Military

Deutsche Bank Aerospace and Defense Stocks to Buy Also Pay Solid Dividends

Published:

Last Updated:

If Thursday is any indication, the market is nervous about first-quarter earnings, and after a big run off the lows posted in February, it looks as though people are taking profits. Treasury bond yields are puny, and corporate investment grade bonds aren’t much better, so where should investors look? One good area is aerospace and defense.

In a new and very comprehensive Deutsche Bank report notes that while commercial aerospace is underperforming due to cycle concerns, defense stocks continue to gain Wall Street and investor attention, based on their relative isolation from the potential for global economic slowdown, the confirmed increases in defense spending and their strong cash flow and dividend yields.

We screened the Deutsche Bank research universe for defense leaning companies that pay solid dividends, and found four that make good sense for investors now. All are rated Buy at Deutsche Bank.

Boeing

This top aerospace industrial has dropped a whopping 14% since the beginning of the year. Boeing Co. (NYSE: BA), together with its subsidiaries, designs, develops, manufactures, sells, services and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems and services worldwide. The company operates in five segments: Commercial Airplanes, Boeing Military Aircraft, Network & Space Systems, Global Services & Support and Boeing Capital.

Top Wall Street analysts have increased confidence in continuing good demand, and they note that the company has made announcements in the past that support the analyst’s thesis that productivity and margins will continue to improve. 787 execution is good as the company works through the backlog, and cash flow looks to be strong with 787 deliveries and C-17 orders. Some Wall Street analysts also point to low oil prices as a bullish indicator for the top carriers who are Boeing’s big customers.

The company is the worst performing Dow Jones Industrial component so far this year, and the current price point offers investors an outstanding entry point, despite some recent upside.

Boeing investors are paid a very solid 3.43% dividend. The Deutsche Bank price target for the stock is $160, and the Thomson/First Call consensus price target is $137.95. The shares were trading down fractionally on Thursday at $126.80.

This company, like other major defense prime contractors, had a very solid year and it makes the list at Deutsche Bank. General Dynamics Corp. (NYSE: GD) is a worldwide aerospace and defense company, and it has over 96,000 employees worldwide. General Dynamics operates through four business groups: Aerospace, Combat Systems, Marine Systems and Information Systems and Technology. The U.S. government is its largest customer, which could continue to bode well if Congress does not change hands.

General Dynamics stock has awarded its investors with returns of about 160% in the past decade, and it posted outstanding third-quarter numbers on solid execution across the board. The company pays regular dividends and has a share repurchase plan in place. This is an outstanding stock for long-term growth portfolios.

General Dynamics investors are paid a 2.3% dividend. Deutsche Bank has placed a $152 price target on the stock, while the consensus estimate is $158.82. The stock was trading on Thursday at $132.35.

L3 Communications

This is one of the companies that the Deutsche Bank analysts like into the first-quarter earnings. L3 Communications Holdings Inc. (NYSE: LLL) provides aerospace systems and a range of communication and electronic systems and products used on military and commercial platforms in the United States and internationally.

The company operates in three segments: Electronic Systems, Aerospace Systems and Communication Systems. It offers a range of products and services, including components, products, subsystems and systems, as well as related services to military and commercial customers in business areas, including precision engagement and training, power and propulsion systems, aviation products and security systems, sensor systems, warrior systems, and optics, telescopes and precision optical subsystems.

The Deutsche Bank team is especially positive on the stock, and they cite the recent infusion of management talent, the attractive cash flow valuation and a portfolio that looks to be stabilizing. They see the stock as needing little more than in-line execution when it reports earnings to begin to really outperform to the upside.

L3 Communications investors are paid a 2.35% dividend. The Deutsche Bank price target is set at $146, and the consensus price objective is lower at $133.89. The stock was trading late Thursday morning at $119.57.

