Russian Deputy Prime Minister Dmitry Rogozin wants to kick the United States off the International Space Station. Even worse — he might be able to do it.

Last week, responding to U.S. sanctions imposed on Russian companies — and Russian officials, including Mr. Rogozin himself — the Russian Deputy PM threatened to cut off the supply of RD-180 rocket engines that American space-launch companies Lockheed Martin (NYSE: LMT) and Boeing (NYSE: BA) depend on to send some of their biggest payloads into orbit.

Now the good news here is that, according to United Launch Alliance, the rocket-launching joint venture between Lockheed Martin and Boeing that handles military satellite launches for the Pentagon, ULA has about a two year supply of RD-180 engines piled up, so Rogozin’s threat to cut off our supply is not imminent. The bad news, though, is that this supply of spare engines will eventually run out. At which point, either we have to figure out a way around the impasse with Russia, or come up with an alternative means of getting U.S. satellites, and astronauts, into space.

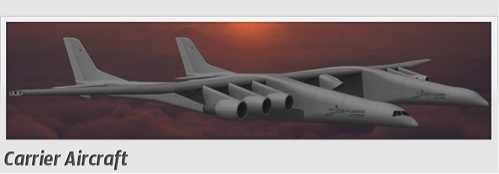

Enter Stratolaunch Systems Corporation, a new space launch venture, which is developing a novel way of getting satellites into orbit. Dubbed the “Eagles Launch System,” Stratolaunch’s plan is to start with a “carrier” aircraft that will carry a space launch package high into the atmosphere, then loft it the rest of the way into orbit aboard a multi-stage launch vehicle.

Northrop Grumman (NYSE: NOC) will build the carrier aircraft, and Orbital Sciences (NYSE: ORB) the launch vehicle. Last year, Stratolaunch picked ATK (NYSE: ATK) — which will soon merge with Orbital, not coincidentally — to build the first two, solid-fuel rocket stages that will loft the launch vehicle into orbit. One more blank in this picture got filled in this week, when Stratolaunch and GenCorp (NYSE: GY) confirmed that GenCorp subsidiary Aerojet Rocketdyne will supply Stratolaunch with the engines it needs to power the third stage of “Eagles.”

According to GenCorp, it will sell Stratolaunch at least six RL10C-1 liquid-fueled rocket engines (and perhaps as many as a dozen) for use in Eagles. Two engines being needed for each launch’s third stage, this would be enough to supply at least the first three (or six) Stratolaunch flights.

Hoping for no flight delays

What does all of this have to do with Russia’s threat to cut off U.S. access to the ISS? Basically this:

- At current usage rates, ULA’s supply of RD-180 engines will run out sometime in early-to-mid 2016.

- ULA believes it can stretch out this supply a bit by only using the huge RD-180 engines on payloads where they’re absolutely essential.

- But even so, ULA’s supply of RD-180s will certainly run out before ATK, which builds the rockets for ULA, can work out a domestically-designed alternative to the RD-180. Experts say such a process can take anywhere from five to eight years.

- Meanwhile, NASA has a contract in place guaranteeing its astronauts rides on Russian rockets to ISS through 2016 and into 2017.

Stratolaunch, meanwhile, expects to have its Eagles flying by as early as 2018. With sufficient juggling of its RD-180 supply by ULA, that might be soon enough to offer the Pentagon an alternative to RD-180-powered space launches — and if we’re very, very lucky, a means of getting U.S. astronauts the ISS as well.

Betting on tomorrow

Betting on the future is not only fun, it can make you rich. The problem is, most investors don’t understand the key to investing in hyper-growth markets. The real trick is to find a small-cap “pure-play” and then watch as it grows in EXPLOSIVE lockstep with its industry. Our expert team of equity analysts has identified one stock that’s poised to produce rocket-ship returns with the next $14.4 TRILLION industry. Click here to get the full story in this eye-opening report.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.