Stocks took a pounding in the first week of 2016, with the Dow Jones Industrial Average losing 6.19% in the first five trading days of the year. And the second biggest loser among the Dow stocks is Boeing Co. (NYSE: BA), down 10.1% in the week.

What’s odd about this is that news from the company was highly positive during the week. On Thursday morning Boeing reported that it delivered a total of 762 commercial jets in 2015, better than the top end of its forecast delivery range of 750 to 755 commercial planes. Later that day the company said that it finished the calendar year with 768 net new orders, pushing its book-to-bill ratio to just over one, the company’s target for the year.

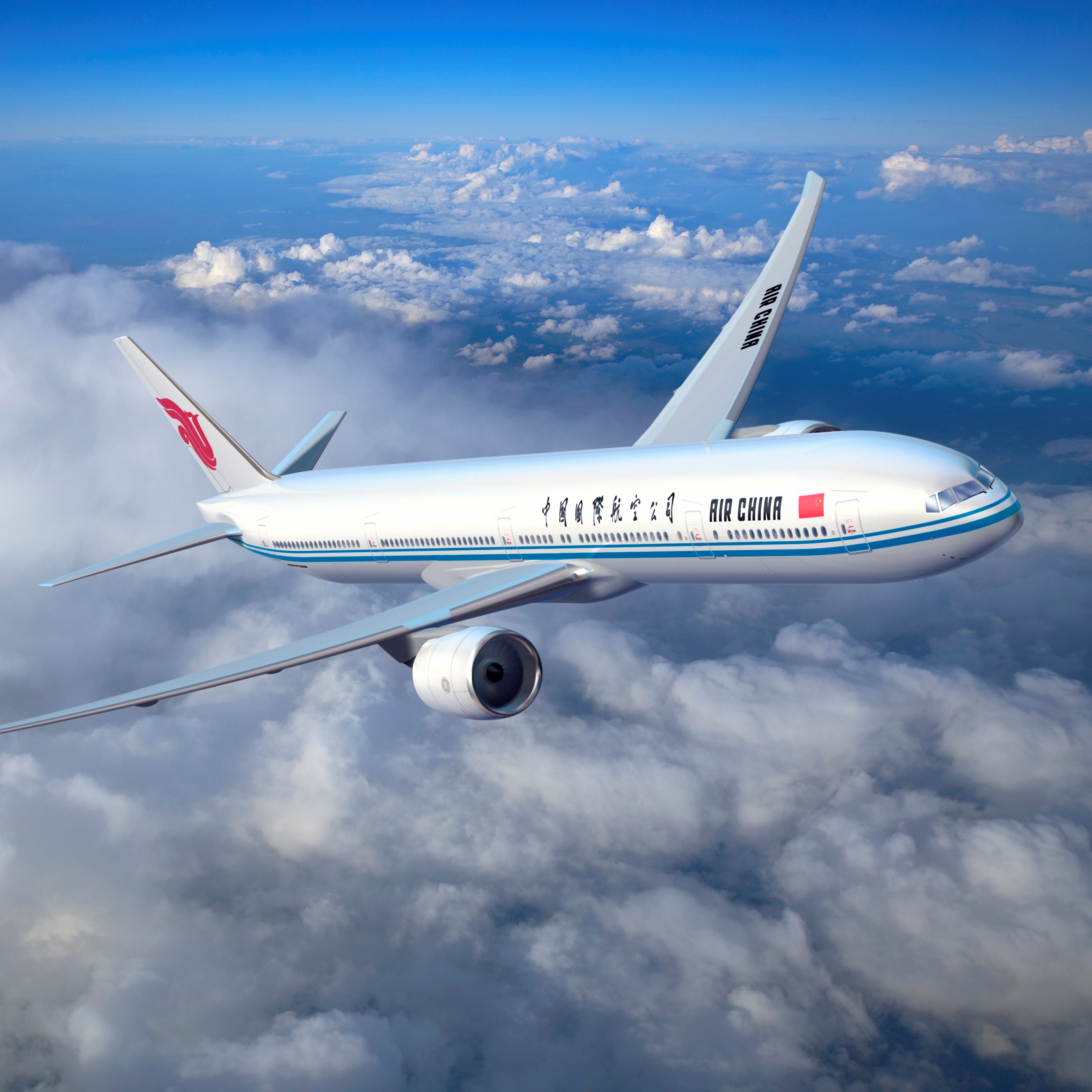

On Friday Boeing confirmed that Air China had ordered six 777-300ERs with a total order value of $2.05 billion at list price. The planes are scheduled to be delivered in 2016 and 2017. That’s a good start to the year for a plane that is critical to Boeing’s success over the next few years.

Even better news for Boeing and its investors is that deliveries of the re-engined 737 MAX actually may occur as planned. First delivery is currently scheduled for the third quarter of 2017 and the company is right on schedule to meet that.

Arch-rival Airbus, however, had to postpone the first delivery of its re-engined A320neo, which the company had planned for late 2015. The problem appears to be with the starting capability of the new Pratt & Whitney geared turbo-fan engines in high temperature environments like the Middle East.

So what happened with the stock price? Are investors worried about what the company will say when it reports results on January 27?

Probably not. Boeing likely got caught up in the worries about China, home of some of its biggest customers, and the Middle East, another location where the company sells a lot of airplanes.

The DJIA dropped more than 6% on general fears for the global economy. Boeing stock dropped more because there is a direct link to global instability and the company’s ability to sell new planes.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.