Military

Pentagon Pays Too Much for 100 Million Barrels of Fuel

Published:

Last Updated:

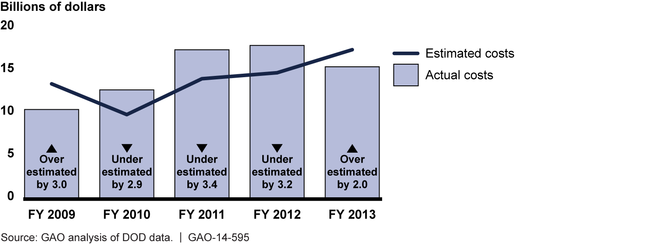

According to the GAO’s analysis, 74% of the difference between what the Pentagon estimated and what it actually paid was the difference between the estimate and the actual cost. The other 26% of the difference was due to the difference between what the different services estimated they would use and their actual use.

In the non-public world, companies try to get more accurate cost forecasts by hedging. In the defense world, price fluctuations are managed using a DOD-wide working capital fund that covers the Defense Department’s costs for commodity purchases, including bulk fuel, and then is reimbursed by the Pentagon’s sale of the commodities to the services and other customers.

For fiscal year 2013, the Pentagon’s price for a barrel of fuel totaled $156.66. Of that, $93.28 per barrel (60%) was allocated to the price of crude oil, $46.64 (30%) was allocated to refinery markup and the remaining $16.74 (10%) covers transportation and other non-product expenses.

In fiscal year 2013, the DOD estimate was $2 billion more than the actual expenditures. In the prior year, the Pentagon estimated a per barrel cost of $131.04; the actual cost totaled $167.33. That cost the DOD $3.2 billion more than it had budgeted.

The GAO stops short of recommending that the DOD begin hedging its fuel purchases. Pentagon officials say that hedging is outside the scope of their current authority and, according to Reuters, “would incur management fees, would increase total costs, and poses additional political and economic risks.”

What the GAO did recommend is that the Pentagon should at least try to use a more accurate benchmark. The DOD purchases 48% of its fuel outside the United States, but it budgets those purchases on West Texas Intermediate (WTI) prices rather than Brent prices. That alone fouls up the budgeting process by $7 to $15 a barrel, and when the Pentagon buys more than 100 million barrels of fuel every year, that turns into real money very quickly.

ALSO READ: 10 Countries Spending the Most on the Military

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.