Boeing said in July that it believes the world’s airlines will demand a total of 25,680 new single-aisle, narrow-body jets like its 737 and Airbus’s A320 family of planes. That is 16% more than the Airbus estimate of 22,071 new planes. Boeing also places the dollar value of those planes higher: $2.56 trillion versus the Airbus estimate of $2.09 trillion.

In the dual-aisle, wide-body segment, the two companies’ estimates are essentially dead even: Boeing expects total sales of 7,260 of the planes and Airbus forecasts sales of 7,256. Boeing’s total dollar value estimate is 10% higher, $2.1 trillion compared with a $1.9 million estimate from Airbus. This category includes Boeing’s 777 and 787 jets and the Airbus A330 and A350 families.

The major discrepancy between the two aircraft makers is in the very large category, where the Boeing 747-8 and the Airbus A380 are the sole competitors. Boeing sees demand for just 500 new planes of this class over the next 20 years, compared with an estimate of 1,228 from Airbus. That is a difference of nearly 60%. Based on dollar value, the Boeing’s estimate is 53% below Airbus’s.

ALSO READ: U.S. Export-Import Bank Would Support Sales of Airbus Planes

We have recently written about discussions between Emirates airline and Airbus for a re-engined version of the A380 that would improve fuel-efficiency by around 10%. Airbus, however, is looking to add seats to bring the average number of seats per plane up from 575 to 600. The A380-900 has a maximum capacity of 900 seats in a single-class (economy) configuration.

Both companies have forecast a rise in the total dollar value of the market, with Boeing’s estimate of $4.86 trillion about 10% higher than the Airbus estimate of $4.415 trillion.

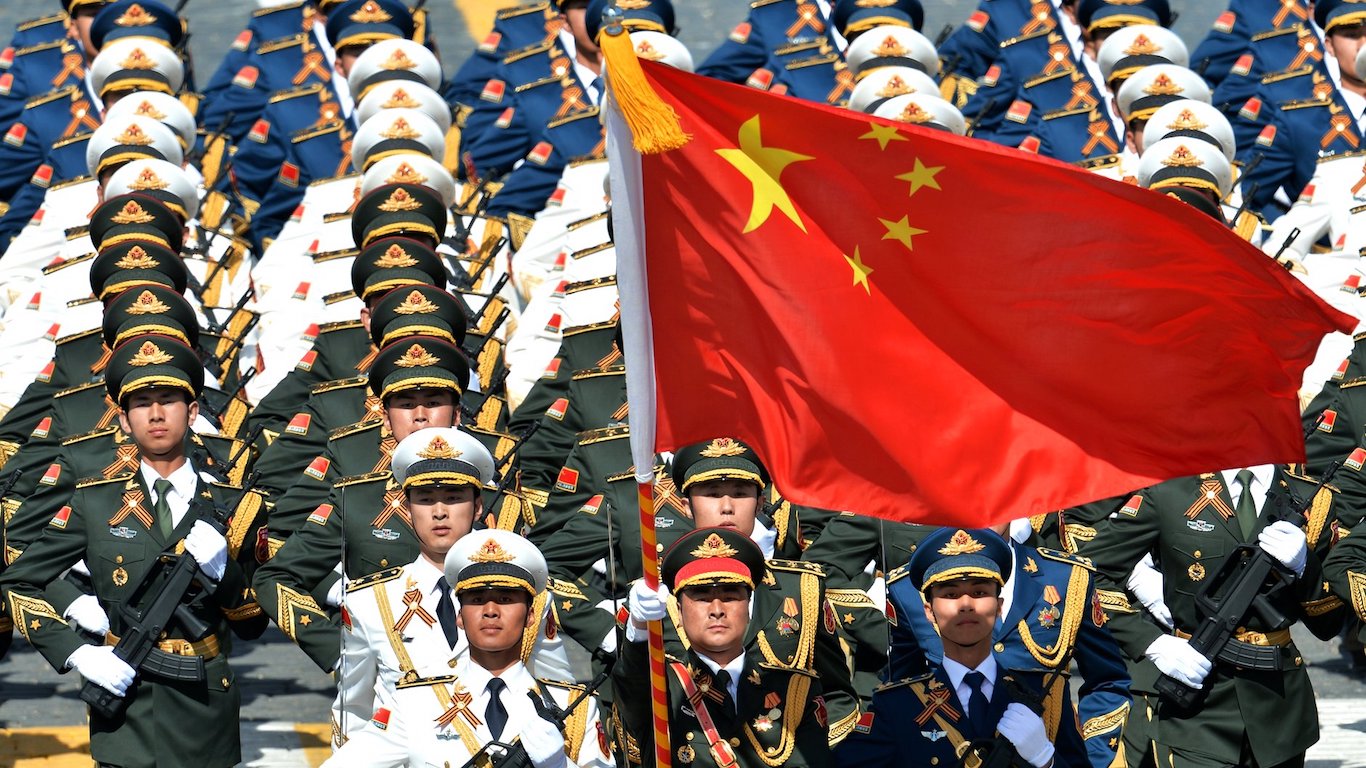

All those planes are going to be needed to fly more passengers more miles. The two aircraft makers have increased estimates of revenue passenger miles by 5% to 7%. Most of the new planes — about 39% — will be delivered to the Asia Pacific region, and by 2033, China is expected to account for 11% of global air traffic on its domestic flights alone.

Shares of Boeing’s stock were down more than 1% at $127.28 in the noon hour on Thursday, following a weak report on August durable goods orders. It is well to recall that July orders were swollen by activity at the Farnborough air show. The stock’s 52-week range is $113.34 to $144.57.

ALSO READ: 10 Companies Cutting the Most Jobs

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.