Sales of new airplanes have been slow this year for both Boeing Co. (NYSE: BA) and rival Airbus. At last count Boeing had accumulated net new orders for 156 planes in the first four months of 2016. Airbus had taken net new orders for just 92.

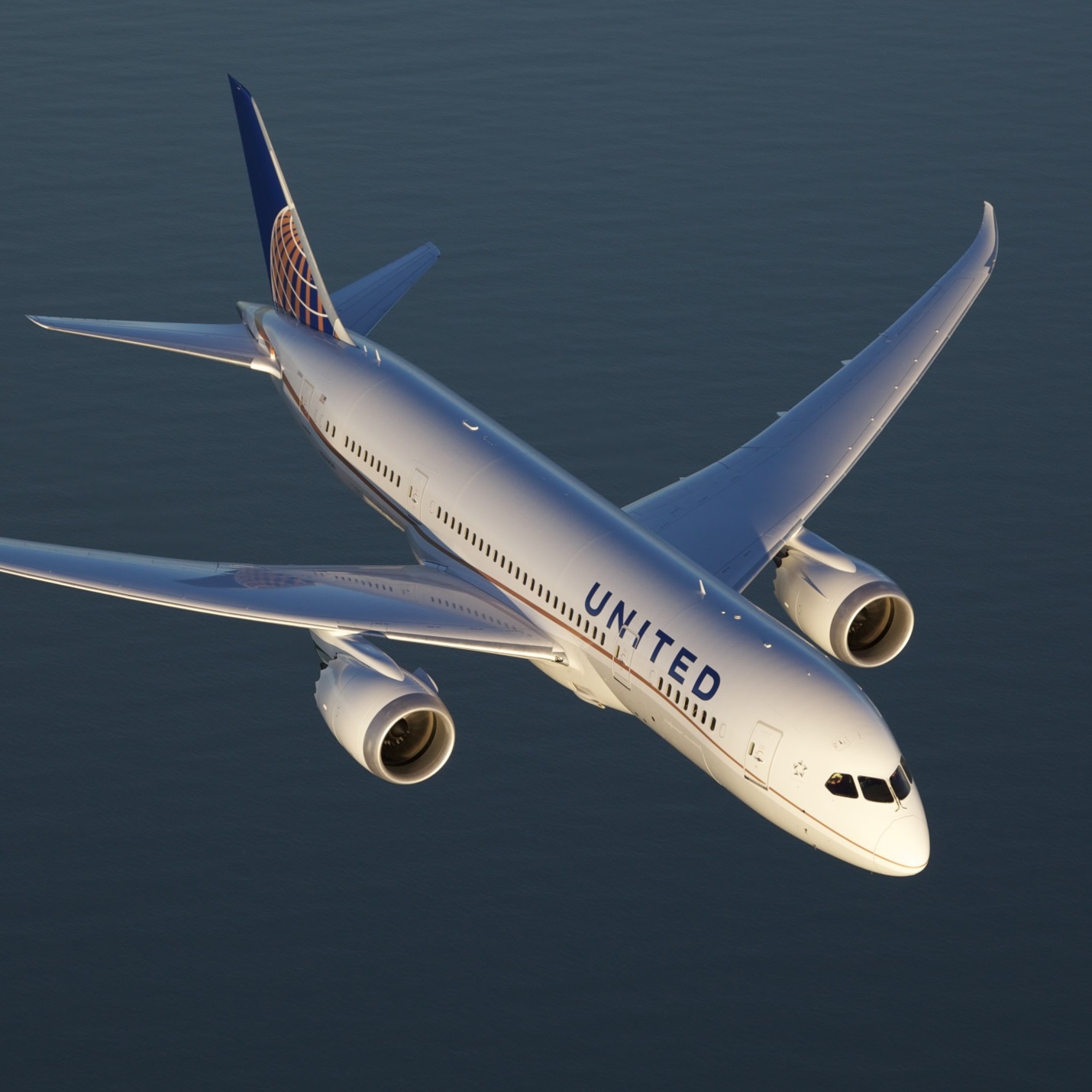

A particular concern for Boeing surfaced after its investor day conference last week. The company is reportedly facing a short-term surplus of its 787s due to reduced leasing rates for the planes. According to a report at Leeham News, lease rates for a 787-8 have fallen below $900,000 a month while rates for the larger 787-9 are somewhat higher.

Boeing’s most commonly quoted sales price for a 787-8 is $115 million, while a 787-9 is quoted at around $125 million. The list price for a 787-8 is $224.6 million and for a 787-9 the list price is $264.6 million. The largest aircraft in the family, the 787-10, carries a list price of $306.1 million, but it won’t be available for delivery to customers until 2018.

A typical lease rate for customers with so-so credit is 1% of the sales price of an aircraft. That would imply a monthly lease rate of around $1.15 million for a 787-8. If lessors are shopping around a lower rate, that puts additional pressure on Boeing to shave its price.

Leeham News noted that lease rates for customers with good to excellent credit typically run between 0.75% and 0.82% of the aircraft’s price. This is the rate that has seen the most pressure.

In order to meet its financial projections for the 787 family, Boeing needs to sell another 161 airplanes in its accounting block of 1,300 aircraft. That total includes a swap of 14 orders for 787-9s for 777-300ERs from United Airlines and a cancellation of 24 787 orders from Russia’s Aeroflot.

Boeing continues to argue that the 1,300 planes in the accounting block will allow the company to recover its deferred production costs on the 787 program. These now total some $29.65 billion.

The big worry related to deferred production costs is not the SEC investigation into Boeing’s accounting practices, but whether Boeing will have to take a charge for some portion of that massive total.

Boeing will begin integrating the 787-10 into its production line, and that is expected to lead to flat deliveries in 2017 and higher deliveries in 2018. Leeham News cited the company’s chief financial officer, Greg Smith:

There will be some headwinds in 2017, despite the growth that is taken into account. Obviously, we’ll have lower 777 production rate, getting down to the seven per month. And at the same time, we’ll begin the transition to 787-10. … Longer initial flow times on those airplanes [the 787-9 and 737 MAX], building test airplanes in 2017, delivering those in 2018, and as a result our delivery expectations for 787 in 2017 will be about similar to 2016. And with all that said, again we continue to expect cash flow to increase in 2017.

There’s Boeing’s silver bullet: cash flow. The company has projected around $10 billion in cash flow this year and, as far as Boeing is concerned, that’s the metric that matters most to it and the one that should matter most to investors.

Monday morning, Boeing shares traded up about 0.8% at $133.19, in a 52-week range of $102.10 to $150.59.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.