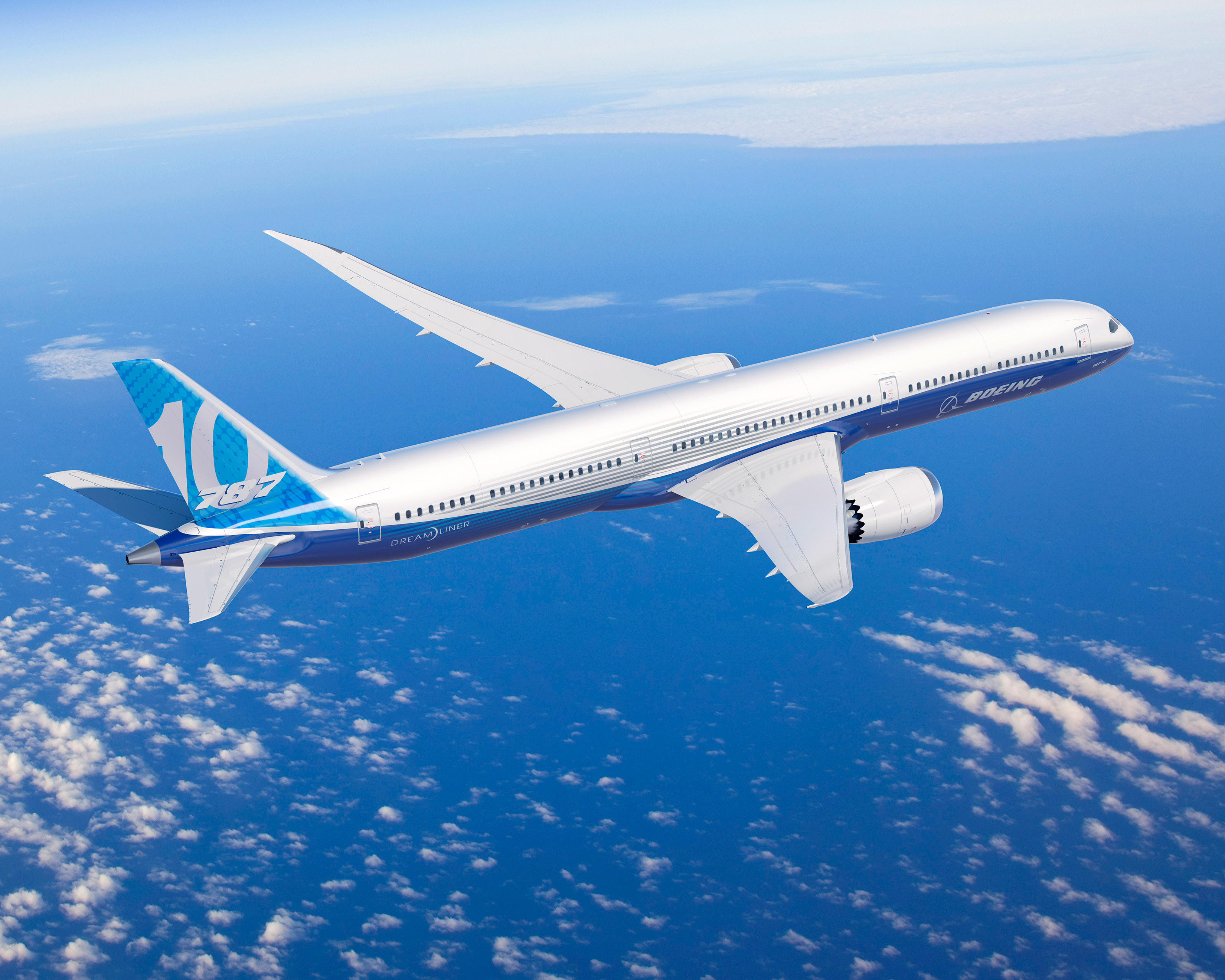

Five airlines have signed on to take 102 “stretch” models of the company’s 787 Dreamliner, dubbed the 787-10. The buyers include Air Lease Corp. (NYSE: AL), which ordered 30 of the new planes; GE Capital Aviation Services, a division of General Electric Co. (NYSE: GE) has ordered 10; International Airlines Group/British Airways ordered 12; Singapore Airlines will take 30; and United Continental Holdings Corp. (NYSE: UAL) has ordered 30.

No list price is given for the new plane, but the 787-9 lists for around $240 million. The new 787-10 should be priced a bit higher than the 787-9, so let’s say $250 million. The orders are then worth about $25.5 billion to Boeing.

All good for Boeing then? Let’s see, according to Boeing, the plane’s first test flight is scheduled for 2017, and the first commercial delivery is targeted for 2018. That is a long ways off, and given Boeing’s delays in getting out the first 787 Dreamliners and the subsequent battery problems, we are a little skeptical about that schedule.

Boeing’s share price is up about 0.3% in premarket trading this morning, at $103.30 in a 52-week range of $69.03 to $103.52. The high was posted yesterday.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.