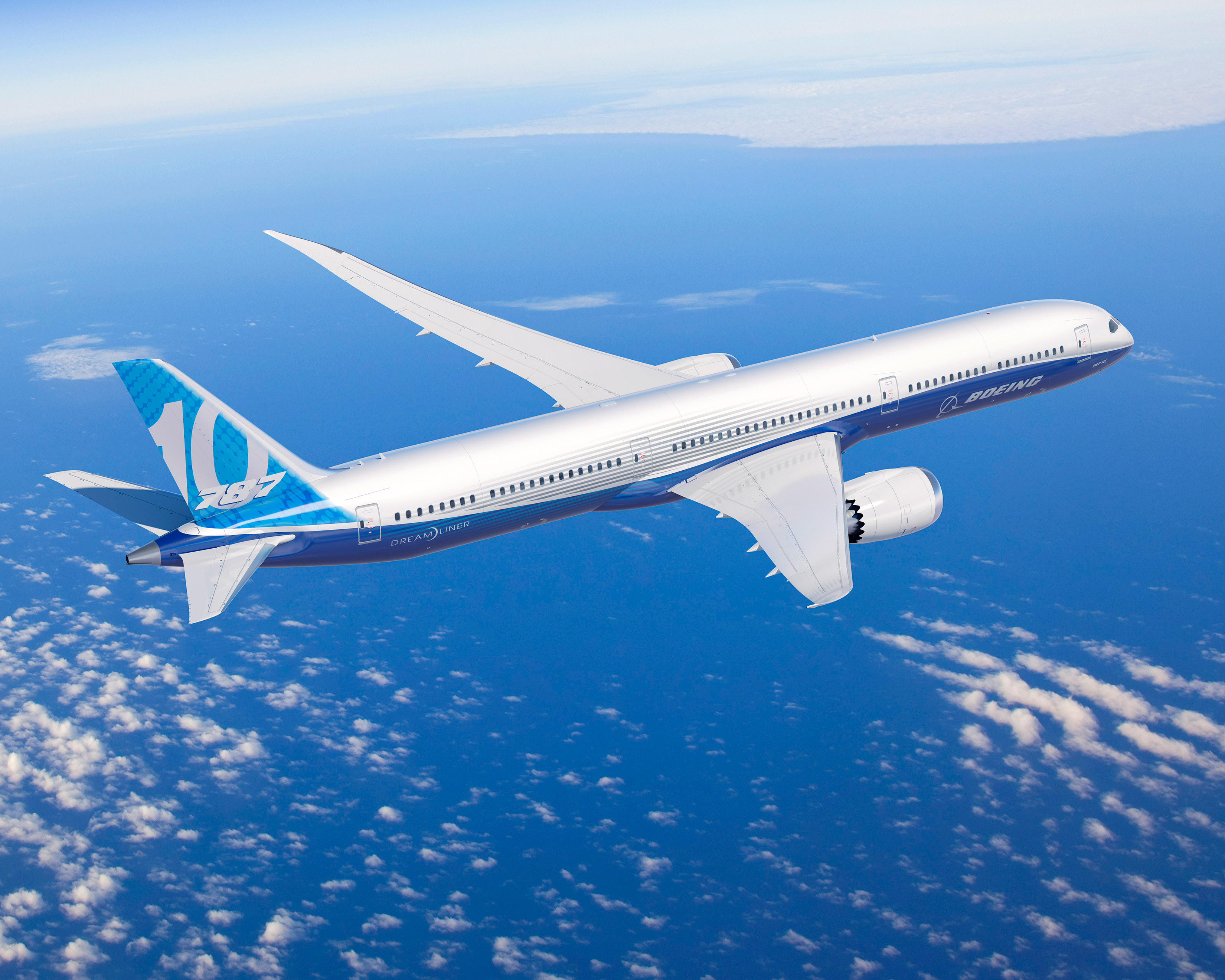

The 787-10 is the longest version of the company’s Dreamliner and can seat 323 passengers, a third more than the 787-8 and 15% more than the 787-9. The 787-10’s range is 7,020 nautical miles, and Boeing plans to deliver the first of the planes in 2018.

The added passenger weight cuts the plane’s range by nearly 1,300 nautical miles, compared with the 787-9. The 787-10 is 18 feet longer than the 787-9 and has a larger wingspan. The first 787-9 was delivered in 2014.

It took nearly eight years for Boeing to get the first Dreamliner off the drawing board and into service with the world’s airlines, at a total development and manufacturing cost estimated at $32 billion. That is about twice as long as the company’s initial estimate and more than five times more expensive.

ALSO READ: Are Sporadic New Plane Orders Becoming a Concern for Boeing?

Boeing launched the 787-10 on June 18, 2013, at the Paris Air Show and said at the time that it had 102 commitments for the new model. Singapore Airlines placed an order for 30 of the planes on the launch date and United Continental Holdings Inc. (NYSE: UAL) ordered 17 in 2010 and another 10 on the launch date. Air Lease Corp. (NYSE: AL) placed an order for 30 of the planes in September of 2013, and General Electric Co.’s (NYSE: GE) Capital Aviation Services ordered 10 in the same month. The United Arab Emirates’ Etihad Airways ordered 30 in November, and British Airways ordered 12 in December. A total of 139 of the planes were on Boeing’s order book as of the end of February, but no new orders have been placed since the British Airways order in December 2013.

The 787’s body is 50% composites and 20% aluminum, almost a full reversal of the make-up of the 777, which is 12% composites and 50% aluminum. The lower weight of the composites is a main contributor to the 787’s fuel efficiency. Boeing claims the airplane is 25% more fuel efficient than similarly sized airplanes and emits 20% less pollutants.

The most interesting thing about the price of a 787 is not how much it costs, but how little. Airlines never pay list price for a plane, and the actual price for a 787-8 has been reported to be around $117 million, compared with a list price of $218.3 million. One analyst had earlier put the unit cost at $160 million and the sale price at $115 million. Fortunately for Boeing, the highly profitable 737 and 777 planes offset the high discounts Boeing is forced to give on the 787s.

Boeing is able to account for these massive losses by using “program accounting,” which allows the company to book future profits now by spreading out the costs and revenue from the unfilled orders for the 787s on Boeing’s books. The company calls the gap between what it costs to manufacture a 787 and what the company sells the plane for “deferred production costs.” At the end of 2014, Boeing’s deferred production costs on the 787 program totaled $26.2 billion, which it will have to pay back before the plane is profitable. One analyst does not think that the aircraft will be profitable until 2019, after the first 1,000 Dreamliners are delivered, and another analyst figures that Boeing will not recover all its costs on the 787 until it sells at least 1,900 planes.

ALSO READ: Credit Suisse’s Top Defense Stock Picks

Although Boeing has raised the list price on the 787s, it still has to sell the planes for far less than that. To add insult to injury, the company is parking two new 787-9s on airstrips in the desert while it waits for seats to arrive from France to be installed in the planes. The two planes were the third and fourth scheduled for delivery to American Airlines Group Inc. (NASDAQ: AAL). The only good news about this is that Airbus is suffering from a similar shortage from the same French manufacturer.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.