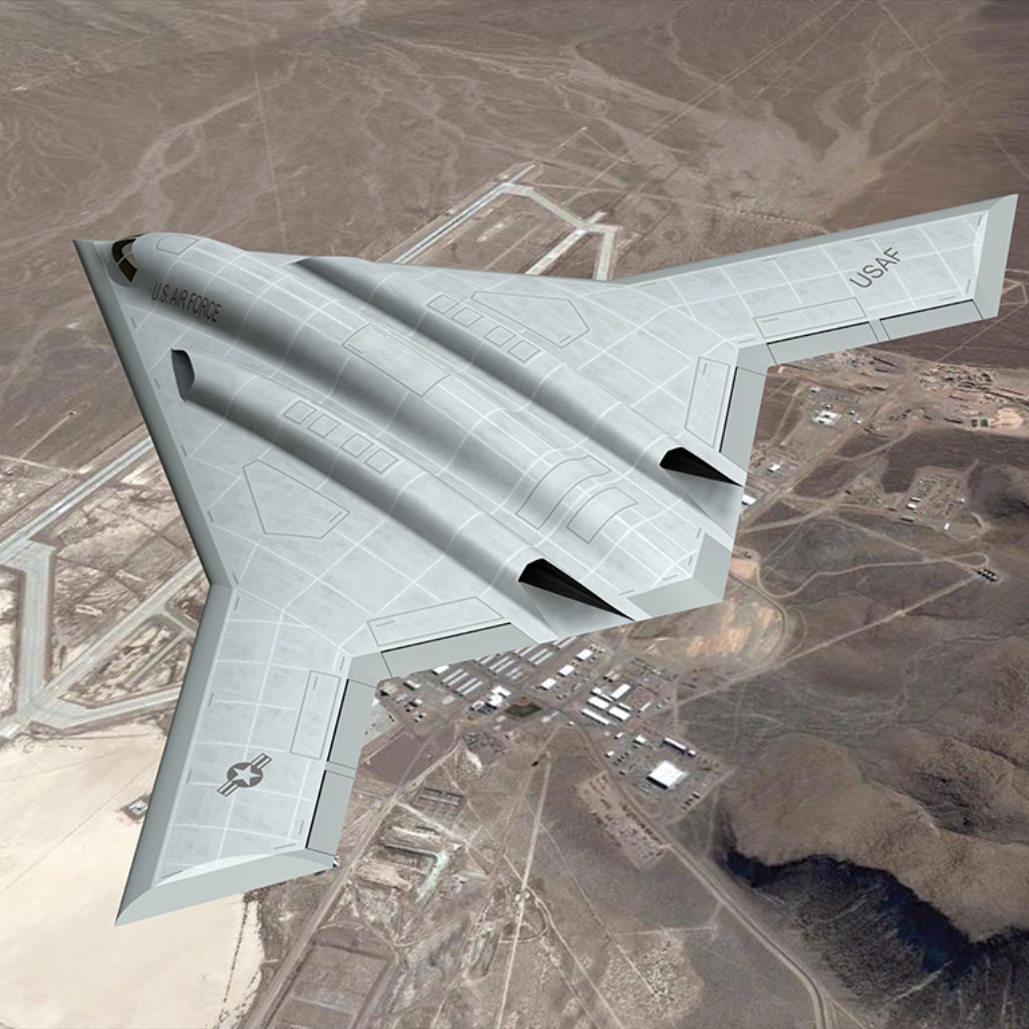

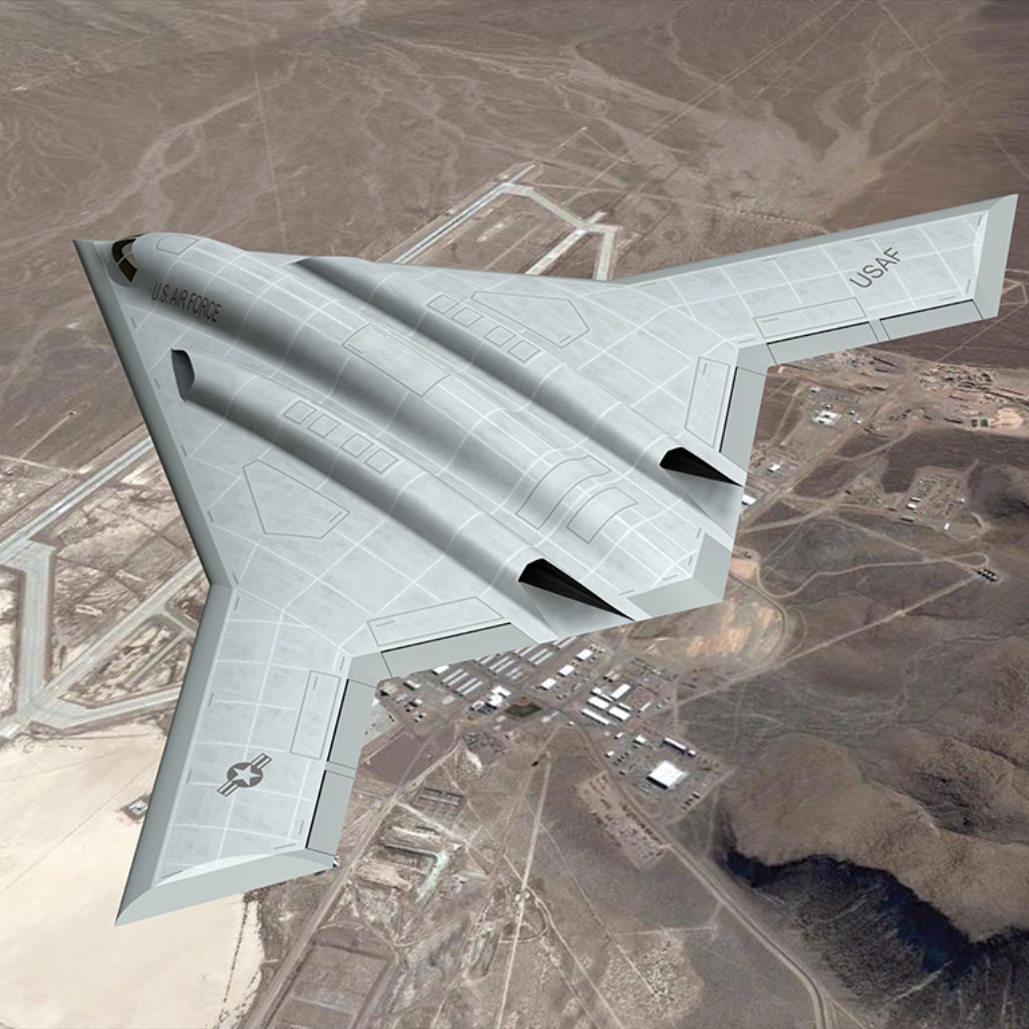

Northrop Grumman

The top defense company was ranked as the sixth-largest defense contractor by sales last year. Northrop Grumman Corp. (NYSE: NOC) provides innovative systems, products and solutions in unmanned systems, cyber, C4ISR and logistics and modernization to government and commercial customers worldwide. The company’s Aerospace Systems segment designs, develops, integrates and produces manned aircraft, unmanned systems, spacecraft, high-energy laser systems, microelectronics and other systems and subsystems.

The Deutsche Bank analysts have earnings estimates basically in line with Wall Street, and they are slightly ahead on revenues. They note that the company beat numbers last quarter but tax and pension tailwinds helped, while segment performance and margins were solid. They think that, as usual, the estimates given by the company are conservative, so an upside beat may be in the cards.

Northrop Grumman investors are paid a 1.6% dividend. The Deutsche Bank price objective was raised to $240 from $220, and the consensus target is at $205.13. The stock was trading down fractionally on Thursday at $200.65.

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.