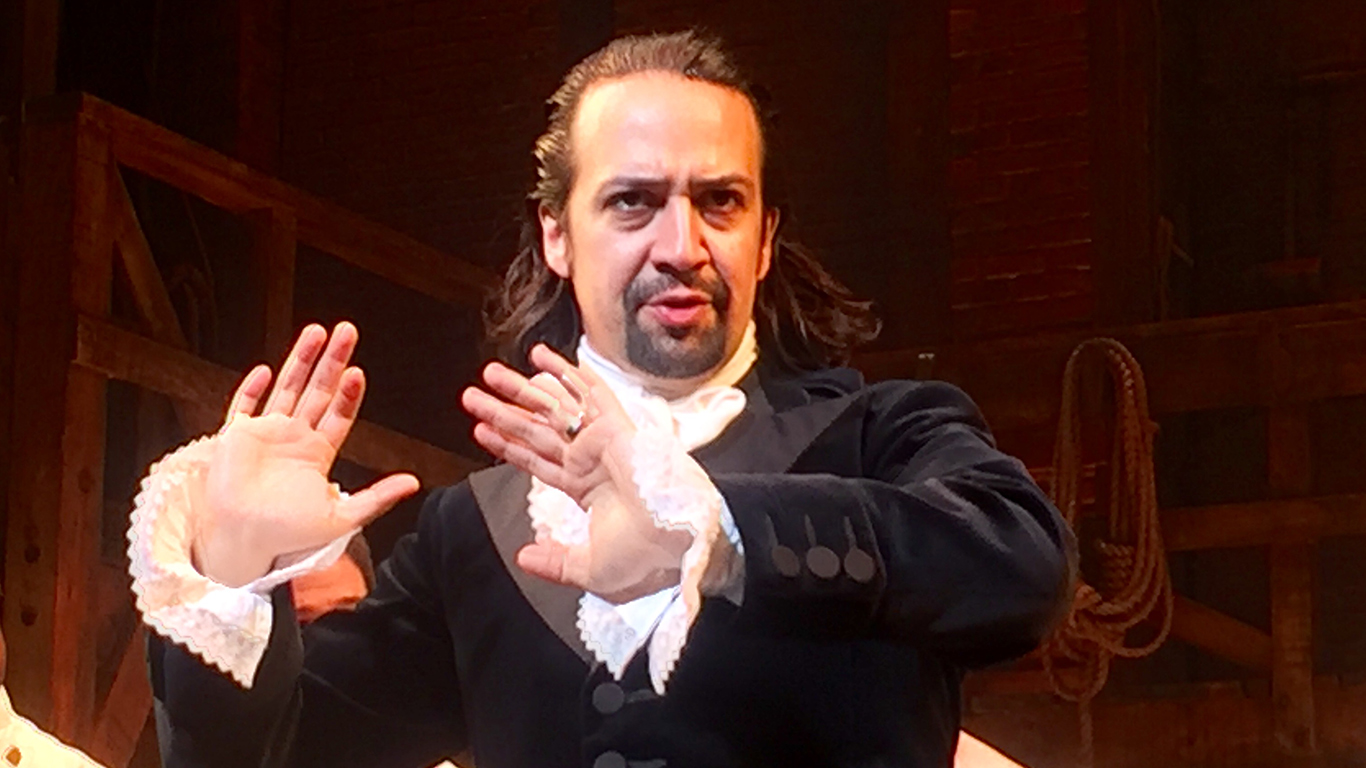

With the premiere of “Hamilton” due to begin streaming on the service on July 3, the company might be trying to avoid giving non-subscribers a free viewing of a movie that is streaming a full year before its planned theatrical release. After all, the Disney folks must be thinking, paying $6.99 for a month of the service is cheap compared to the average price of a movie ticket (provided, of course, that movie theaters are open).

That approach is at best shortsighted and may cost Disney a lot of potential long-term subscribers, according to media analytics firm Wicket Lab.

In an April interview with nScreenMedia, Wicket Labs CEO Marty Roberts spoke directly about the effectiveness of free trial, noting that his company is seeing a conversion rate of around 68% after the free trial period ends.

A Disney spokesperson told Variety that a subscription to Disney+ “was set at an attractive price-to-value proposition that we believe delivers a compelling entertainment offering on its own.” In other words, Disney doesn’t think it needs to use a free trial to lure new customers to Disney+.

Maybe Disney is worried that consumers will sign up for the free trial and then cancel once they’ve seen the show they wanted. About a third of U.S. consumers have done that even once and about one in six has done it multiple times. Just 2% have done the deed more than six times, according to an nScreenMedia survey.

Disney does continue to offer a seven-day free trial period for its Hulu + Live TV but does not offer the freebie for the three-pack of Disney+, Hulu and ESPN Plus. AT&T Inc. (NYSE: T) just launched WarnerMedia’s HBO Max streaming service with a seven-day free trial period, and Netflix Inc. (NASDAQ: NFLX) offers a 30-day free trial.

To punish those few, Disney is willing to give up a conversion rate of more than two-thirds?

Or maybe the company is trying to make up some revenue that it has lost at its theme parks as a result of the COVID-19 pandemic. Disney has about 29 million U.S. subscribers, less than a quarter of all U.S. households and less than half the 70 million U.S. households that subscribe to Netflix.

One thing Disney management may have considered was launching “Hamilton” on Hulu in order to drum up more subscribers for that service. Hulu had 32 million U.S. subscribers at the end of the first quarter, paying either $6 or $12 for the service, or $55 a month for Hulu + Live.

Couldn’t premiering “Hamilton” as a teaser for Hulu + Live have juiced subscriber numbers for that service? The premium service had just 3.3 million subscribers at the end of the first quarter.

Disney stock traded up about 0.7% shortly after the opening bell Tuesday, at $116.77 in a 52-week range of $79.07 to $153.41. The consensus 12-month price target on the stock is $121.71.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.