Military

Rockwell Collins Earnings Just So-So, Spends $6.4 Billion on Acquisition

Published:

Last Updated:

Rockwell Collins Inc. (NYSE: COL) announced Sunday that it has agreed to acquire aircraft interior manufacturer B/E Aerospace Inc. (NYSE: BEAV) for $6.4 billion in cash and stock plus the assumption of $1.9 billion in B/E debt in a deal with a total price tag of $8.3 billion. As we might expect, that announcement has pushed Rockwell’s fourth quarter and full-year 2016 results off the front page.

Rockwell reported fourth-quarter earnings per share (EPS) of $1.58 and revenues of $1.45 billion, up 14% from $1.38 and 4% from $1.38 billion, respectively, in the fourth fiscal quarter of last year. Consensus estimates called for EPS of $1.57 and revenues of $1.48 billion.

For the full year, the company said it had EPS of $5.50 on revenues of $5.26 billion. For the prior year, EPS came in at $5.19 and revenues totaled $5.24 billion. Analysts had estimated EPS of $5.50 and revenues of $5.3 billion.

In its initial guidance statement for fiscal year 2017, Rockwell said it expects revenue in its existing businesses, not including any effect from the proposed B/E acquisition, to come in at $5.3 billion to $5.4 billion, with free cash flow of $600 million to $700 million. Free cash flow in 2016 totaled $530 million. The guidance is based on the following assumptions:

Rockwell’s offer for B/E is $20 a share, which includes $34.10 per share in cash and $27.90 in Rockwell stock for a total of $62 per share, a premium of 22.5% to Friday’s closing price for B/E.

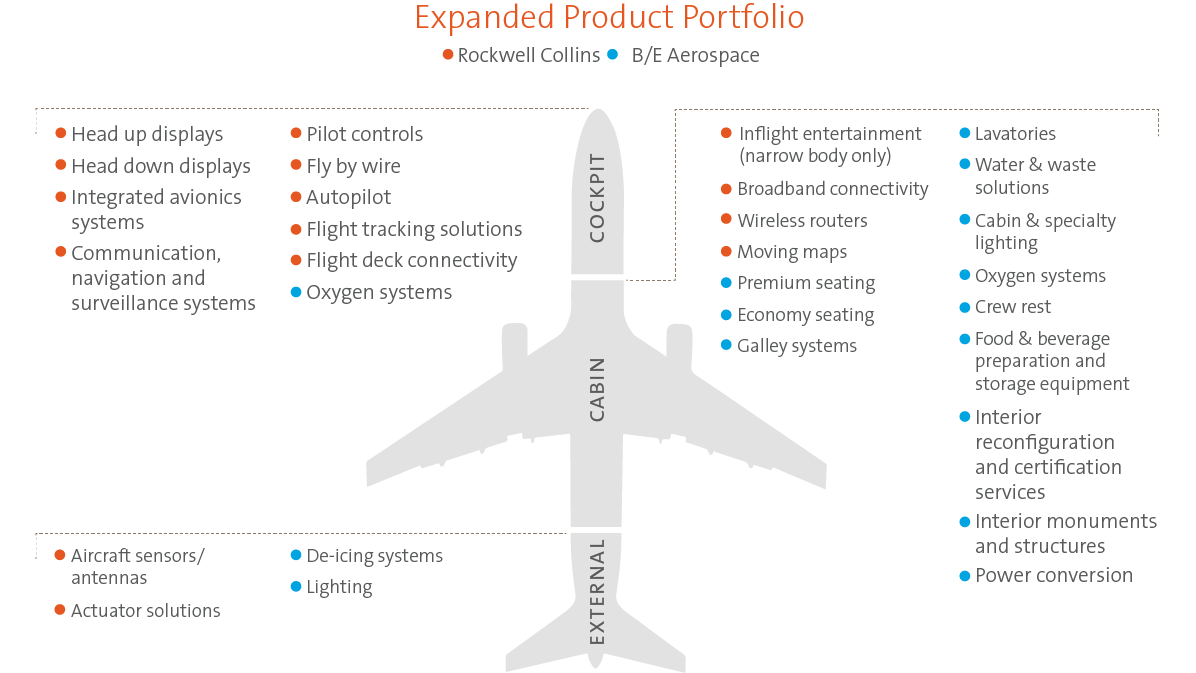

As a graphic at Rockwell’s website highlights, the two companies have complementary businesses: Rockwell has focused primarily on electronics systems primarily cockpit-related while B/E is primarily a supplier of cabin interiors.

Anyone watching the aerospace industry even moderately closely is aware of the difficulties facing the cabin interiors suppliers. The poster child for this problem is Zodiac Aerospace, the French company that cannot supply enough interiors to Airbus for its A320neo and the wide-body A350. Airbus won’t even consider Zodiac as an interior supplier for the new A330neo program.

Here’s an illustration provided by Rockwell on the two companies’ strengths. Note that there is little overlap, indicating that synergies are not likely to be very large.

But the bigger problem for cabin interior suppliers are demands from aircraft makers like Airbus and Boeing Co. (NYSE: BA) to lower their prices. Boeing has been putting the squeeze on suppliers for months now. As Scott Hamilton at Leeham News points out, both Airbus and Boeing also have been reducing the number of suppliers for their interiors in an effort to simplify production and to try to wring out the best price the makers can get by offering bigger contracts.

In Monday’s premarket session, Rockwell traded down about 2.4%, at $82.46 in a 52-week range of $76.03 to $95.11. The 12-month consensus price target on the stock is $92.88.

Shares of B/E traded up about 16.6% at $59.00, well above the 52-week range of $36.38 to $53.25.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.